Copper is the Commodity of the New Year

As I write this, I’m sitting in a rainy, cold Vancouver, British Columbia.

Copper is the Commodity of the New Year

This week is the Metals Investor Forum, the Vancouver Resource Investor Conference, and the Association for Mineral Exploration’s Roundup Conference.

It’s one of the critical weeks of information for natural resource investors. Today, the goldminers get all the market’s love. But the data coming out of the big banks points to a different commodity winning the next 12 to 24 months…copper.

But I don’t want you to take my word for it. Let’s go through the data.

Big miners aren’t going to produce enough copper to meet demand. Take Anglo American for example. This giant company produced over 2% of the world’s copper in 2022. It just cut its production forecast for 2024 by 20% and another 18% for 2025.

They aren’t the only giant producer cutting forecasts.

Giant mining company Vale also lowered its forecast to the same production as 2023.

The giant copper Cobre Panama mine just closed, cutting about 1% of the world’s copper supply off the market.

According to BloombergNEF, the copper supply will dip below demand between 2023 and 2027. This year, the forecast copper deficit will be 3.6 million tons. The group forecasts a 20% increase in the copper price.

S&P Global’s Senior Copper Analyst Wang Ruilin told CNBC:

“Lower supply also means that new copper smelters coming online will have a shortage of concentrates to work with. Copper smelters will see a supply shortage of concentrate starting in 2024, and the forecast deficits in the concentrate market is expected to deepen in 2025–27.”

The reduced supply and increased demand combine to make price forecasts soar. In a recent note, Goldman Sachs analysts forecast copper prices near $5 per pound this year and up to $15 per pound in 2025.

“The supply cuts reinforce our view that the copper market is entering a period of much clearer tightening.”

They expect more of an “oil-type” price response. From 2003 to 2008, the price of oil soared from $30 per barrel to more than $140 per barrel. This was the period of reduced supply and soaring demand. The commodity responded by going up 366%.

If the copper price responded the same way, we would see the copper price break $14 per pound.

That’s not as far fetched as it sounds. The commodity market is full of those stories. Along with oil, the price of palladium soared 275% from 2015 to 2021. The price of uranium rose over 400% from 2017 to today.

Copper has a history of incredible runs.

The price soared 430% from 2003 to 2006. And it ripped off a 260% gain from 2008 to 2011. So, there is precedent for the predictions we see among the big bank analysts.

That’s why we are going to add a new copper producer to our portfolio this month: Teck Resources (NYSE: TECK).

A Stalwart Mining Company Will Profit from Higher Copper Prices

Teck Resources is a $19.9 billion integrated mining company. Corporate Knights, an award-winning sustainable economy magazine named Teck one of the 2024 Global 100 Most Sustainable Corporations. It’s the sixth straight year that the company earned that honor.

The company also ranks among the Best 50 Corporate Citizens for the 17th consecutive year. And in 2023, the company was one of Canada’s Top 100 Employers for the seventh consecutive year.

Those accolades come even as Teck is one of the world’s largest commodity miners, with operations in Canada, the U.S., Chile, and Peru. The company’s focus is on safety and sustainability, and it shows.

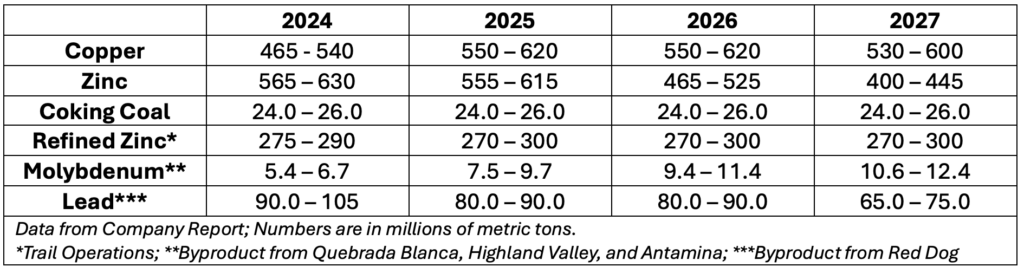

Teck’s business is mining. It focuses on three main products: coking (or steelmaking) coal, zinc, and copper. In 2023, it produced 23.7 million metric tons of coking coal, 644.0 million metric tons of zinc, and 296.5 million metric tons of copper. It also produced lead and molybdenum as byproducts.

The company published its copper production forecast for 2024 to 2027:

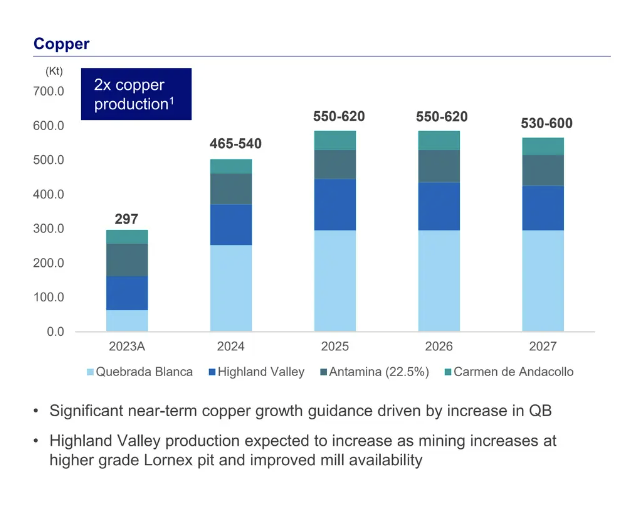

Teck has four copper mines: Antamina in Peru, Quebrada Blanca in Chile, Carmen de Andacollo in Chile, and Highland Valley in British Columbia. The company’s copper production forecast is excellent, as you can see below.

