Your “Sustainable” Investments Might Not Be

Hint: Some Own Big Oil — Here’s How to Tell

The idea that we can invest in companies that have a positive impact on society and the world is catching on. The shorthand for this type of investing is ESG, which stands for environmental, social, and governance.

According to business news organization CNBC:

ESG funds are on track for a record year of inflows, raking in over $21 billion in the first quarter of 2021. That’s an acceleration from 2020, when they earned over $51 billion for the year; 2019, when they accrued $21.4 billion; and 2018, when they saw about $5.4 billion in inflows.

That’s an enormous amount of money that’s looking for investments. And the big banks are creating ESG funds as fast as they can.

According to financial research company Morningstar, as of January 2021, 534 index funds worldwide focus on sustainable investing. They hold over $250 billion in assets. However, most of those are outside of the U.S.

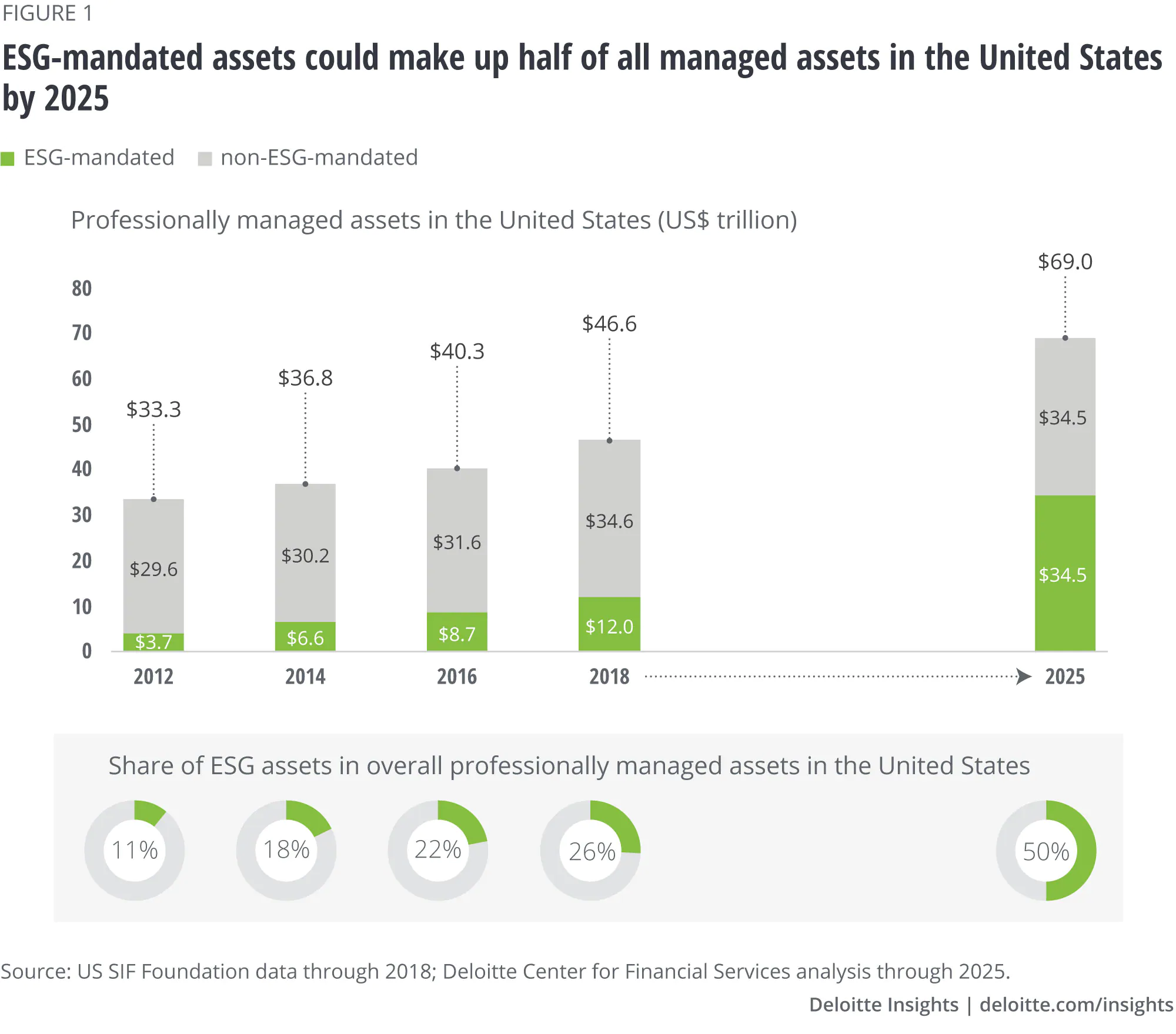

That trend will change, according to the Deloitte Center for Financial Services.

As you can see from the table below, by 2025, growth in ESG assets in managed funds will likely be massive:

Market Share of Sustainable Funds in the U.S.

In the U.S., sustainable funds make up less than 1% of the market today. And those fund managers don’t focus on the kinds of companies that we’d expect.

You see, it’s not as easy to build this kind of fund as it is to build a technology or oil industry fund.

Nearly every company out there touts some sort of ESG milestone. It’s a common form of virtue signaling. (Think: a tech company that talks about how green its office buildings are – while downplaying its dirty factories.)

That’s why few of the American ESG funds’ portfolios hold companies that are strictly focused on sustainability or ESG.

Take FlexShares STOXX Global ESG Select Index Fund (ESGG), for example. The top 10 stocks, which make up 27% of this popular fund, are:

