How to Position Your Portfolio for the Greatest Economic Change in Our Lifetimes

The U.S. whaling industry began back in the 1600s. But from 1810 to 1850, the industry exploded. For every whaling ship sailing in 1816, fourteen plied the ocean by 1850. The industry raked in money. Whaling ports like Nantucket and New Bedford, Massachusetts, and Boothbay Harbor, Maine became rich. They were the Dallases and Houstons of their day.

High-quality whale oil lubricated new machinery in factories all over the country. Lower quality oil lit people’s homes. Whaling became the fifth largest industry in the U.S. by 1850… and then it collapsed.

According to this essay in the Atlantic, its end was only partly due to over-hunting whales. It was mostly about innovation:

The life and death of American whaling… [is] really a modern story about innovation. It’s about how technology replaces workers and enriches workers, how rising wages benefit us and challenge companies, and how opportunity costs influence investors and change economies. The essay can stand on its own, without my muddying the waters with political points about how Washington or CEOs should learn from yesterday’s Ahabs. Suffice it to say that whaling became the fifth largest industry in the United States in the 1850s, and within decades, it had disappeared.

The unification of the power base will be the major change of the next generation.

The ability to capture and store natural energy – from wind, sun, tides, and the earth’s heat – will power the future. The transition will create enormous change in the economic landscape. There will be winners and losers. The key for us is knowing which companies to own and which to avoid.

Energy Source Dominance Changes Throughout History

Transitions don’t happen quickly. According to Benjamin Sovacool, it took nearly 50 years for oil to come into its own at 10% of the U.S. energy market – from its discovery in the 1860s to 1910. It took another 30 years to get to 25% of the market. And as you can see, it’s still only at 33% of the market today.

Natural gas took even longer… 70 years from 1% to 20%. King coal, which remains the world’s dominant energy source, took 103 years to get to 5% of U.S. energy consumption. It took another 26 years to hit 25%.

Nuclear energy was among the fastest adoptions. It took just 38 years to reach 20% of U.S. energy market, which it hit in 1995.

However, the Fukushima Daiichi disaster in 2011, brought that industry to a screeching halt.

The plant, hit by an earthquake and tsunami, suffered a containment failure and leaked radiation. According to the World Nuclear Association (WNA), there were 2,313 deaths associated with the meltdown. It was the worst nuclear accident since the 1986 Chernobyl disaster.

In direct response, Germany’s Chancellor Angela Merkel shut down eight of the country’s 17 nuclear power plants. And she announced total shutdown of the German nuclear power industry by 2022.

At the time, the Director General of the International Atomic Energy Agency (IAEA) Yukiya Amano said the Japanese nuclear disaster “caused deep public anxiety throughout the world and damaged confidence in nuclear power.”

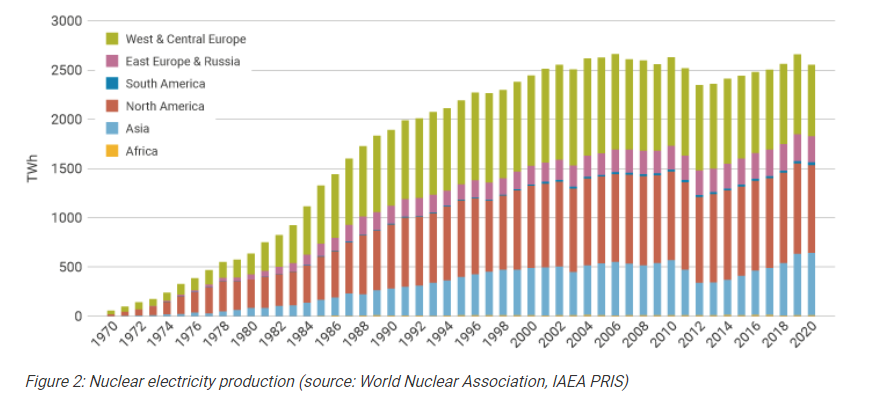

As you can see in the chart below, from the WNA, global nuclear energy production dropped dramatically after 2011:

However, in the 11 years since the accident, a new crisis has moved to the forefront of the conversation – energy security.

Russia Has Made Energy Security a Major Talking Point in 2022

As Europe divested itself from nuclear energy, it moved to natural gas. And that has meant agreements with Russia – Europe gets nearly a third of its natural gas from Russia.

