New Energy Weekly – Capital Markets for Geoscientists

I’m in snowy, icy Vancouver British Columbia for several conferences

I spent the day in a short course titled “Capital Markets for Geoscientists and Engineers.”

It was all about how public mining companies behave (both good and bad). One of the most interesting charts that I saw came from Dr. Nikki Adshead Bell’s presentation. Dr. Adshead Bell is a serially successful geologist/analyst. She was a CEO, sits on multiple boards, and raised millions of dollars for mining companies. She’s incredibly influential and well connected.

During her presentation, she quizzed the audience. She asked us to predict how the prices of commodities like uranium, lithium, and copper would perform this year.

A shocking number of people were bullish on lithium. I guess I shouldn’t be surprised. But then she showed us her forecast and I felt vindicated.

Here’s what she thinks:

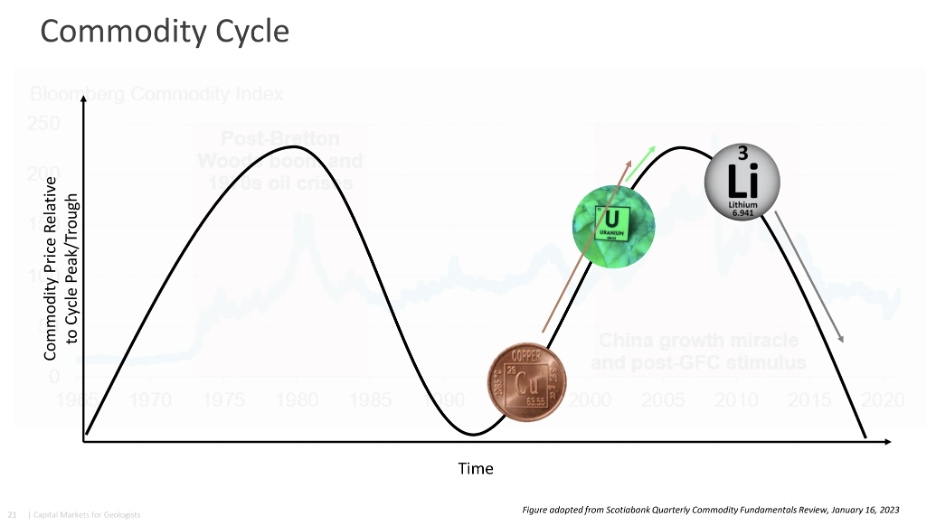

She adapted this from Scotiabank’s Quarterly Commodity Fundamentals Review. It shows us that lithium price has passed its peak and will head lower. Uranium still has room to rise, and the copper price is only just starting to rally.

Sound familiar? I love it when someone I respect (and who’s far smarter than I am) comes to the same conclusions as me.

The big takeaway here is that we should avoid lithium companies. Too much risk. And we should be preparing to sell our uranium positions because they are near the top. Finally, the best place to put investment dollars right now is in copper companies.

So hopefully, I’ll find some great copper ideas while I’m here.

Sincerely,

Matt Badiali