Market Overview and Portfolio Update

Happy Holidays everyone! I hope you had a great Thanksgiving

We are preparing for Christmas now. I got a fresh tree in Pennsylvania this year. I love the smell of pine that permeates the house this time of year.

This month, we are going to look at the macro-economic forces moving the market. And we’ll do a proper portfolio review. There are some moves to make ahead of 2024.

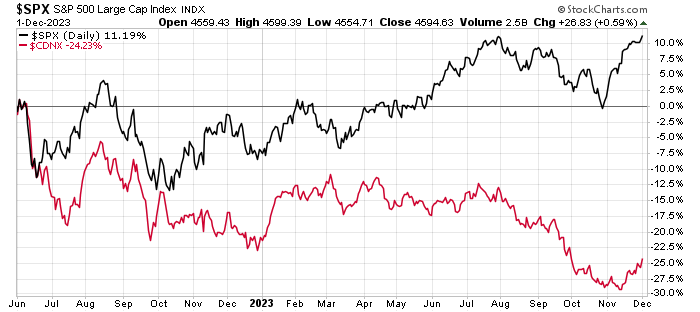

We launched New Energy in June 2022, to take advantage of the early stages of global electrification. However, the global market forces for all stocks didn’t play along with us:

The black line is the S&P 500. As you can see, these blue chips are only up 10% over the last 18 months. The red line is the TSX Venture Index. That’s the “Dow Industrials” of junior natural resource stocks – the ones that are leading the charge in electrification. And it’s down 24% over the period.

The takeaway here is that the market is difficult. Canadian stocks were clobbered. And there was no general uptrend in the greater market.

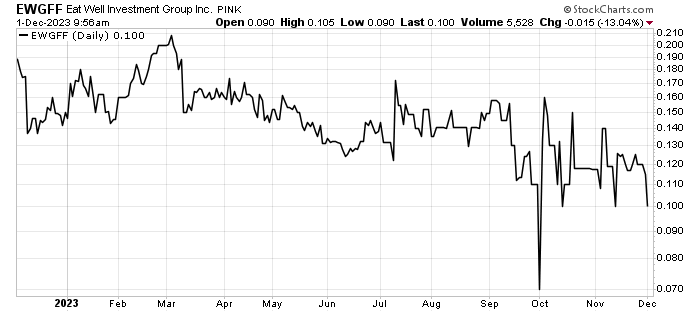

Our portfolio reflects a similar dichotomy. We did quite well on some positions. For example, Genie Energy (Nasdaq: GNE) is up 124% since we recommended it in January 2023. On the other hand, our position in Eat Well Investment Group (OTC: EWGFF) performed so poorly that we need to cut our losses.

As you know, not every position works out the way we expect or want it to. That’s investing. The goal is to cut our losers short and let our winners run. We’ll address that below. This is a great time to prune our losses and prepare for 2024.

Shades of What’s to Come in 2024

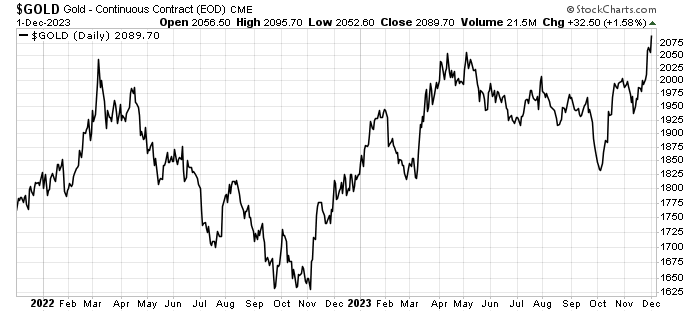

There are some interesting hints of the future showing up in data today. The most interesting (to me) is the performance of the gold price:

As you can see, the gold price broke $2,089 per ounce. That’s an all time high for the yellow metal. The rising gold price is a reflection of the world losing faith in paper money.

