Are power shortages in our future?

The New Scientist thinks so.

According to a recent article by Jeremy Hsu, the U.S. and Canada could struggle to provide reliable power to more than three hundred million people. He blames “soaring energy demand from the tech industry and electrification of buildings and vehicles.”

He’s not alone. Mark Spurr, legislative director at the International District Energy Associations believes “a massive grid disruption is inevitable.”

The risk is from extreme weather conditions, as well as increased demand. It brings us a new opportunity in energy, that we’re really excited about.

This month, we’re going to jump into the power market. It is one of the most boring, stable sectors of the market. But we’re going to see how that could be ending. And we found a fantastic opportunity in the electric utility sector that suffered from an extreme weather event in 2023. It has a near monopoly on power to an entire state. And it’s exceptionally cheap today.

Our Peaceful Power Market is Coming to an End

From 1970 to 2000, the U.S. added about one trillion kilowatt hours of new power generation every year. It was a slow but steady climb for decades. But growth slowed after 2000, until we hit about 4,000 billion kilowatt hours in 2005, where we remained since. There hasn’t been a material change in total power generation in 15 years. And demand is the same.

However, there are fundamental changes going on today that will impact both the supply and demand of electricity in the U.S. (and the world). The move away from fossil fuels and towards electrification has the potential to derail the placid power market we’ve had for the last decade and a half.

The power supply buffet is changing rapidly. According to the Energy Information Administration (EIA), approximately thirty-seven gigawatts (GW) of new solar power will come online in 2024. Wind and solar combined should overtake power generation from coal for the first time ever.

That’s a huge milestone, but it comes with a cost. Coal power is dependable. It’s called “baseload” because it’s always there. Wind and solar are not always available. They need additional power supplies or storage as backup. And that’s a potential problem for both power providers and customers.

We can easily imagine a situation where a hot, still period disrupts wind power when everyone wants to use their air conditioning. That could be enough to cause power issues.

Who is at Risk and Why?

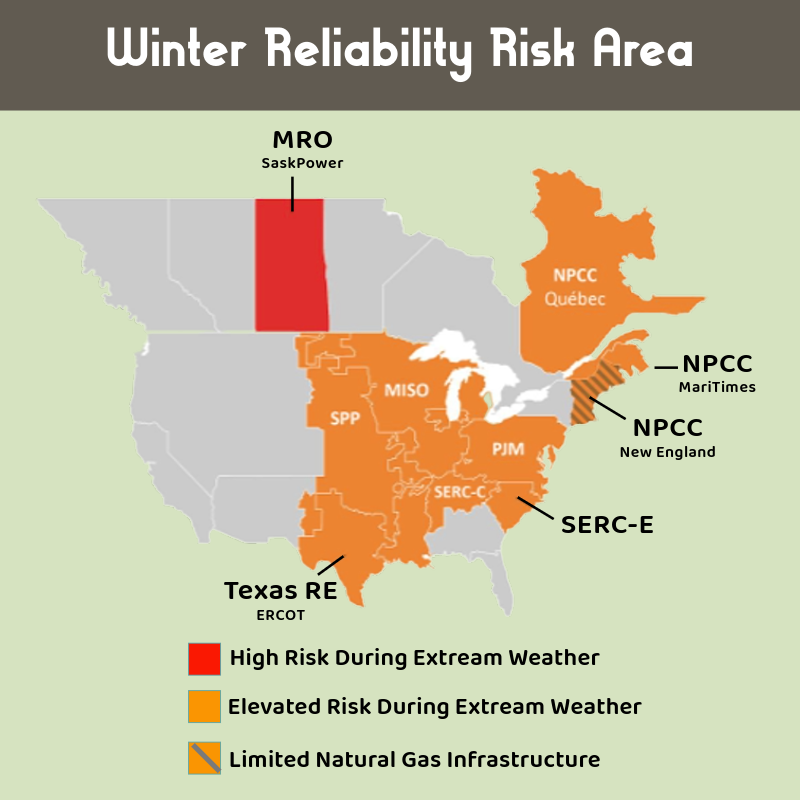

We know there are power grids that have failed recently. The best example is Texas’ ERCOT. An unusual storm event caused a massive power failure to more than 4.5 million homes in 2021. The North American Electric Reliability Corporation (NERC) identified several other systems at risk in 2023/2024. The infographic below shows their assessment.

As we’ve discussed here in the past, we have an old power infrastructure in North America. Many places need massive overhauls. Over half the transmission lines and transformers are over 50 years old.

Jennifer Granholm, secretary of the Department of Energy said,

“Right now, the U.S. electric grid is the largest connected machine in the world. It’s 5.7 million miles of transmission and distribution with about 55,000 substations And it needs upgrading, clearly.”

