This Politicized Topic Leads to Profitable Investments

The acronym “ESG” is a polarizing topic today. Environmental, Social, and Governance (ESG) issues are a recent addition to traditional financial metrics.

But most of the critics have no idea of the history or the criteria. But it has its roots in industrial safety.

Safety is the reduction of risk…which is also a goal of investors. How do we maximize our return and minimize our risks. Turns out, ESG is a useful tool for that.

This month, we’ll discuss this most politicized facet of investing.

We’ll look at its history, how the S&P researchers use ESG criteria to screen the companies in the S&P 500 to create their index. And we’ll add a new company to our portfolio.

ESG’s Roots are in Safety and Community

I was fifteen when the Union Carbide pesticide plant leaked in Bhopal India. Considered the world’s worst industrial accident, it killed around 8,000 people and injured half a million. The leak and its impact dominated headlines and the nightly news.

It was a crystalline moment for me. An accident that illustrated the dangers in the world. Dangers that had existed simply because a manager wanted to eke out a bit more profit.

Sadly, the world hasn’t changed much.

In 2019, one of the worst modern mining disasters hit Brumadinho in Brazil. The tailings dam at giant miner Vale’s Corrego do Feijao iron ore mine failed. It created a mudflow that killed 270 people and left another eleven missing.

It was the second tailings dam failure for Vale in less than five years. In both cases, engineers at the company knew about instability in the dams ahead of time. In both cases, the company failed to do anything about it.

That neglect led to massive damage and death to an unsuspecting community.

A quick internet search will bring up dozens and dozens of disasters, stretching back to the industrial revolution. And that doesn’t include the super-fund cleanups, industrial blight, and ruined families left as a legacy of mismanaged industries.

In the past, those sorts of problems could take weeks or even months to become known. But today, everyone has a cell phone. And everyone is on social media. That makes everyone an activist investor. And it doesn’t take a tailings dam disaster to have a negative impact on a stock.

It doesn’t have to be this way.

In 2016, I visited Ireland to see the zinc mining industry. I was amazed to see that, in the first town we visited, European miner Boliden’s mine sat within the town itself. The mine employed a large part of the town. It sponsored the local soccer team. And was a valued part of the community.

The most important thing was that it fit right in.

I saw many American mining operations. Giant, industrial pits with bent chain-link fences, gravel parking lots, and heavy equipment. Boliden’s operation looked nothing like that. It was clean, orderly, and green. There was a berm around the property, covered in green grass, with shaggy sheep grazing on it.

Honestly, the only way I knew it was a mine, was that I could see a building that looked like a headframe. That’s the part of the mine that holds the hoist to bring up ore. It’s hard to disguise, but they did an excellent job of making it blend in.

The grounds were impeccable because the company didn’t try to squeeze out every penny in profit. They became part of the community, which saved them a fortune in time and legal fees.

This is a fitting example of what goes into ESG. It’s not regulation, so much as being part of the community. It’s the opposite of exploitation.

Don’t get me wrong, a company must be profitable. But it shouldn’t be profitable at the expense of its workers and its community. Our goal is to find companies that are professionally managed, financially. I’d own Boliden, (if they listed the stock in the U.S.) on the strength of what I saw in Ireland.

Its facilities showed me that it was a well-run company. Its financials backed that up as well. It pays a 4.8% dividend too.

However, these are hard metrics to measure. If I hadn’t gone to Ireland, Boliden would be just another name on the list. That’s where the S&P Global research team comes in. They set up some excellent criteria for ranking companies’ ESG scores. Let me show you…

S&P 500 ESG Index – How Do They Define ESG?

The S&P 500 ESG Index launched in April 2019. Since then, it outperformed the S&P 500 itself.

One thing the researchers point to is that ESG and “sustainability” are not the same thing. The researchers’ goal was to create a much broader selection tool that incorporates ESG values. It’s important to understand that the issues that make up ESG for one industry will be different for another. For example, in mining, the “Environmental” aspects will include waste management and water issues. Banks, on the other hand, don’t have those impacts. You obviously can’t rank a bank using a mining company’s criteria. It wouldn’t work.

In addition, the S&P Global team excludes companies for several reasons:

- If the ESG Score is in the bottom 25%

- If they mine or use coal for power or get more than 5% of revenue from it

- If they grow or make tobacco products or get more than 5% of revenue from it

- If they make or own a stake in controversial weapons (cluster bombs, land mines, biological, chemical, nuclear etc.)

- Manufacture or sale of small arms above 5% of revenue or hold 25% stake in a similar company.

- Manufacture or sale of military weapons or provide products or services to support military weapons above 10% of revenue.

- Have greater than 5% of revenue from oil sands extraction.

- Fail to comply with the ten principals of the United Nations Global Compact

Applying these exclusions to the S&P 500 eliminates 196 companies from consideration.

The S&P Global research team pointed out exactly what we believe at Mangrove Investor – that an ESG Index enables investors to align our investments with our values without compromising our overall investment objectives.

That’s hugely important to us. But does it work?

We can answer that question by looking at the exchange traded funds (ETFs) that track ESG and the S&P 500 ESG Index.

