The Best New Energy Companies in the World

How $150 Trillion in Spending will Transform the Global Energy Infrastructure

The smell of the salt marsh holds a fond place in my heart.

If you’ve ever been near a tidal marsh, it has a distinct, earthy smell. To me, it smells of secrets hidden in the dark mud. Of crabs caught in nets. Minnows darting around clusters of juvenile mussel shells. Of rotten boat hulls covered in reeds.

According to Harvard’s Venkatesh Murthy, Raymond Leo Erikson Life Sciences Professor and chair of the Department of Molecular and Cellular Biology, smell and memory are closely linked because of the brain’s anatomy.

It works like this: smells hit the olfactory bulb in the front of the brain first. From there, smells take a direct route to the amygdala and the hippocampus, which control emotion and memory. That’s why we can have such powerful emotional responses to a smell.

For me, one whiff of the marsh was the harbinger of summer vacation.

Every summer, my family would pack bathing suits and coolers for a week “down the shore.” My grandmother was our matriarch. And that week in Brigantine, New Jersey was sacrosanct.

My many cousins and I would roam the beaches and boardwalk in packs. Sometimes swimming. Sometimes fishing. Sometimes fighting. It was the highlight of my summers.

But those days are long behind me.

We stopped going to Brigantine after the casinos went into Atlantic City. My cousins and I scattered after college. And I found the allure of other coasts, other beaches, and other marshes.

Imagine my surprise when I came across a mention of those towns from my childhood. It was in reference to several ambitious new energy projects. Giant offshore wind farms will be built near my childhood vacation spot.

My grandmother would be thrilled.

I can hear her now, hustling us into the car to go somewhere. We would go to the Brigantine Hotel for footlong hot dogs. We would go to Cape May to look for “diamonds” in the quartz pebbles. We would go to Campbells to catch blue crabs for dinner.

A wind farm would absolutely make her ‘must-see’ list. She would have marveled at the size and grace of the huge blades. I have no doubt that seeing the wind farm would have been a highlight of every summer trip.

That’s why, when I heard about all these wind farm projects, I investigated.

The Atlantic Shores project is one of three offshore wind farms planned for several miles off the southern New Jersey coast. Together, they will generate enough electricity to power 1.6 million homes.

Those new wind farms are part of New Jersey’s stated goal of 100% clean electricity by 2050. And while that seems a long way off, it isn’t. These giant capital projects take years of planning and construction.

Massachusetts, New York, New Jersey, Virginia, and California have all embraced offshore wind power. Research indicates that developing just 4% of our potential offshore wind capacity could power 25 million homes.

The companies building these ambitious new projects are primarily European. Today, Dominion Resources is the only U.S.-based power company building offshore wind capacity.

That makes it tough for us to invest in these fields, but we found a way. And offshore wind projects are just one aspect of a major transition in electric power generation. We have two other ways to play the booming alternative energy market.

That’s a huge opportunity for investors who want to see their investment dollars support change for the good.

We see the potential for both growing wealth and supporting the companies actively changing the world’s energy supply.

This report will highlight three premier companies in the alternative energy space. They aren’t giant power companies. Instead, we’re diving into three different ways to play the massive growth in this industry.

These three companies should grow substantially over the next 18 months-24 months as their portfolios grow and mature. We believe they offer excellent risk-to-reward profiles.

Industry Overview

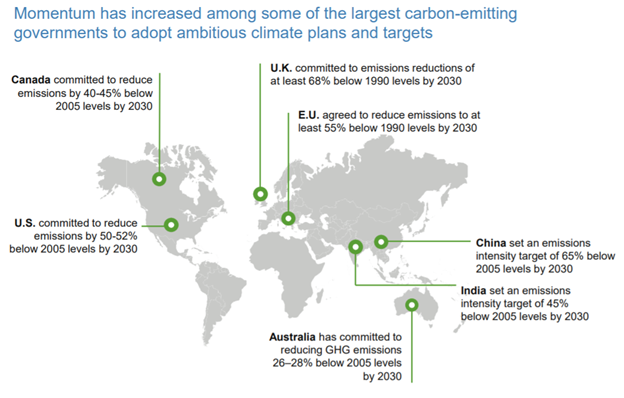

In the past year, sustainable investing has taken a huge leap forward. As Mark Carney, head of Transition Investing for Brookfield Renewable Partners pointed out in the company’s 2021 Investor Day presentation.