And Russia has a history of wielding that position like a bludgeon to make Europe do what it wants. In 2006, Russian state oil company Gazprom quadrupled the price of gas from $50 to $230 per 1,000 cubic meters. And in 2009, Russia cut off the natural gas supply to Ukraine in a fight over gas tariffs. Several European Union countries went short gas supplies when the weather fell below freezing.

That’s why the events in 2022 puts all these events in a new light. Western Europe depends on Russian energy. That makes it difficult to put pressure on the rogue nation as it wages war on Ukraine.

But this is also driving home a critical lesson for governments all around the world. We must use less fossil fuel to cut support for the bad actors that supply them.

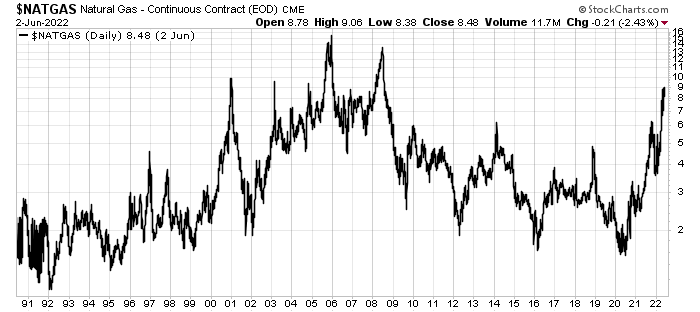

Natural gas is a lightning rod, politically. It must travel through pipes or special ships. Supply disruptions, by both natural and man-made events, happen often (think of the tariff dance between Russia and the EU that I just told you about). And its price can be quite volatile, which makes planning difficult.

Here’s a 32-year chart of the price of natural gas in the United States – you can see that it jumps all over the place:

The price differs around the world, but Europe mostly pays more than we do. In addition, natural gas is a fossil fuel. And there is a global push to move away from them, which is giving us an opportunity.

The Move Away from Fossil Fuels

Around the world, more than 1,500 corporations pledged to get to “net zero” carbon emissions by 2050. That means they are promising to limit their emissions, and to offset any carbon that they do emit.

Many governments have passed mandates to require all new cars and light trucks to be zero emissions That includes states like California (which issued a deadline of 2035) and governments like Iceland (2030), Scotland (2032), Denmark (2030), and Canada (2035). Automakers like General Motors and Toyota will stop making cars that run on gasoline by 2035 and 2040, respectively.

These are massive tidal forces driving this “new energy reality.” According to DivestInvest, an organization dedicated to moving businesses away from polluting investments, more than $5 trillion in total assets has been pledged to move out of fossil fuels. From the organization’s briefing:

Historically, the fossil fuel industry has been a source of strong returns for shareholders. But the risks of fossil fuel reserves becoming stranded assets, the increasing costs of extraction, and the increasing cost competitiveness of renewables, now threaten those traditionally healthy yields. It is now financially prudent to move investment from fossil fuels to renewable energy and other climate solutions.

The transition from our current energy portfolio to the updated version will be painful. There will be winners and there will be losers. But that is the nature of change. There isn’t a lot of demand for whaling ships today. We don’t make a lot of buggy whips or typewriters anymore.

The key for investors will be to get out of the companies that will fail and find those new energy companies that will succeed.

What Will the New Energy Menu Look Like?

What we see today is the opposite of the decades-long adoption process of single fuel sources. Companies and governments are latching on to green energy much more quickly. That’s because many of these adaptations are small scale and economically driven.

For example, in 2015 just 4% of U.S. households had an LED light. By 2020, almost half had them. The reason is efficiency. An LED uses just 25% of the energy of a traditional incandescent bulb. And the bulbs last 25 years. That’s an economic benefit

A lack of overt economic benefit means that solar power hasn’t exploded in sunlit places like Florida. It costs about $15,000 to install a 5-kilowatt solar system on a home. It takes over 12 years for a homeowner to recover that cost. That’s a high barrier to entry and a low economic benefit to homeowners.

However, one power source has multiple economic factors in its favor, and it is an excellent source of carbon-free electricity: nuclear. And the 2022 version of the nuclear power plant is low-waste and high efficiency.

There’s a funny story about what happened in Germany after they panicked in 2011. They tried to build enough wind and solar to meet power demands and couldn’t. They ended up ramping up their coal consumption… and importing electricity from France. And about 85% of France’s electric power came from nuclear power plants.

