Why We Should Embrace “Slow Corn”

Why We Should Embrace “Slow Corn” as an Alternative to Plastics

One sultry evening on an island in northeastern Florida, my wife and I went to a pub to hear some live music.

An older man played an acoustic guitar and sang. It was a classic Florida scene – the breeze off the water ruffled our hair and occasionally stole a napkin. We sipped our cocktails at the patio bar and enjoyed the music.

The difference is that the performer was a retired geneticist. He spent years developing a row crop that would resist disease and grow stronger. And this month, I’m going to show you a company that takes these crops and turns them into all sorts of sophisticated products.

I’d met him years earlier, through friends, when I was studying the economics of some massive plantations in the southern United States. I found these giant fields of “slow corn” to be incredible feats of agriculture.

They were pine plantations. The crop cycle of a typical pine plantation can last up to 30 years. The seedlings are planted in long rows. They thrive in nutrient poor, acidic, sandy soil. After about fifteen years, the plantation is thinned. And then every five years or so after.

And one thing I remember well was the social push-back I received, when I talked about these huge farms. The slow growth makes people forget that they are a crop. And the sight of a cut plantation is on a much larger scale than a corn field. That creates a strong negative bias among some folks…because they were trees.

Some people hate to see trees cut down. Any tree. And that’s incorrect.

Now don’t get me wrong, I am a tree hugger from way back. But I don’t get broken up when I see farmers harvesting corn or wheat. And that’s what pine plantations are – slow growing corn.

Much of the wood products we use grows like this. We don’t make toilet paper out of old growth The scale is just much larger than the corn or wheat fields we are used to seeing.

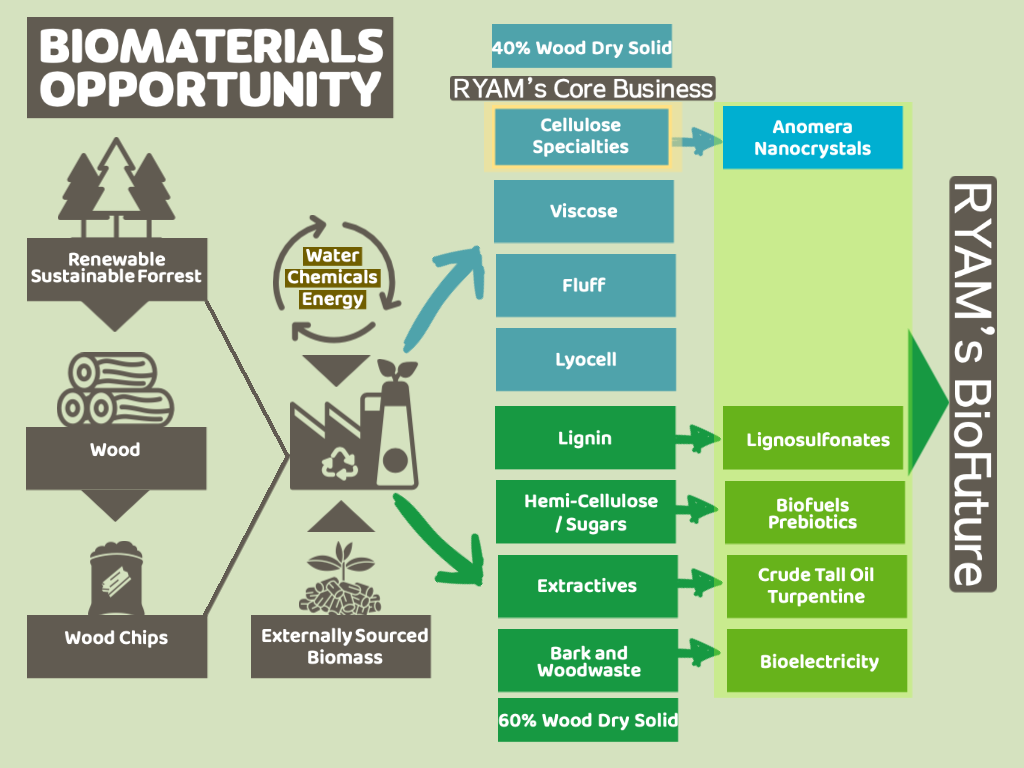

The incredible thing about pine is how versatile it is. Don’t think inexpensive lumber. Pine products go into everything from liquid crystal displays to hand soaps, to foods to medicine. And the most important part is that it’s renewable.

That’s an important point to understand. This is biotechnology that can replace fossil fuel-derived chemicals.

The pine wood plantations are a huge industry in the U.S. Amber waves of grain make us think of Kansas and the grain belt, there is an area of pine plantations just as large. Yellow pine plantations cover 300,000 square miles in Alabama, Arkansas, Florida, Georgia, Louisiana, Mississippi, North Carolina, South Carolina, Oklahoma, Tennessee, Texas, and Virginia.

That’s enough forest to cover all of California and Montana.

That’s because pine is a critical material for buildings, paper, and energy source (biomass). There is a huge market for non-wood products as well. Things like bioherbicides, biofuels, green plastics and polyurethane are all possible from pine trees. And now the products are going high-tech.