Sustainable investing went from a fuzzy concept to a concrete plan in about 18 months. The concept of Net Zero exploded onto the scene. Net Zero means that the individual, company, or country emits excess carbon dioxide.

To achieve Net Zero, the world needs to reduce carbon emissions by 7% per year (compounded) over the next decade. We achieve that through renewable power – wind, solar, hydroelectric, and nuclear. And that’s where we want to put our investment dollars to work today.

Let’s jump into the space…

Pure-play renewable power companies are difficult to find. Most renewables are part of larger power portfolios. Take NextEra Energy (NEE) for example. It claims to be the world’s largest power generator from the wind and the sun. However, it also operates nuclear power plants and natural gas-fired plants.

Don’t get me wrong, I’m not anti-nukes. And I’m not anti-gas either. Both have a role in power production going forward. But those spaces aren’t growing as fast as renewables like offshore wind and solar. That’s really where we want to be.

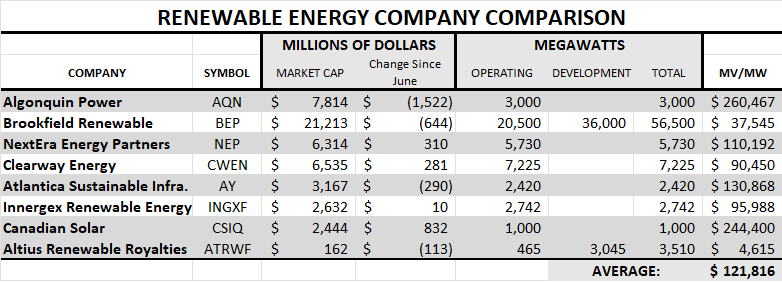

And we aren’t alone in the market. Investors are buying up anything related to alternative power. As you can see in the comparison below, we will pay a lot per megawatt (MW) for the more mature power companies.

The table below is a proprietary compilation of public data from company websites and reports. The data are as complete as we could make them. But remember, it’s a moving target, particularly on the development side.

However, we believe that the price per megawatt (MW) is a good place to start for comparing these companies.

We used two different values for comparison – market cap (MC) and enterprise value (EV). The MC is the value of the company (calculated by multiplying its share price by the number of shares outstanding).

The EV is a little more involved. It is the market cap plus total debt, minus cash. We like to use it because it’s what you would pay if you wanted to purchase the company.

The average price for a renewable energy company using MC is $173,299 per MW. The average price using EV is $318,420 per MW. That gives us a basis for valuing companies.

For example, Brookfield Renewables (NYSE: BEP) has a current value of $15,974 per MW. That means it could go up 984% before it hits the average price. That seems inexpensive. The reason for that discount is that more than half of the company’s total power is still in development. The discount is simply the market’s way of pricing in risk.

However, the EV to MW price is much higher – $50,825 per MW. That means it could go up 500% to get to the average. That’s more evidence of the market pricing in debt. Brookfield has more than $19 billion in debt, borrowed to build its power portfolio.

That’s still an attractive risk-to-reward ratio, in our opinion. That’s why you’ll find Brookfield Renewables in our recommendations below. We believe this company could deliver a 500% gain in the next couple of years.

One of our primary targets on this list was Aker Offshore Wind (OTC: AKOWF). But its parent company reacquired it (announced in March 2022). Otherwise, it would be on our recommended list. It trades at a significant discount to its peers. And it has an outstanding technical background.