The Biden Administration’s Infrastructure Law allocated $10.5 billion for grid resilience. In October, the administration announced a $3.46 billion investment in the grid. The private sector will contribute another $4.7 billion as well.

The money will go to fifty-eight projects across forty-four states. The money will help bring on thirty-five gigawatts of clean energy into the grid.

This month, we’re following the money.

There is an opportunity to invest in a company that’s doing exactly this. It’s upgrading a power station from oil to biofuel. And it’s cheap, due to a recent storm-related disaster.

This month’s recommendation: Hawaiian Electric Industries (NYSE: HE)

Supplying Power to 95% of Hawaii is a Fantastic Moat

Hawaiian Electric Industries (NYSE: HE) controls the power to the 13th most population-dense state in the Union. It’s made up of three business units – Hawaiian Electric, American Savings Bank, and Pacific Current (a special investment platform). The bulk of the company’s revenue comes from its electric power division ($43.5 million in the third quarter 2023). The bank contributed $11.4 million over that same period.

The company is modest, just $1.7 billion market cap. However, that’s well down from its recent high, due to the catastrophic fires on Maui last summer.

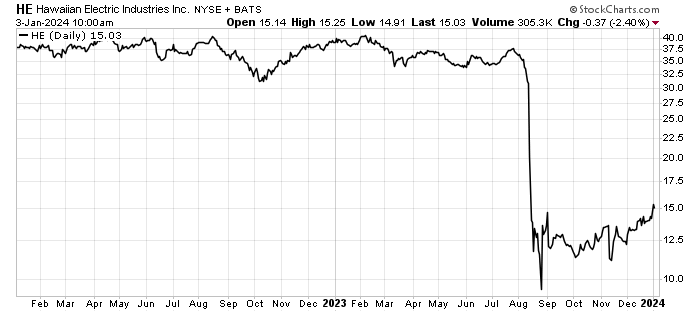

You can see the impact on the stock here:

This is a market over-reaction. It currently trades at 8.9 times price to earnings ratio, according to Financial Visualizations (FINVIZ). That’s among the lowest of all utility companies…and it supports our thesis that the stock price can go up from here.

The events on Maui didn’t materially impact the company’s business. They lost a branch of the bank in Lahaina and had some utility damage. The company reported a $10 million incremental cost associated with the fires. The fundamental business remains strong, which means we should get an outsized dividend as well as solid growth from Hawaiian Electric.

In December, the company announced an ambitious project to retire six fossil-fuel generators at its Waiau Power Plant on Oahu. The company will replace the old system with efficient, fuel-flexible units. The proposed 253-megawatt project will be the largest power project in Hawaiian Electric’s 132-year history.

The six new units will be combustion turbines (think jet engines). They will backstop the growing number of wind and solar power systems on the island. The new units are smaller and more efficient than the old oil-fired boilers. The new system can use biodiesel, methane gas, or hydrogen.

The old units came into service between 1947 and 1968. They require high maintenance and repair costs to keep them running. This is the kind of project that will have an immediate impact on the community it serves. The upgrade will have an immediate impact on emissions and economics.

One risk that we have with Hawaiian Electric is that it has not paid a fourth quarter dividend yet.

Typically, the company usually pays dividends in February, May, August, and November. Prior to this, the company’s dividend payment went uninterrupted since 1901. That’s seriously impressive.

But they missed the November payment. If they announce an interruption of dividends, it could send the stock price down again.

We have no guidance on that issue yet. However, that’s okay. If they do renew the dividend at the current level, we’ll earn 14.9% on the dividend yield alone. The stock priced in a cut to the dividend to help offset losses in Maui (which I expect the company to announce shortly).

However, the company’s main customer base is on Oahu, not Maui. So, it shouldn’t disrupt revenue significantly in 2024.

So, we could easily see the dividend return to pre-fire levels. Which would be fantastic for the share price and our position.

Action to Take: Buy Hawaiian Electric Industries (NYSE: HE). We will put a 30% trailing stop on our position. That means, if shares close down more than 30% from your entry price (or highest closing price) you will sell.

We believe that investing in the grid is a fantastic way to make money over the next few years.

We like everything from the companies that make the components, the metals that go into it, the engineering companies that install the systems, and the utility companies that will spend the money to upgrade the systems.

This is a large part of why we created New Energy in the first place.

This is the kind of boring, lucrative investing that many people will overlook. While the mainstream investors chase hot trends, we’ll quietly profit from these boring – but lucrative ideas. And when the Jim Cramer’s of the world want to buy our stocks, we’ll cash in.

For the Good,

The Mangrove Investor Team