Applying the Index Methodology to the Real World

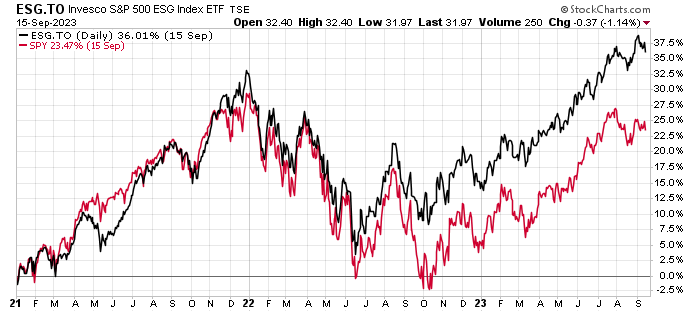

The evidence shows that the methodology works. If we look at the Spyder S&P 500 ETF compared to the Invesco S&P 500 ESG Index ETF, you can see what I mean:

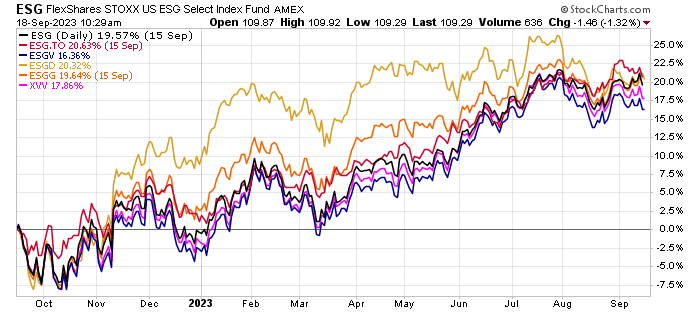

I have to admit, I randomly chose the Invesco ETF. There are many ESG ETFs on the market. I found six, without looking all that hard:

- FlexShares STOXX ESG Select (ESG)

- Invesco S&P 500 ESG Index (ESG.TO)

- Vanguard ESG ETF (ESGV)

- iShares ESG Aware MSCI ETF (ESGD)

- BMO MSCI Global ESG Leaders ETF (ESGG)

- iShares ESG Screened S&P 500 ETF (XVV)

Every major fund group has one. And over the past year, their performance clustered between 16.3% and 20.6%.

That’s a large spread for a group of funds theoretically tracking the same index. And for most of that period, three funds outperformed the group: Invesco S&P 500 ESG Index (ESG.TO), iShares ESG Aware MSCI ETF (ESGD), and BMO MSCI Global ESG Leaders ETF (ESGG).

However, unless you can trade Canadian stocks, we don’t have access to the Invesco ETF. So, let’s compare the two U.S. listed ETFs.

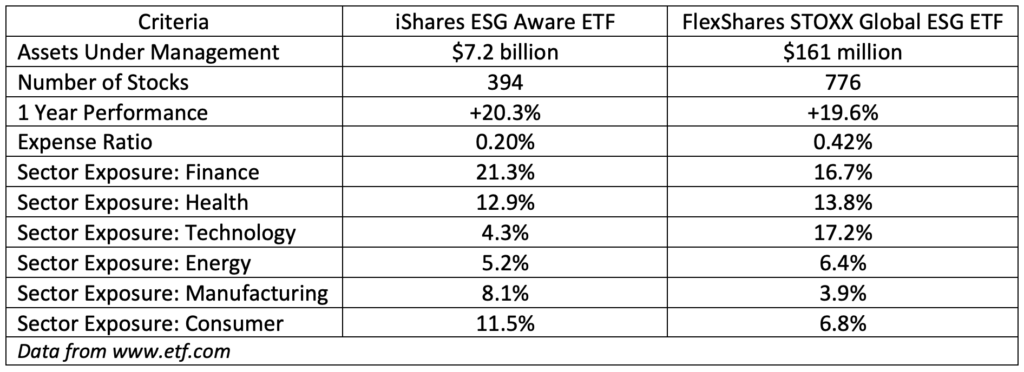

Here’s how they stack up:

A couple of interesting points. Both of these ETFs track data service MSCI’s ESG indices. They don’t track the S&P Global version. However, MSCI’s ESG criteria are quite similar. And, as we saw in the charts, the performances are comparable as well.

That said, the FlexShares STOXX Global ETF is not really what we are looking for. It’s small. It has a higher expense ratio. But most important, its top stocks read like a Nasdaq top one hundred list. It’s top ten stocks are:

- Microsoft (5.09%),

- Apple (4.75%),

- Amazon.com (4.01%),

- Meta Platforms (2.72%),

- JP Morgan Chase (2.59%),

- ExxonMobil (2.39%),

- Johnson & Johnson (2.38%),

- Berkshire Hathaway (1.91%),

- Chevron (1.77%)

- Alphabet (1.63%).

This is a fund more interested in performance than ESG.

That’s why this month’s recommendation is the iShares ESG Aware ETF (Nasdaq: ESGD). It’s a $7.9 billion fund that holds 394 stocks.

It holds large to mid-cap stocks from Europe, Australia, and Asia.

Its top ten stocks are:

- Nestle – Consumer S (2.14%)

- Novo Nordisk – Health Care (2.09%)

- ASML Holdings – Information Technology (1.76%)

- LVMH – Consumer Discretionary (1.52%)

- Shell PLC – Energy (1.43%)

- Astrazeneca – Health Care (1.41%)

- Novartis – Health Care (1.35%)

- Toyota Motor Corp. – Consumer Discretionary (1.29%)

- SAP – Information Technology (1.21%)

- Roche Holdings – Health Care (1.16%)

This fund focuses on companies outside North America, as you can see.

It currently pays a 2.3% dividend.

Action to Take: Buy iShares ESG Aware MSCI ETF (Nasdaq: ESGD) and use a 25% trailing stop. Its current price is $71.39. With a 25% stop, we will sell our position if it closes below $52.56 per share.

ESG shouldn’t be as polarizing as it is today. But then again, we feel that way about a lot of things right now. This is simply an expansion of risk reduction strategies.

With cell phones and social media, companies must do the right thing. A bystander with a cell phone can instantly amplify any indiscretion.

As the data showed, focusing on ESG isn’t a drag on return. In the past couple of years, ESG funds outperformed the market. And that’s good for everyone.

For the Good,

Mangrove Investor Team