Company | ESGG Percentage* |

Microsoft (MSFT) | 5.0% |

Amazon (AMZN) | 4.9% |

Apple (AAPL) | 4.9% |

Alphabet (GOOGL) | 3.4% |

Tesla (TSLA) | 1.8% |

Procter & Gamble (PG) | 1.7% |

Bank of America (BAC) | 1.5% |

Home Depot (HD) | 1.4% |

JPMorgan Chase (JPM) | 1.2% |

Walt Disney (DIS) | 1.1% |

* as of March 2021.

Those companies are fine investments, but they don’t jump off the page as titans of sustainability. Except for Tesla, these stocks could be in any generic fund out there.

ESGG: The Devil Is in the Details

As we dig deeper through ESGG’s holdings, we see these beauties:

Company | Industry | ESGG Percentage* |

Chevron (CVX) | Oil | 0.8% |

Exxon Mobil (XOM) | Oil | 0.8% |

Goldman Sachs Group (GS) | Bank | 0.5% |

Royal Dutch Shell (RDS) | Oil | 0.3% |

Total (TOT) | Oil | 0.3% |

Rio Tinto Group (RIO) | Mining | 0.1 |

* as of March 2021.

In total, the fund holds 721 positions (as of March 31, 2021). That includes 26 companies in the “energy” space. Most of those 26 holdings are oil companies.

Not only does the fund own the major oil companies I listed above, but it owns oil sands companies Suncor Energy (SU) and Canadian Natural Resources (CNQ).

It also owns major oil services companies Schlumberger (SLB) and Halliburton (HAL).

The problem isn’t investing in those companies. The problem is doing it as a “sustainable” investment fund. This is greenwashing at its laziest.

And it wasn’t just FlexShares’ ESG fund. I found this problem in most of the popular ESG funds.

Before you buy shares, make sure to do your research.

Seeing what stocks the fund holds is the best way to know whether your money is going into just the companies that make a difference. Go to the fund’s website and look at a list of its holdings.

As conscientious investing becomes a more mainstream idea, we expect to see more funds that reflect our values.

But until then, make sure you read the fine print before investing in an ESG fund.

Many aren’t what we want them to be – yet.

Sincerely,

Matt Badiali