Our first recommendation is also on this list. Altius Renewable Royalties (TSX: ARR & OTC: ATRWF), offers us low risk and excellent value in a ‘For the Good’ company.

So let’s get to the details…

Altius Renewable Royalties (TSX: ARR or OTC: ATRWF) – My Favorite Kind of Business

Our first investment opportunity is a C$266 million renewable energy royalty company listed on the Toronto Stock Exchange (TSX).

I heard rumors about this deal all the way back in 2016, while on a trip with the company’s top brass. This group specializes in royalties. I am thrilled that it moved its focus into renewable energy.

Full disclosure, I know this management team well. I met them back in 2007 and I have kept up with their work ever since. In 2016, traveled to Ireland with the executives of the parent company, Altius Minerals. We toured the country, looking at zinc exploration and mines co-existing in small towns.

It was a master class in how mining should look.

During that trip, we discussed several ideas that the Altius team had brewing. They had a kernel of an idea about bringing the royalty business model to energy.

Longtime readers know that I love royalties. I have recommended many royalty companies over the years and done well. Some of my best recommendations came from companies like Royal Gold (RGLD) and Wheaton Precious Metals (WPM) – although the latter was called Silver Wheaton back then.

The royalty business model is simple and advantageous for us, as investors. It works like this:

Altius Renewable Royalties starts out with a pool of capital. It then uses that money to partner with renewable utilities companies. In exchange for some of that cash, the utilities agree to pay a royalty on future power production.

That helps the utility get the project built and lowers the amount of cash it needs to borrow. In exchange, the royalty holder gets cash flow.

The royalty company takes small bits (1% to 3%) of many projects. That creates a portfolio of cash flows from renewable energy projects.

As investors, we get several benefits:

- Reduced risk from the portfolio – if one project has issues, the company’s cash flow only takes a small hit.

- Unencumbered cash flow – royalties have no costs after the initial investment.

- Growth – the company reinvests its excess capital into more royalties, creating a virtuous circle.

Altius Renewable Royalties takes this powerful model and applies it to hydro, wind, and solar power plants. As I said, this company was just on the drawing board in 2016. It only went public in March 2021.

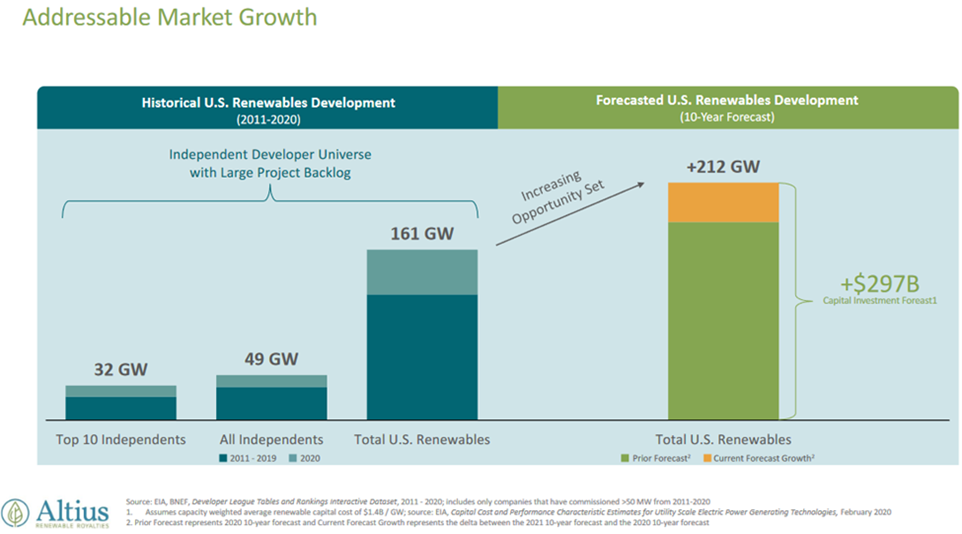

But even back in 2016, the management team identified the trend we discussed earlier. That there is a massive need for renewable energy projects. Here’s how they identify the opportunity:

The opportunity that Altius saw was not as an operator, but rather as a banker. Its business model supplies capital to these projects and receives a percentage (royalty) of the revenue of the operation. And the company found a huge need for capital.

