Spotlight Weekly – Summer

We are deep in the throes of summer

That means different things to different people. To my family it means fresh peaches, juicy tomatoes, and sweet summer watermelons. But to stockbrokers and fund managers it means holidays.

The old saying, Sell in May and Go Away is in full effect. That term comes from the old days in London’s financial district. Aristocrats, bankers, and merchants would sell all their holdings in May and leave the city for the seaside or the country. They wouldn’t come back until St. Leger’s Day.

This year, St. Leger’s Day is September 16th.

This isn’t some religious saint’s day. It’s named for Lieutenant Colonel Anthony St. Leger, an Irish soldier. He created a horse race in 1776. Originally, it was a two-mile course with a purse of 25 Guineas. Now, it’s a celebrated event in horse racing.

It’s the oldest race in Britain’s five Classics and the only one run at Doncaster.

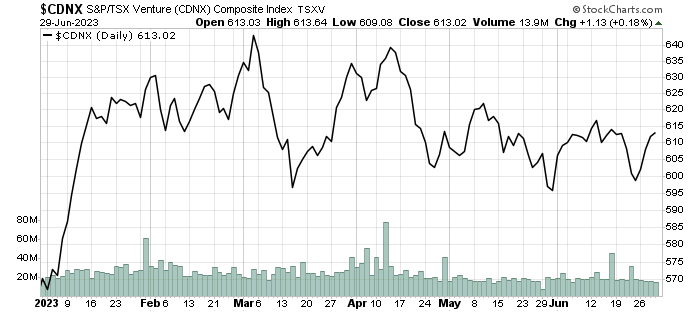

Basically, I told you all that to tell you that June, July, and August are typically quiet months in the market. And this year it’s definitely true. The market is treading water right now. Just look at the Canadian TSX Venture Index this year. This is the Dow Jones Industrial Average for small mining stocks:

The market traded essentially flat since the March rally. And the volume for May and June are well below the first part of the year. Investors sold in May and went away…

But here’s the thing about leaving for the summer. The folks who are still here can find bargains. Even the companies are active right now. There were a slew of mergers and acquisitions announced this month:

- Hudbay Minerals acquired Rockcliff Metals

- Blackwolf Copper and Gold acquired Optimum Ventures

- Lithium One Metals and Norris Lithium Merged

- Trillium Gold Acquired Pacton Gold

- Benchmark Metals and Thesis Gold Merged

There were that many or more deals in May, too. That shows us the summertime is a suitable time to look for bargains. So, when the brokers come back on St. Leger’s Day, we have our positions ready to profit.

Good Investing,

Matt Badiali