Energy Pragmatism

Energy Pragmatism as a Global Investment Theme

In BlackRock’s annual Chairman’s Letter, CEO Larry Fink identified the area the company sees the greatest demand for new investment: energy infrastructure.

He laid out two critical trends happening in the sector right now. The first is “energy transition”. That’s the movement away from fossil fuels to less carbon intensive energy sources. According to Fink:

“It’s a mega force, a major economic trend being driven by nations representing 90% of the world’s GDP. With wind and solar power now cheaper in many places than fossil-fuel-generated electricity, these countries are increasingly installing renewables.49 It’s also a major way to address climate change. This shift – or energy transition – has created a ripple effect in the markets, creating both risks and opportunities for investors, including BlackRock’s clients.”

This is the trend that led to the creation of Mangrove Investor. We saw the demand for clean energy trend as early as 2019. During our travels in Texas, it was clear that someone was investing heavily in wind and solar. That’s why we created our flagship New Energy letter to invest alongside major banks like BlackRock.

However, a second trend eclipsed the energy transition: energy security.

As Fink points out in the letter, the eruption of conflicts in Ukraine and Israel sent shockwaves through the world. These wars demonstrated both the vulnerability of European natural gas supplies from Russia and oil tankers in the Red Sea.

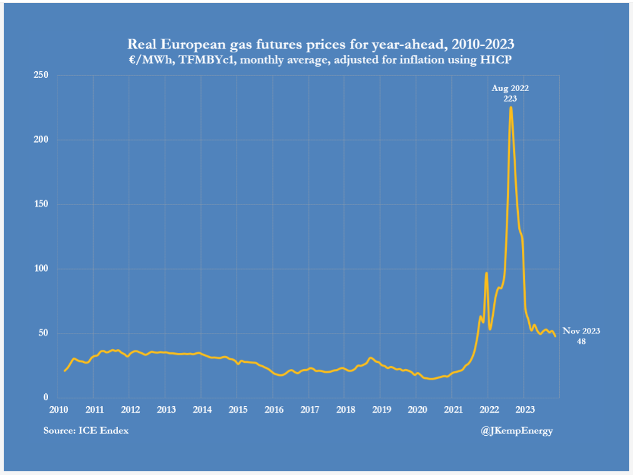

In Europe alone, governments spent over $800 billion euros subsidizing energy costs. When Russia Invaded Ukraine in 2022, European natural gas prices exploded

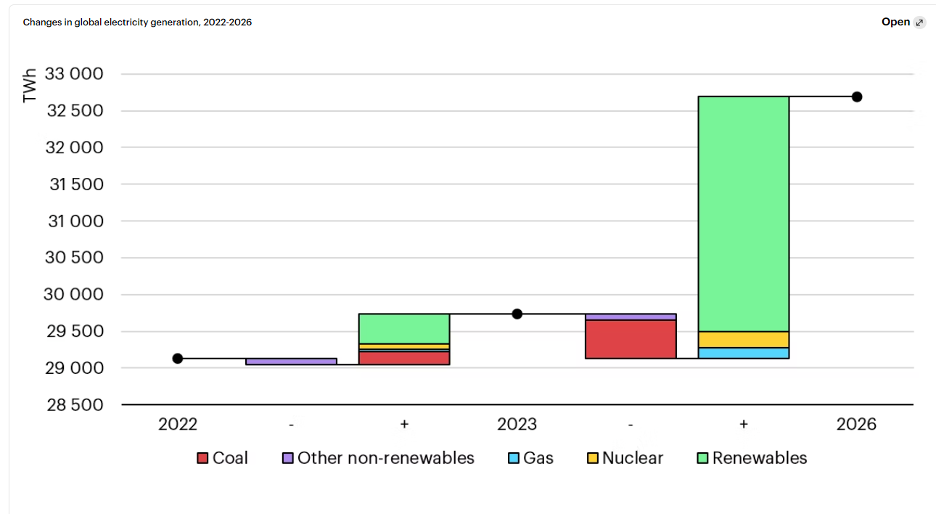

Most of Europe sourced its natural gas from Russia. However, the conflict and sanctions made that supply unreliable and expensive. The lesson of diversification came at a high cost. The high cost of electricity in Europe during the pandemic and after, stunted demand. Electric power demand fell 6% in 2022 and again in 2023. Most of that decline came from energy-intensive industry. That’s because prices in Europe were double the price of power in the U.S. and China. According to the International Energy Agency, European Union electric consumption isn’t expected to reach 2021 levels until 2026.

The soaring cost of hydrocarbons like oil and natural gas led to massive investment in clean electric power. That’s because windmills and solar panels don’t need fuel to generate power. That makes them safer that a gas plant that needs fuel from Russia or Iraq.

Globally, investment in nuclear, solar, wind, and hydro power will add enough new power to supply demand growth through 2026.

The best example of global energy pragmatism is the return of nuclear power.

The world turned away from nuclear power after the 2011 Fukushima Daiichi disaster. A major earthquake in Japan damaged the reactor, followed by a 15-meter-high tsunami that disabled the cooling system of three reactors. According to the World Nuclear Organization, the resulting event rated a 7 out of ten on the International Nuclear and Radiological Event Scale.

However, the IEA data shows that global nuclear power generation will hit a new high in 2025. As Fink pointed out, capital markets are ideal for facilitating this kind of growth. Since 2011, the nuclear power industry grew safer, smarter, and more modern. The new small modular reactors (SMR) make attractive investments in the current market.

The benefit of nuclear power, from an energy security point of view, is that they take much less fuel, which can be sourced from stable regimes.

Ultimately, the point of energy pragmatism is that the best energy sources are the ones that are safe. Countries are choosing to reduce risk. And that often lines up with low carbon power as well. That’s why Fink and BlackRock still consider Energy Transition as a “Mega Force” in global investing today.

For the Good,

The Mangrove Investor Staff

Numbers You Need to Know

303 Billion

A record-shattering $303.3 billion in energy transition financing was deployed in the US for clean energy technologies, including renewables, electric vehicles, power grid investment and others. (The Business Council for Sustainable Energy))

42GW

42GW of new renewable power-generating capacity was added to the US grid, primarily driven by robust solar additions. Renewable energy use also set new highs: 8.8% of total US energy demand and 23% of electricity demand. (The Business Council for Sustainable Energy)

3.4%

Global electricity demand is expected to rise at a faster rate over the next three years, growing by an average of 3.4% annually through 2026. (International Energy Agency)

What’s New in Sustainable Investing

Larry Fink’s 2024 Annual Chairman’s Letter to Investors

Investment giant BlackRock will continue to view the global transition to low carbon energy sources as one of the most powerful drivers of capital market opportunity and risk, even as the energy transition becomes “more contentious in the U.S.,” according to the firm’s Chairman and CEO Larry Fink’s annual letter to investors. (BlackRock)

U.S. investors are more willing to sacrifice returns in favor of impact

American Century Investments, a global asset manager with $240 billion under management, said in its annual impact investing survey that 40% of U.S. investors would give up some returns in order to have an impact. Among countries represented in the survey only Singapore, where 47% of investors agreed on the returns vs. impact question, scored higher. (Equities News)

Video Of The Week

Clean energy investing: There’s lots of capital on sidelines

One significant factor impacting investment decisions is the increased interest rate environment, which has affected the “ability to put capital to work” in the energy sector.