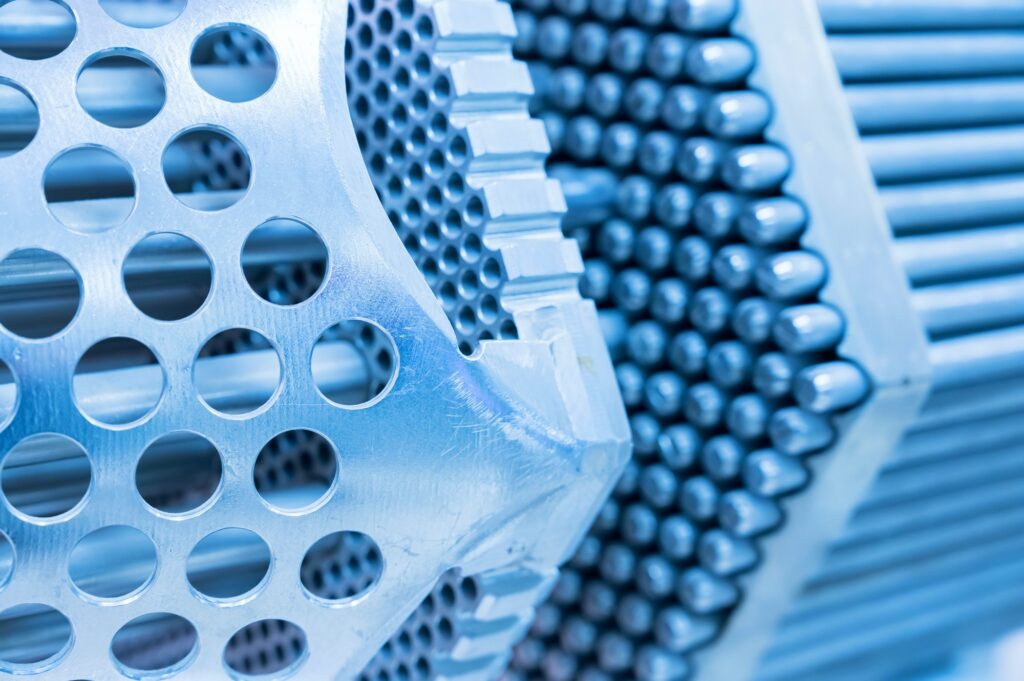

But this month’s recommendation isn’t a nuclear power plant. Instead, we’re looking at the companies that mine the fuel.

Ultimately, the Fukushima disaster resulted in more than a decade of under-investment in nuclear energy and uranium mining. Nuclear power fuel has come mainly from existing stockpiles since 2016. That’s when many uranium mines like McArthur River, Rabbit Lake, Ranger, and Cominak began shut down.

Uranium is a “hot” commodity these days. Russia supplied about 5.9% of the world’s mined uranium in 2020 according to the WNA. That will be significantly lower in 2022 and well into the future.

All this has left the world with a dwindling uranium supply.

At the same time, demand for uranium is up thanks to a new push for nuclear power. Countries like the U.S., South Korea, France, Japan, and the U.K. all have nuclear-supportive energy policies. Today, we have the highest volume of uncontracted uranium needs (by existing power plants) on record. That means we need more uranium today than we ever have before.

The 2021 “Nuclear Fuel Report,” a comprehensive look at the nuclear market from the WNA, predicts a supply deficit of 100 million pounds by 2030 and 200 million pounds by 2040. And like most mined commodities, there is no quick fix.

That makes safe, sustainable uranium supplies more valuable today. And they are difficult for investors to find:

- 71% of uranium production comes from state owned companies.

- 13% of uranium production comes from small scale producers or non-public companies

- 9% of uranium production comes from major, diversified miners

That means 93% of the world’s uranium supply isn’t available for investors. And that’s why we are excited to tell you about one of Canada’s best new uranium miners.

NexGen Energy (NYSE: NXE) – Uranium Mining Done Well

NexGen Energy is a $2.4 billion uranium mining company based in Vancouver, British Columbia. It owns the Rook 1 uranium project in the Athabasca Basin in Saskatchewan.

“NexGen is driven by our vision of delivering the clean energy fuel of the future, and guided by our values of honesty, integrity, accountability and resilience.”

– NexGen President and CEO Leigh Curyer

That’s about as clear a vision statement as we can get, that lines up with what we are trying to find at New Energy. And it sums up the way NexGen does business.

Why Buy NexGen Energy?

There is a simple case for buying NexGen… Its Rook 1 Project is a world-class uranium deposit that is still in development. It will cost around $1.25 billion and three years to build. To the market, that’s a long time before it proves itself. That means the market is still pricing in a lot of risk – it’s cheaper today than it will be in three years.