Inflation destroys the value of paper currencies. We see it reflected in the price of things like bread and milk. It takes a lot more paper money to buy those staples today than it did a couple of years ago. Gold is like bread and milk – it now takes a record amount of U.S. dollars to buy an ounce of the yellow metal.

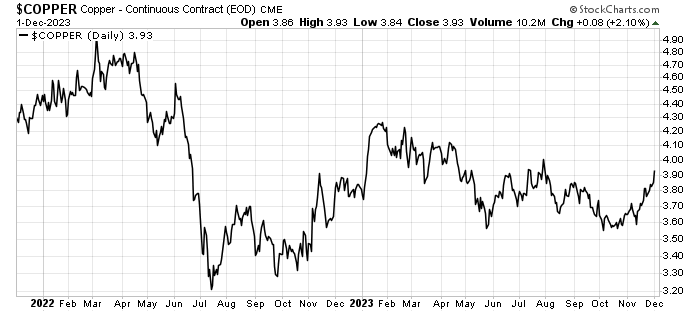

And that trend will impact battery metals too. The gold price tends to lead all other metals. In 2008, gold bottomed in November. Copper bottomed in December that year. Now the red metal has a way to go to set a new price record:

The good news is that we see the upturn reflected in its price as well.

The basis of our New Energy investment thesis is that the drive towards global electrification will eventually send metal prices soaring. The gold price isn’t part of that math…but the copper price is fundamental to it.

That’s why this uptrend is so interesting. The math says copper prices must rise. The recent closure of the giant Cobre Panama mine took about 1% of the world’s copper supply offline. Demand figures continue to climb. That should equate to a significant increase in the copper price.

The last few weeks could be the start of that move. I look forward to a profitable and hectic 2024!

But for now, let’s do some work on our portfolio.

What’s Happening in the New Energy Portfolio

Eat Well Investment Group Inc (OTC: EWGFF) – Plant-based food investment company

Eat Well Group is the worst performing company in our portfolio. We are down 40% in nine months on our position.

However, Eat Well continues to execute its strategy. The company sold its position in Sapientia for $10 million to Superlatus (Nasdaq: MEDS). The deal breaks down to $350,000 in cash, a $1.15 million loan to Superlatus (at 12% per year interest), and $8.5 million in shares.

Tim Alford, the interim CEO of Superlatus said:

“This transformative deal positions us to build a company with an exceptional growth strategy. The NASDAQ listing not only grants us access to a wealth of potential Food Tech acquisitions but also presents remarkable opportunities for all stakeholders involved. We are particularly thrilled with the acquisition of Sapientia from Eat Well as it enables us to leverage our extensive network of tens of thousands of retailers, school boards, and hotels to distribute Sapientia’s exceptional products.”

In addition, the company restructured $24.5 million in debt to consolidate the loans and reduce monthly payments. The deal will save the company $2 million in annual interest payments.

The company can’t catch a bid. And this market isn’t rewarding small wins, as you can see in the chart:

That said, I don’t see any catalysts that will revitalize the stock price in the next 12 months.

Action to Take: Sell our position in Eat Well from the portfolio and record a 40% loss.

Nel ASA (OTC: NLLSF) – Hydrogen Fuel Cells and Refueling Stations

We added Nel, our Norwegian hydrogen company, to the portfolio in July 2023. Shares fell 38% since then. The decline in shares spurred buying by three different insiders in November 2023.

The company’s business is booming. It reported a 121% increase in third quarter income (over the same period in 2022). In contrast, new orders slowed. They had about half the orders in the third quarter 2023 as they did in 2022. That still left the company with a backlog of work worth $266.3 million. That’s 36% more than the same period in 2022.

Nel’s CEO, Håkon Volldal said:

“For the first time we have exceeded one billion NOK in YTD revenues, with still one quarter to go. At the same time, margins are improving as the company is scaling production and becoming more streamlined. This shows that our newly implemented strategy is starting show real impact”.

“With increased project size, complexity and risk, the need for competence and experience increases accordingly. Nel is therefore well positioned for large-scale leadership. We are in a financially sound position and will only sign contracts with acceptable risk profiles that have a positive financial contribution”.