It owns 50% of Great Bay Renewables (GBR). Its partner is Apollo Global Management (APO), the $40 billion investment group. ARR shares the funding of GBR 50-50 with Apollo.

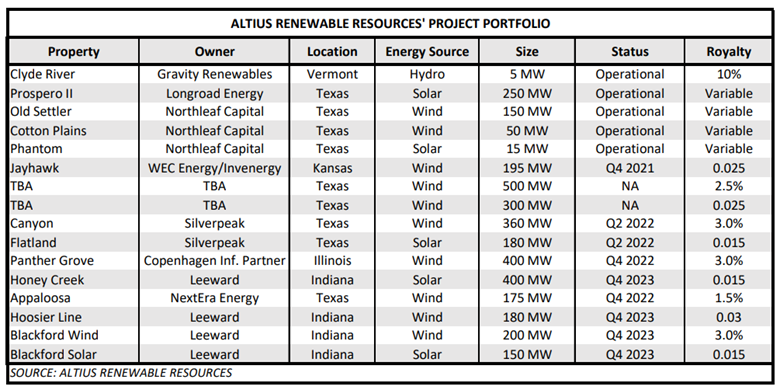

In all, the venture controls 3,510 megawatts of renewable energy, net. The table below shows the list of projects and selected data from the company’s website:

As we can see, the company has five projects that either just came online or should come online this year. And another four projects slated for operation by the end of 2023. That significantly reduces our risk. That’s because we aren’t committing capital to a company with projects slated to come online in five or ten years.

Time equals risk, in this case. We want revenue in the short term, and that’s what ARR offers us. In addition, we want the company to use that cash flow to grow. And Altius has a track record of doing that.

Altius Renewable Royalties is a spinoff of Altius Minerals. The company has a long history of acquiring royalties. In fact, way back when the company first started, it acquired a royalty on the giant Voisey’s Bay nickel, copper, and cobalt project. That tiny royalty generated the cash flow that kept Altius going through several bear markets in natural resources.

Altius Minerals currently has 54 royalties across eleven different commodities. Twelve of those royalties are generating cash flows today.

That’s how I base my estimate that Altius Renewables will continue to find and acquire more royalties. Same management team, same philosophy, and same forward thinking.

ACTION TO TAKE: Buy Altius Renewable Royalties (TSX: ARR)up to C$15 per share on the Toronto Stock Exchange. You can also buy Altius Renewable Royalties (OTC: ATRWF) up to $12 per share on the OTC market. Please use a limit order at the market price to buy shares, especially on the OTC. There isn’t a lot of volume, so be patient.

The New Clean Energy Supermajor – Brookfield Renewable Partners (BEP)

Brookfield Renewable Partners (NYSE: BEP) is a $9.49 billion renewable energy utility company. It is a limited partnership (not a Master Limited Partnership!). We’ll talk more about what that means below.

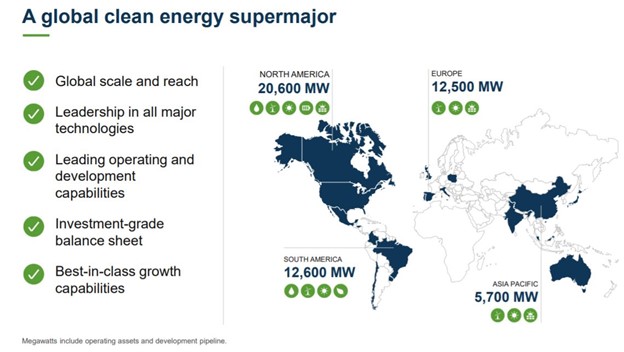

The company owns a portfolio of renewable power generating facilities around the world: in North America, Columbia, Brazil, India, and China. It considers itself to be “one of the world’s largest pure-play renewable power platforms.”