Arrow has excellent economics. If it were in production today, it would be in the lowest 10% of all uranium mines in terms of cost. The project has an after-tax net present value (NPV) of C$3.47 billion, roughly the same as its current market value (in Canadian dollars). That means investors today are in good shape to make a profit, but that may not be the case down the line.

As it moves toward production, we expect NexGen shares to increase in value. Producing companies trade on price to earnings, not the project NPV. We just have to be patient. If it follows every other mine development project, its shares will ease lower at times. That means we can slowly build our position in NexGen, buying when the share price falls.

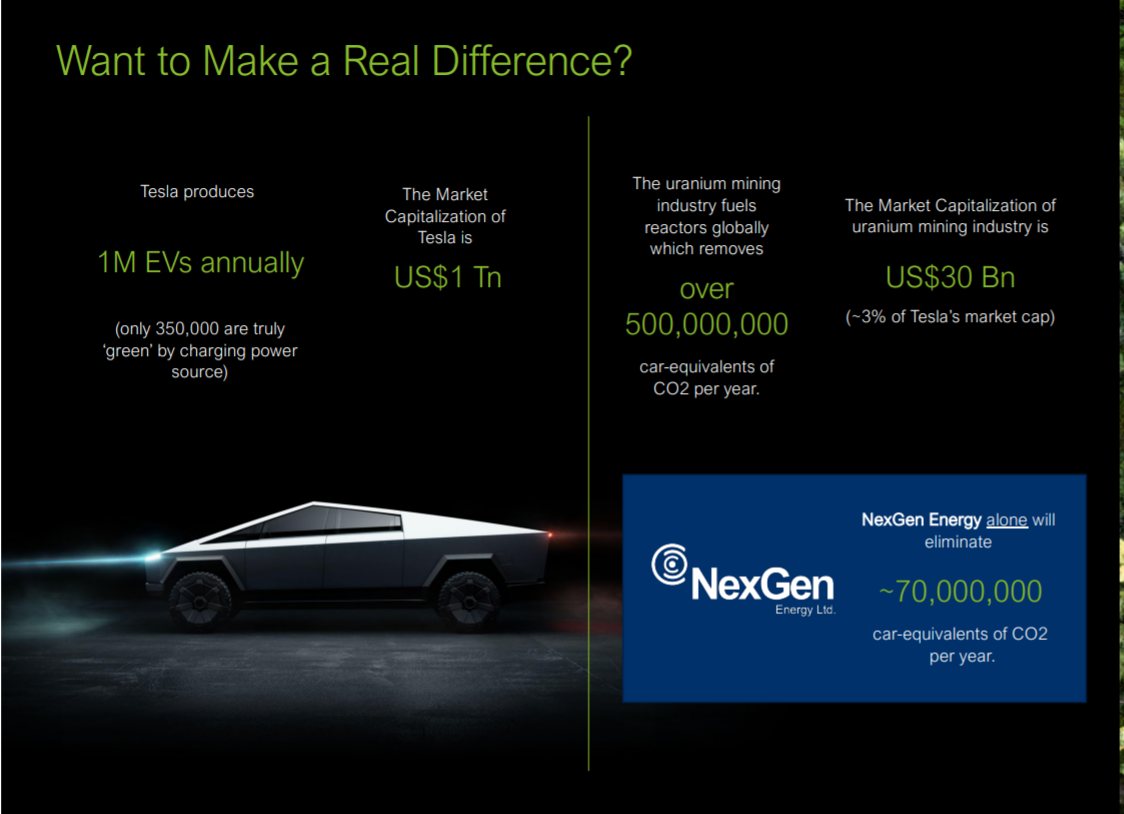

The reason we want to own NexGen and uranium producers at all comes down the fundamentals of new energy. In order to make all those new electric vehicles go, we need electricity. And there just isn’t enough wind and solar to make that happen.

To generate the amount of power we need without coal and natural gas, nuclear has to be part of the equation. Here’s a graphic that NexGen uses to illustrate that point:

There simply isn’t any way forward except with nuclear as part of the global power supply. And that means we need uranium supplies. The Rook 1 project is one of the best new developments coming online in the next couple of years. It’s in a safe jurisdiction, developed and managed by an outstanding mining company that prioritizes sustainability and modern mining practices.

Action to Take: Buy NexGen Energy (NYSE: NXE) Below $5.75 per share. Buy the dips on NexGen. This is another example of when patience will get us a better price. We believe the stock will range between $4 on the low side and more than $6 on the high side due to the market volatility and ongoing development issues. We should be able to accumulate this stock over the next six to 12 months.

For the good,

Matt Badiali