Nel’s electrolyser sales increased significantly in the third quarter. The division saw an 116% increase in revenue compared to the third quarter of 2022.

While the stock price performed poorly since we bought shares, the company itself continues to execute its plan. However, we can’t put “hope” ahead of performance. The company’s recent low price was $0.58 per share. If shares of Nel close below that price, we will sell our position and take the loss.

Action to take: Put a hard stop on Nel at $0.58 per share. If the company closes below that price, sell.

Nickel 28 Capital Corp. (TSX V: NKL) – Nickel royalty company

We bought Nickel 28 Capital Corp in June 2023. Our position is down 36.2% since then. Shares fell on both news of a natural disaster and the general malaise in the nickel market at the moment.

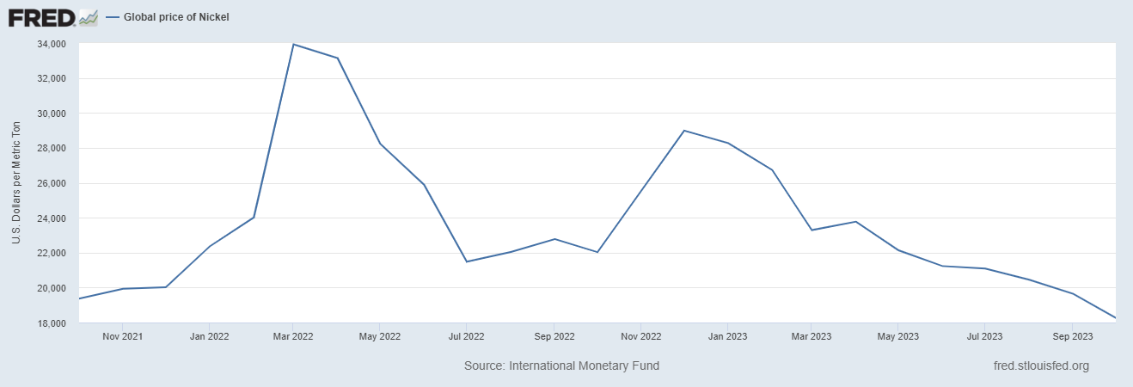

Nickel is a critical metal in the energy transition. However, the global price of nickel fell in 2023.

Today, it’s at the lowest price since June 2021 as you can see here:

The price move is surprising considering that nickel supply is difficult to find. That’s why we added Alaska Energy Metals to the portfolio as well. We see the low nickel price as an entry point in nickel, rather than a deterrent.

Nickel 28’s poor price performance is less about the nickel price and more about the performance of the Ramu mine.

The company’s primary asset is an 8.56% joint-venture interest in the Ramu Nickel-Cobalt mine in Papua New Guinea. The year-to-date data published through the third quarter from the mine showed us a couple of warts.

Even though the mine produced more ore (+3%) in 2023 than it did in the same period of 2022. However, it produced less nickel (-2%) and only slightly more cobalt (+1%). That tells us that the ore was lower grade than what was mined a year ago. In addition, the cost to mine the ore rose 9% from $2.96 per metric ton in 2022 to $3.24 per metric ton in 2023.

In addition, on October 7th, the mine experienced a large, magnitude 6.7, earthquake. The mine staff shut down the plant to evaluate any issues from the event.

The mine returned to operation later that month. But it means we can expect the fourth quarter production to be less than expected.

Those are the fundamental reasons why the position is down since we bought. All of them are short term issues. That said, we are going to put a hard stop on our position at C$0.80 per share. That would be a 12% decline from its current price.

Action to Take: Put a hard stop on Nickel 28 Capital Corp. (TSX V: NKL). If shares close below C$0.80 per share, we will sell our position and take the loss.

