Do You Own Leaders or Followers?

Net Zero will Transform the Investing World – Do You Own Leaders or Followers?

“We don’t use the term ESG,” I said to a friend in Vancouver, recently.

“It’s too political.”

It seems everyone has an opinion on the term ESG. It’s polarizing. It has political overtones. That’s no good for investing. And I’m not the only one who sees “ESG” as a dead term. The CEO of Black Rock, Larry Fink, agrees with me.

To be fair, Fink took a whole lot more grief than we did. He’s the face of “woke investing”. That makes him enemy number one for groups like the conservative American Legislative Exchange. Attacks on Fink come often. They are highly visible.

BlackRock responded by abandoning the term ESG.

After the attacks, they don’t talk about 2050 goals. They don’t talk about climate alliances like they used to. Instead, they do the same thing we do – they find great companies that will profit from the transition and help drive it forward.

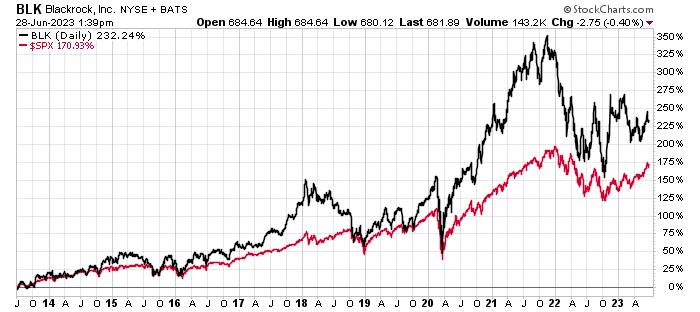

Fink is a smart guy. He co-founded BlackRock and became its CEO in 1988. The company’s shares outperformed the S&P 500 over the last decade as well:

BlackRock and Mangrove Investor Media hold similar corporate philosophies. We both understand the massive change that is happening and must continue. And we both look for leaders in that landscape of change. If we find and invest in the right companies today, we can build wealth for years to come.

In his 2020 Annual Letter, Fink identified environmental sustainability as one of BlackRock’s core goals. And each year he writes a CEO letter on behalf of BlackRock’s clients who are investors (through BlackRock) in their companies.

And he laid out exactly what BlackRock is doing:

Stakeholder capitalism is not about politics. It is not a social or ideological agenda. It is not “woke.” It is capitalism, driven by mutually beneficial relationships between you and the employees, customers, suppliers, and communities your company relies on to prosper. This is the power of capitalism.

In today’s globally interconnected world, a company must create value for and be valued by its full range of stakeholders in order to deliver long-term value for its shareholders. It is through effective stakeholder capitalism that capital is efficiently allocated, companies achieve durable profitability, and value is created and sustained over the long-term. Make no mistake, the fair pursuit of profit is still what animates markets; and long-term profitability is the measure by which markets will ultimately determine your company’s success.

It is a basic freedom – voting with your dollars. And he’s very succinct about the changes all companies face today. He makes it clear that the old nine to five workplace, with stagnant wage growth and a lack of mental health awareness is gone.

And companies that don’t adjust to the new reality and respond to workers’ needs are in trouble. My favorite takeaway from this letter was this:

Every company and every industry will be transformed by the transition to a net zero world. The question is, will you lead, or will you be led?

At Mangrove Investor, we embrace those same sentiments. We stand alone in the retail investment publishing world. We share those sentiments and are prepared to lead. And our goal is to help investors find those same kinds of companies for their portfolios.

Sincerely,

Matt Badiali

Numbers to Know

10

The 10 highest-ranking corporations in Corporate Knights’ Global 100 Index are not only committed to environmental sustainability, but also the wellbeing of employees, gender diversity and more. (CEO Magazine)

1.4%

On average, investors anticipate that ESG equities will return 1.4% per year less than the overall equity market over a 10-year period. (Harvard)

5,301

There are 5,301 organizations representing over $100 trillion in assets under management have become signatories to the United Nations Principles of Responsible Investment and the first three of these principles include explicit commitments to ESG. (MIT)

What’s New in Sustainable Investing

BlackRock’s Fink says he’s stopped using ‘weaponised’ term ESG

BlackRock boss Larry Fink, at the forefront of the business world’s adoption of environmental, social and corporate governance (ESG) standards, has stopped using the term, saying it has become too politicized. (Reuters)

And the finalist are...

Investment Week and Sustainable-Investment.com are pleased to announce the finalists for the Sustainable Investment Awards 2023 (Investment Week)

Video Of The Week

Hear from Larry himself

ow does the company reconcile the greater good with the bottom line? C.E.O. Larry Fink discussed at the Dealbook Summit event.