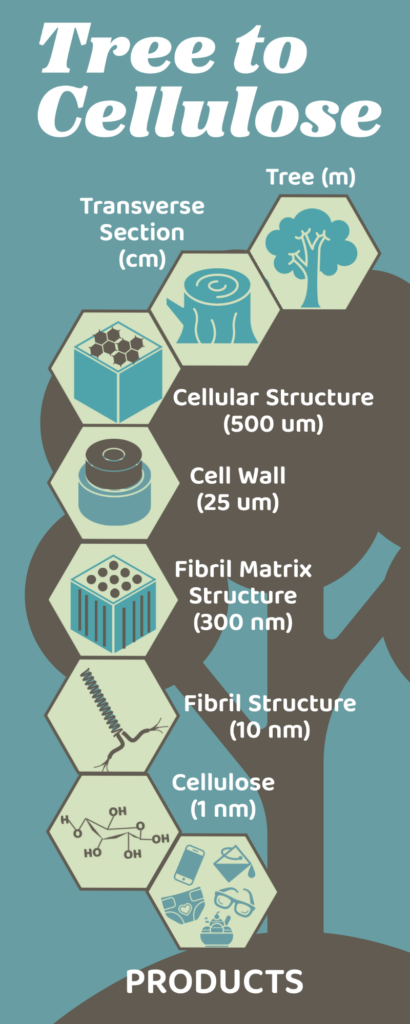

The last decade saw pine take a leap into new industries through its nanocellulose and long fibers.

Nanocellulose is an attractive sustainable material for many applications. As Amir Sheikhi wrote in his book Nanomaterials and Polymer Nanocomposites (2019):

Nanocelluloses and their nanocomposites have been emerging since the past decade, providing advanced solutions to several key challenges in the modern society. The field is propelled by the unique features of nanocelluloses, including sustainable sources, facile chemical functionalization, and promising physical and chemical properties.

The variety of uses are incredible. For example, there is nanocellulose in pre-made food like sauces, dressings, icings, sour cream, whipped topping, and frozen dairy desserts. It can be used as a low-calorie additive, thickener, stabilizer, and texture modifier.

As you can imagine, it takes a lot of effort to reduce a tree into particles of nanocellulose measured in nanometers. For reference, there are 25.4 million nanometers per inch.

This is an exciting new area of research and development. It draws heavily from techniques learned from petrochemical work. But instead of oil, we can now use plants. That’s a huge leap forward for reducing our dependence on fossil fuels.

Now let’s see how the investment looks.

Rayonier Advanced Materials (NYSE: RYAM) – Pure Nature. Pure Science.

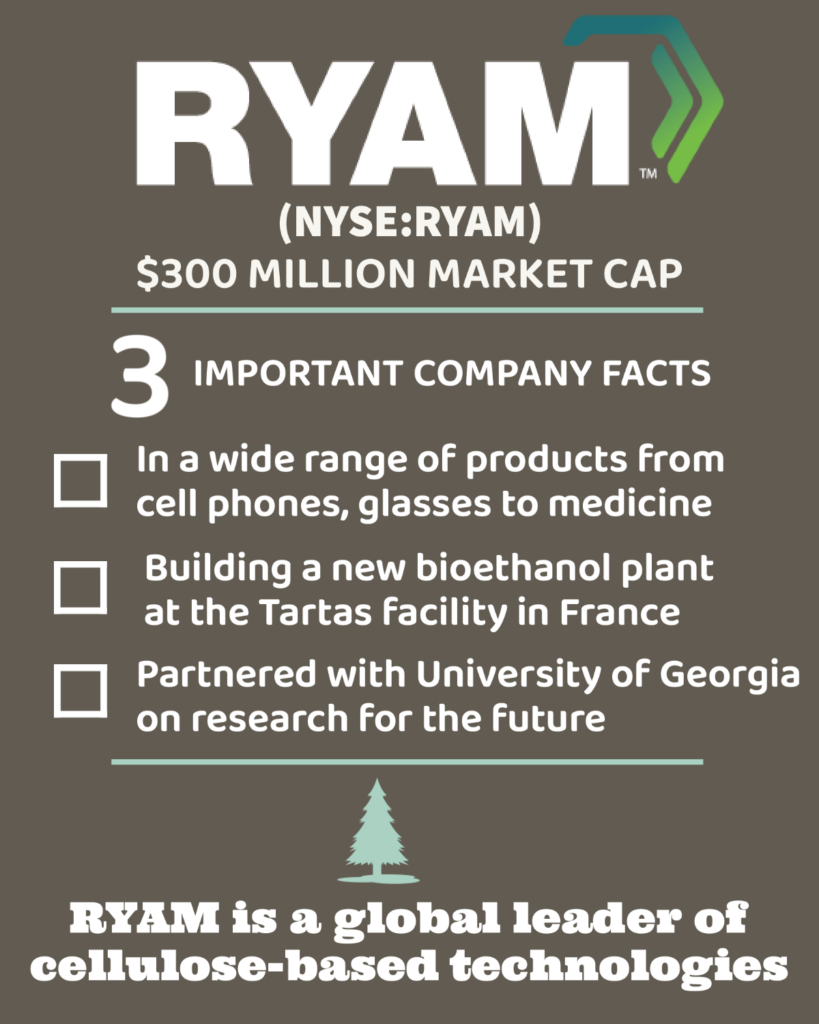

Rayonier Advanced Materials (NYSE: RYAM) is a $287 million market cap company that makes cellulose specialty products from pine trees.