Like Altius Renewable Royalties, Brookfield owns parts of many different generating facilities. That diversity reduces the risk of a single event disrupting cash flows. And Brookfield invests across multiple technologies as well.

The company owns roughly 21 gigawatts of producing power and has another 15 gigawatts under construction. In total, the company has 63 gigawatts of new power plants in its pipeline. This is simply the best renewable power utility on the market today.

In 2021, the company and its partners generated 14,946 gigawatt hours of power. That’s almost enough power for all the houses in Connecticut, for the year. Brookfield’s share was 6.6 gigawatt hours.

And because that’s clean energy, it prevented the equivalent of all of London’s annual emissions. Or, to put it another way, it was equal to removing 6 million vehicles from the road.

And that energy production makes money – a critical component for our investment case. You might scoff, but there are many (many) companies that are little more than science experiments. And while they make delightful stories… they are terrible investments.

Brookfield isn’t like that. It produces renewable energy and gets paid for it.

Brookfield’s Business

The company generated $934 million in “funds from operations” (FFO). That’s up 10% from 2020. That’s great, but there’s more that we need to understand. Brookfield’s income is stable. It comes from long-term, inflation-linked contracts. That means, we don’t have to worry about it suddenly falling.

The development portfolio is important because it will power Brookfield’s continued growth. From 2001 to 2021, the company grew its distribution (its version of a dividend) by 6% per year, with an 18% total return.

It beat the S&P 500 Index (7%), the S&P Utilities Index (8%), and the Alerian MLP Index (9%).

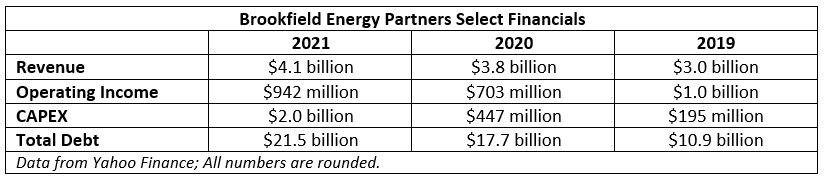

The company’s goal is to return 12% to 15% per year for investors. That’s a big ask compared with its performance in 2020 and 2021. It grew operating income by 34% from 2020 to 2021, but it still hasn’t recovered to pre-COVID-19 levels of operating income. Revenue, on the other hand, grew by $1.1 billion, or 37%, from 2019 to 2021. You can see the numbers in the table below:

The one aspect of Brookfield Energy Partners that we need to watch is its debt levels. The company has borrowed $10.6 billion since 2019. Most of that money will go into power plants. That’s the fuel for growth.

But today, the ratio between debt and revenue is high – about 5.26. We can think of that as how many years’ worth of revenue would it take to pay off all its debt. The industry average (for the big utilities) is about 2.3 times. However, once the new production comes online, Brookfield’s revenue should soar, bringing that ratio back into line.

That’s important to understand. Debt is a tool for companies like Brookfield to grow. If it had to use cash flows to buy or build new projects, it would take forever to grow. Instead, Brookfield can use the debt market (bonds) to grow quickly.

The company must generate electricity to pay those bonds back. If all that debt went into one big power plant, the risk would be too much. However, because Brookfield owns pieces of many power plants all over the world, it reduces that risk. That means we don’t need to worry about Brookfield going bankrupt over this debt load.

Our Upside

Even combined with its $6 billion partner Brookfield Renewable Corporation (BEPC), this company is small for a power utility company.

That will change.

The table above that shows EV/MW valued Brookfield’s total capacity at roughly $51,000 per MW. And the average value is $223,000 per MW. That means this company’s value would have to go up more than four times, just to get to the average.