This, combined with the forecast for rising copper prices is why we want to own Teck right now.

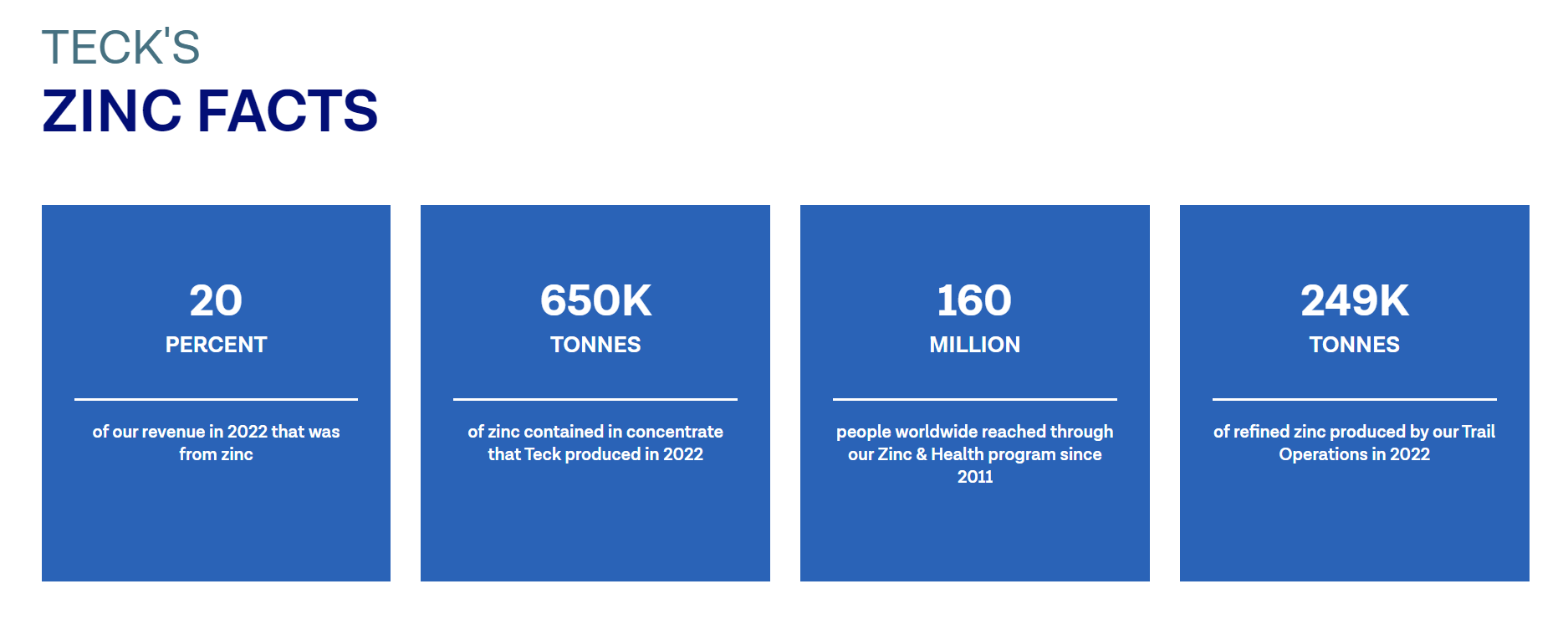

Teck Produces other metals as well as copper. It produces zinc at two mines: Red Dog in Alaska and Trail in British Columbia.

Coking coal is a special variety of low-contaminant coal used to turn iron into steel. Teck has four coking coal mines in British Columbia: Fording River, Elkview, Greenhills, and Line Creek.

Teck Financials

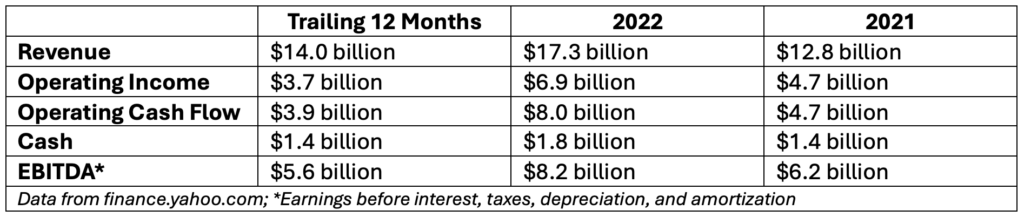

Teck currently has about $10 billion in debt, which is no problem for them.

As we discussed earlier, Teck has huge potential. The increased copper production combined with the forecast for higher copper prices, points to higher revenue over the next year or two. Teck is an excellent company to play rising copper prices.

Action to Take: Buy Teck Resources (NYSE: TECK) and use a 25% trailing stop on the position

The outlook for copper is particularly good over the next 12 to 24 months.

We need to add copper production to our portfolio now, before the general investors figure out the trend.

Good Investing,

Matt Badiali

Further Reading on Copper Price Trend:

Copper Prices May Jump 20% by 2027 as Supply Deficit Rises (Barrons)

Tighter supplies to create tailwind for copper prices. (Reuters)

What is in Store for Copper Prices in 2024? (Nasdaq)

Copper could skyrocket over 75% to record highs by 2025 — brace for deficits, analysts say (CNBC)