New Energy Weekly – Look Out Tesla!

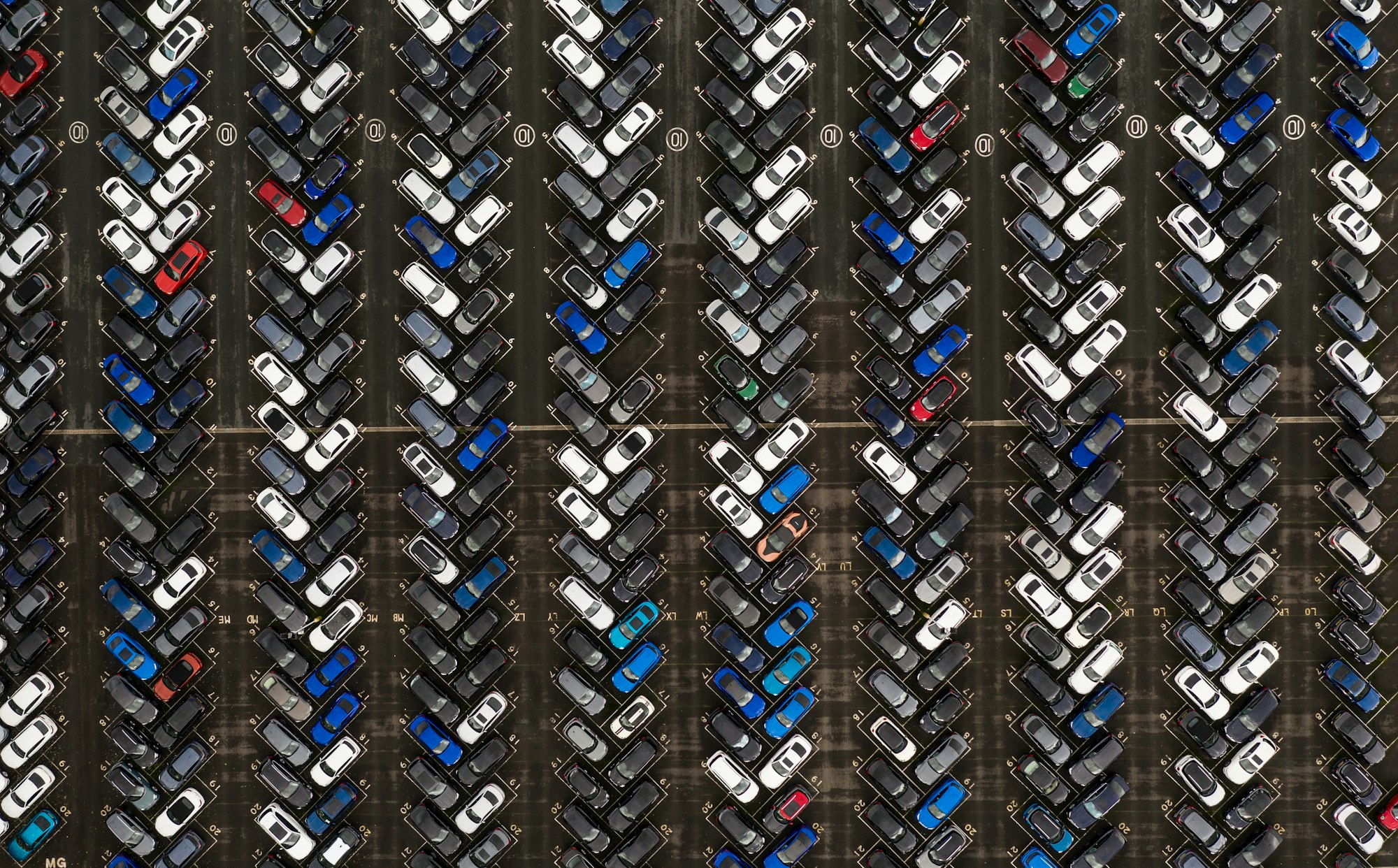

Look Out Tesla! Here’s Why Our Next Electric Vehicle Could be Chinese

The Economist magazine had an interesting article this week titled: An influx of Chinese cars is terrifying the West.

It points out the Chinese carmaker BYD, China’s largest carmaker, sold half a million electric vehicles (EVs) in the last three months of 2023. That’s slightly more cars than Tesla made and 15,500 more than Tesla sold.

The article says:

Chinese evs are so snazzy, whizzy and—most important—cheap that the constraint on their export today is the scarcity of vessels for shipping them. As the world decarbonizes, demand will rise further. By 2030 China could double its share of the global market, to a third, ending the dominance of the West’s national champions, especially in Europe.

BYD’s cars are far less expensive. And its competition forced Tesla to lower its prices. Even with lower prices, Tesla’s sales were no where near CEO Elon Musk’s prediction of 50% growth.

BYD, meanwhile, is moving into Europe. In December, the company announced plans to open its first European EV production factory. It will be located in the southern Hungarian city of Szeged. This dovetails with Hungary’s buildout of lithium battery manufacturing.

Hungary attracted battery factories by Samsung and China’s CATL, among others. According to the Associated Press:

CATL’s 100 GWh battery plant in Debrecen, which is expected to create around 9,000 jobs, is the largest such EV battery factory in Hungary so far, part of the government’s strategy to serve foreign car manufacturers present in the country — like German carmakers Audi, BMW, and Mercedes-Benz — as they transition to battery-powered vehicles.

BYD already has an electric bus manufacturing plant in Hungary. The new plant in Szeged is near a rail corridor that is part of China’s Belt and Road trade initiative. That’s the name for China’s massive investment in roads, power plants, railroads, and ports around the world. Its goal is to bring Chinese goods to new markets.

That’s going to make Chinese EVs far more accessible than other vehicles.

The takeaway here is that electrification is going global. China continues to drive the world towards electric vehicles. And they are making them available in places that most car makers wouldn’t. Add to that a lower price point and you have the recipe for surging EV sales.

That yet another argument for our investment thesis in metals and EV suppliers. The trend is moving steadily. We just need to be patient.