We see the price of this stock doubling, easily, in the next year or two. And we can collect distributions while we wait.

As we said above, Brookfield Renewable Partners is a limited partnership. That means the company doesn’t earn active business income. All its revenue comes in the form of interest, dividends, and return of capital. That last bit is important for the tax implications.

As the company says on its website:

A significant portion of Brookfield Renewable Partners’ distributions are eligible to be treated as nontaxable return of capital distributions for U.S. tax purposes. A significant portion of Brookfield Renewable Partners’ dividends are “qualified dividends” and therefore eligible for a preferential U.S. income tax rate (for individuals).

That means a part of the distributions that we receive from Brookfield Energy Partners is “return of capital”. That’s a fancy way of saying that the distributions contain repayment for our investment. Like when you pay a mortgage, part of the payment is interest and part is principal. The interest part of the payment is taxed at one rate and the principal is taxed at another.

Which means that those distributions get less tax taken out of them than regular dividends.

While that sounds great, it can complicate your tax return. In order to figure out the different amounts, the company issues a K-1 form.

For some people, that’s fine. But if you file simple EZ tax forms, you may not want to own too much of the partnership. Instead, you may want to buy the Brookfield Renewable Corporation instead. It issues dividends, instead of distributions.

We like the partnership because of the corporate structure (we like to earn steady, low-tax dividends). However, the rest of the research applies to both entities, so feel free to buy either the corporation (BEPC) or the partnership (BEP).

ACTION TO TAKE: Buy Brookfield Renewable Partners (NYSE: BEP) up to $40 per share. Please use a limit order at the market price to buy shares.

You can also buy BEPC, however for the purpose of our model portfolio, we will only track BEP. Regardless of which version you buy, we believe this company will do well.

Fusion Fuel (Nasdaq: HTOO) – Solar Powered Green Hydrogen

Our third recommendation focuses on a different form of alternative energy – green hydrogen. Fusion Fuel (Nasdaq: HTOO) is a $105 million market cap tech company with a world-changing focus.

The company improved, miniaturized, and updated decades-old technology: It takes in solar radiation and water and produces hydrogen. That technology could change the world.

In fact, hydrogen is the fuel that will probably dominate the future.

Like oil, coal, and natural gas, hydrogen is an efficient battery to store solar energy. Where fossil fuels store that energy in carbon (which converts to CO2 when we combust it), hydrogen converts to water.

It’s a natural replacement for methane (natural gas). When we combust natural gas in a power plant or stove, we produce both carbon and water – and that carbon gets pumped into the atmosphere. When we combust hydrogen, we just produce water. There is minimal waste.

Even better, to generate hydrogen fuel, we simply use electricity to split water molecules into oxygen and hydrogen. The electricity and water can come from almost anywhere. And if that power is coming from solar panels, it’s a virtually zero-emission process.

If we move to hydrogen power, it will change the world. Imagine being able to produce fuel anywhere we have access to sunlight and water. It will cause a massive shift in global economics. Countries that once had to buy energy – usually in the form of oil and gas, regardless of the price – could now produce their own.

Hydrogen fuel has the potential to change the world in a more fundamental way than today’s chemical batteries. In part because it is much more efficient.

And it gets better. But to understand the benefits, we have to talk about hydrogen fuel cells.

Here’s Why Hydrogen Will Replace Fossil Fuels in the Future

Hydrogen fuel cells aren’t new technology. According to the Energy Information Administration, there are 166 fuel cell electric power generators at 113 facilities in the U.S. They generate 260 megawatts of power – enough for about 120,000 homes in a year, or enough to comfortably power all the homes in Salt Lake City.

Hydrogen’s use as vehicle fuel dates all the way back to the Energy Policy Act of 1992. Cars’ hydrogen fuel cells are two to three times more efficient than a standard gas-burning engine. And as we said, the cells have zero emissions, because heat and water are the only byproducts.

Now with MORE MATH!