The company sells its products to customers in 40 countries throughout the world.

The company has four plants, one each in Georgia, Florida, France, and Quebec.

And something is going on. Insiders are buying stock like crazy.

Since May 2023, insiders bought 156,000 shares at an average price of $4.35, according to FINVIZ.com. The CEO, DeLyle Bloomquist bought 60,000 shares at $4.47 per share on May 15th. Clearly, they believe the company’s share price is too low.

Right now, shares of RYAM is now $4.29 each. That means we can buy shares below the average price the insiders paid.

They make a range of products from pine – acetate, ethers, fluff pulp, and cellulose. It’s the bioproducts that are most exciting. RYAM’s Temiscaming facility in Quebec produces TemSilkTM, which is the main ingredient in a semi-synthetic fabric called Lyocell.

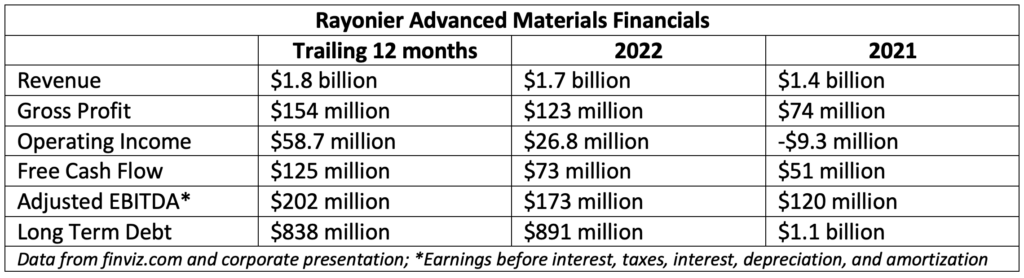

The company is on a path to get its debt under control. It paid off $91 million from 2022 through April 2023. And it has increased sales by 7% since 2021. It funded that debt repayment through sales of its lumber and newsprint facilities, which were non-core to its current business plan.

The company is currently reworking its Georgia plant to make it more efficient. That will increase earnings starting in the second half of 2023.

The company plans to build a new bioethanol plant at the Tartas facility in France. The plant will produce non-food-based ethanol to support cleaner vehicle emissions in line with the European Union Renewable Energy Directive. The plant will produce 21 million liters per year. The carbon savings will be equal to taking 12,500 cars off the road. The company should begin to see revenue in the first part of 2024.

The company’s presentation shows that its high-purity cellulose division took off in the last six months. In the first quarter of 2022, the earnings from that division were just $16 million. By the fourth quarter 2022, that was up to $45 million. And in the first quarter of 2023, it was $44 million. That’s nearly 88% of all the earnings for the quarter from its cellulose division. The company said the price of the specialty cellulose rose 29% since 2019.

Here are the Top Five Cellulose Specialty End Markets:

- Filter Tow (cigarette filters)

- Food/Pharmaceuticals/Personal Care (plant-based alternatives in food and drugs)

- Construction/Coatings (high-performance products)

- Plastics/Film (sustainable alternatives to oil-based plastics)

- Automotive (industrial filters and high-performance tire cord)

Another area that looks promising is RYAM’s EBITDA margin. In 2020, it was just 7.4% – so the company only made 7.4 cents on every dollar of sales. That was up to 10.3% in 2022. It’s currently at 11.4%, with a company goal of 13% to 15% within 3 to 5 years.

That’s double the profitability, which could be a reason for the insider buying.

The company also invests in research that will improve its markets down the road. For example, the company partnered with the University of Georgia to demonstrate the utility of cellulose-derived prebiotics in poultry feed. It’s an alternative nutrient that can enhance poultry health. And it’s a potential new method to support sustainable poultry farming.

RYAM is the lead investor in Anomera Inc., a Montreal-based biotech firm. Anomera makes a specialized cellulose called “carboxylated cellulose nanocrystals”. This biodegradable product can be used in cosmetics, concrete, inks, polymer composites, coatings, and adhesives.

Action to Take: Buy Rayonier Advanced Materials (NYSE: RYAM) up to $4.47 per share. That will put us on even footing with the CEO’s investment. We should use a 30% trailing stop on our position. That means if it falls below $3.13 per share, we will sell our position.

This is an interesting company that’s using innovative science to make highly specialized products from renewable trees. This is the essence of what we look for at Mangrove Investor. It’s profitable, it’s forward-thinking, and it’s a good corporate partner.

For the Good,

The Mangrove Investor Team