Unlikely New Bull

There is an unlikely new bull market in commodities

The uranium price is running.

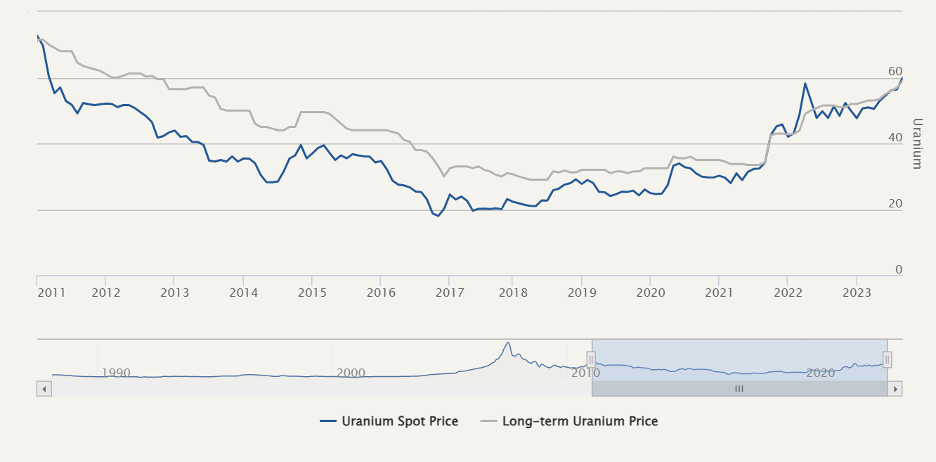

Here’s a chart of uranium prices from uranium mining company Cameco’s website:

As you can see, the price fell by more than 70% of its value from 2011 to 2017. From 2017 to 2021, the price traded sideways for the most part. However, since late 2021, the price began to climb in earnest. Today, the price is three times its 2017 low and at the highest point since 2011.

The companies that explore for and produce uranium responded to that move. But only recently. As you can see in this chart, Cameco Corp (the ExxonMobil of uranium production) was under $22 per share in December 2022. It’s nearly doubled in less than a year.

The question I get from readers is: Did we miss all the gains?

And the answer is: no. This bull market is different from the past, for two reasons. First, we had nearly fifteen years of underinvestment in uranium. Second, there is a global political will for new nuclear power.

Bloomberg Green reported on the recent United Nations General Assembly in New York City this week. And the mood there is all about providing reliable energy sources. Many countries experienced weather-induced natural disasters this year. Floods, storms, and fires are all on the minds of the representatives.

And that puts climate change in the spotlight.

Nuclear power is the single best source of base-load electric power that doesn’t produce carbon dioxide, or other gaseous pollution. As Bloomberg reported:

COP28 President Sultan Al Jaber has said climate diplomacy should focus on phasing out emissions from oil and gas, leaving the door open for their continued use alongside technologies to capture the carbon pollution produced by burning them. This is also known as phasing out “unabated” fossil fuels; on Tuesday, US Climate Envoy John Kerry co-authored a Washington Post editorial that called for the end of new unabated coal plants.

Sweden is a good example of the changing political will concerning nuclear power. In 1980, the government decided to phase out nuclear power. In 2010, they repealed the policy. In 2015, the government decided to close four older reactors by 2020. That cuts 2.8 gigawatt-hours of electricity.

However, climate concerns led the country to target a 100% renewable electricity by 2040. Earlier this year, the Swedish government revised that commitment to 100% fossil free electricity. That allowed the government to go ahead with plans for new nuclear reactors.

According to the World Nuclear Organization, there are sixty new nuclear reactors under construction today. That’s a 14% increase of the total power plants worldwide.

There are another 100 nuclear power plants on order or planned. And there are 300 more proposed power plants. That would effectively double the current number of power plants.

And that’s why we see the bull market in uranium as a long-term investment play.

Good investing,

Matt Badiali

Numbers to Know

1798

The year Martin Klaproth dissolved pitchblende in nitric acid then added potash to obtain a yellow precipitate. Klaproth concluded he had discovered a new element. He named it uranium in honor of the planet Uranus, discovered in 1781. (Famous Scientist)

1897

The year uranium was discovered as radioactive when French physicist Henri Becquerel left some uranium salts on a photographic plate to see how light influenced the salt, But when the plate fogged up he discovered some sort of emissions from the uranium salts. Becquerel shared a Nobel Prize with Marie and Pierre Curie in 1903 for the discovery. (Live Science)

1951

The year EBR-I became the first power plant to produce usable electricity through atomic fission. It powered four 200-watt lightbulbs and eventually generated enough electricity to light the entire facility. (Energy.gov)

What’s New in Sustainable Investing

Sustainability as a Business Imperative: Investing for Success

In today’s world, sustainability has evolved from a corporate responsibility to a critical ethical and business imperative. To achieve sustainability goals effectively, organizations must both reexamine traditional thinking of sustainability as a cost-based, zero-sum game and expand beyond traditional return-on-investment metrics and approaches. (CSR Wire)

Uranium primed to extend rally on resurgent nuclear power, say analysts

Uranium spot prices are expected to climb to $75-$80 a pound by end-December, in a fitting finish to a year that has seen the metal rally about 36% to-date. (Mining.com)

Video Of The Week

Nuclear energy: What investors need to know about its future and clean energy

Where do we stand with nuclear energy and where could we be going?