The energy in a kilogram (kg) of hydrogen is equal to the energy in a gallon of gasoline. And hydrogen fuel cell vehicles are far more efficient. A typical hydrogen fuel cell vehicle will get more than 60 miles per kg

As we gain the ability to create hydrogen anywhere that has sun and water, we will see hydrogen vehicles explode in popularity. Because they do not pollute, they don’t need expensive catalytic converters, and they don’t need to spend hours recharging.

Hydrogen vehicles are currently where electric vehicles (EVs) were in 2012. They have a handful of fuel stations and almost zero market share.

A fuel cell works like a battery – as long as you put hydrogen in, it will supply power. And that’s where Fusion Fuel comes in. Its hydrogen fuel cell generators can go anywhere there’s water and sunlight.

A single unit can produce a ton of hydrogen fuel per year from solar power alone. If it’s connected to the grid, it can double that output. I highly recommend you watch this video of the CEO discussing the technology and showing us the product.

What are Our Risks?

Fusion Fuel went public only a year and a half ago. It’s still a research-and-development stage company. That means it has no revenue. Our main risk is capital. We don’t want it to run out of cash or issue so many new shares that it dilutes our position.

The company had $58 million when it capitalized at the end of 2020. It has burned through $51 million so far.

It filed a “shelf registration” (basically a notice it would be issuing new stock) up to $75 million. At $8.00 per share, that’s about 9.4 million new shares. It currently has just 13.1 million shares outstanding. If it ends up distributing that much, that is a lot of dilution.

However, it will be using that capital to grow. And make no mistake, it’s growing quickly. The company has a pipeline of over 2.4 GW of green hydrogen projects. The Portuguese government named Fusion Fuel as a company of strategic importance in its National Hydrogen Strategy.

On May 19, the company announced a deal (a non-binding Memorandum of Understanding) with Toshiba Energy Systems to pursue technical and commercial opportunities in green hydrogen. The two companies offer complimentary technologies.

Toshiba has nearly 60 years of history in hydrogen fuel cell research. And Fusion Fuel’s technology allows it to make the hydrogen completely green. That’s a huge leap forward for Toshiba.

That growth potential offsets some of our risk of dilution.

Fusion Fuel could become a major player in the next couple of years. Higher energy prices will drive an expansion of hydrogen fuel cells. Whether it’s transportation or electricity, this technology offers a real alternative to fossil fuels today.

And this is not something that will happen in the arm-waving distant future. Hydrogen fuel-cells are here now. And Fusion Fuel offers a simple technology to make hydrogen with solar power at a competitive price.

ACTION TO TAKE: Buy Fusion Fuel (Nasdaq: HTOO) below $10 per share and use a 30% trailing stop. We don’t need to buy our entire position right now. Averaging in over the next few weeks should allow us to take advantage of dips in the price.

UPDATE 10/9/22: Unfortunately, we closed our position in Fusion Fuel. This had nothing to do with the company and everything to do with the market. As the bear market deepened, investors sold everything risky. And while we see huge upside to making hydrogen with solar panels, there isn’t much demand for it right now.

That’s a short-term problem for Fusion Fuel. Without any revenue, the company must sell shares to raise money. That means there will be dilution and risk for the duration of this bear market. That’s why investors wanted out. We are going to sit on the sidelines and watch this company for now. When the market turns, we will revisit the company and see if it’s still appropriate.

In Summary

We hope that these three companies become stalwart performers in your investment portfolios. We believe decarbonization will create an enormous opportunity in the future. According to the experts at Brookfield Renewable, it could be over $150 trillion in the next thirty years.

That’s the kind of money and drive that will create massive new industries with massive new companies. It will spawn the renewable equivalent of an Exxon Mobil or Chevron. We saw the massive wealth created by these companies as they grew up in the 1940s, 1950s, 1960s, and 1970s. Now it’s our turn to create wealth, even as we do good for the planet.

For the good,

Matt Badiali