Alaska Energy Metals Corporation (TSX V: AEMC)

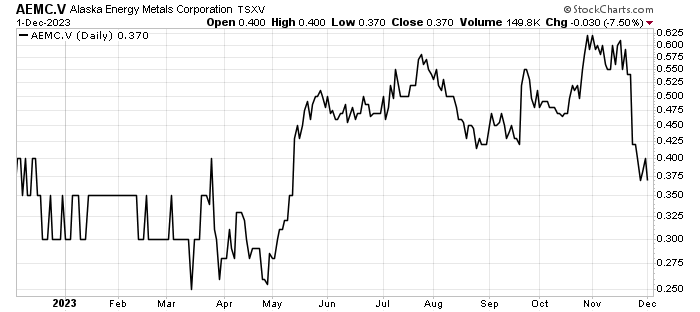

The last time I saw stocks fall this far in the weeks after I recommended them was back in 2008…We recommended Alaska Energy Metals on November 6th. Shares fell 36.2% in just a few weeks.

In the short month since we recommended AEMC, the company announced a maiden resource for its Nikolai project of more than 1.5 billion pounds of nickel. It also held 373 million pounds of copper, 115 million pounds of cobalt, and over 1.3 million ounces of platinum, palladium, and gold.

It’s a massive deposit, but it’s low grade. It will also grow. As CEO Greg Beischer commented:

The two areas in which we were able to calculate an inferred mineral resource, based only on historical drill holes, are approximately two kilometers apart. Other sparse, historical holes drilled between the deposits indicate a reasonable likelihood that further grid-based drilling will ultimately connect the two deposits together. The drilling we recently conducted in Summer 2023 will go part way towards joining the deposits together and is likely to further increase the contained metal in the deposits substantially. The rapid growth in resources speaks to the consistency and predictability of the deposit, which remains open in all directions. Eureka is quickly evolving into one of the larger nickel resources on the continent.

In a good market, this news would send this tiny stock soaring. In any other market, this is good news. In the current market, the good news spurred selling.

This is classic “market bottom” behavior. But, since the stock fell so deeply, we need to put a hard stop on our position.

Action to Take: Put a hard stop on Alaska Energy Metals (TSX V: AEMC). If shares close below C$0.30 per share, we will sell our position and take the loss.

Brookfield Renewable Partners (NYSE: BEP)

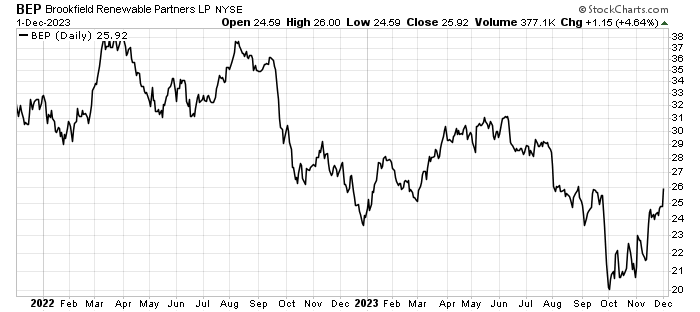

Brookfield Renewable Partners is our dividend stock. One of the first companies we added to the portfolio, it paid us nearly $2.00 per share so far. However, the underlying stock price is down over the period:

In its latest earnings call, Brookfield Renewable Partners’ CEO Coonnor David Teskey said:

Notably, we are seeing particularly attractive opportunities to acquire businesses with strong development pipelines but lack the access to capital or scale operating capabilities to build out these projects. This is creating a powerful and virtuous cycle. We are capturing increasing demand through our existing capabilities and pipeline, while at the same time, using our access to capital to add leading platforms in core markets around the world, further enhancing our capabilities and positioning us to capture even further demand in the future as we position ourselves as the clean energy and decarbonization partner of choice for leading corporations.

Basically, the company’s access to capital will allow it to acquire great projects that are currently starved for capital. That means we should see Brookfield Renewable Partners continue to grow its dividend and its share price.

We believe that the decline in Brookfield Renewable Partners’ shares has more to do with the market than the company’s fundamentals.

Action to Take: continue to hold Brookfield Renewable Partners.

Those are the stocks that needed our attention right away. We will continue to address our portfolio in the regular monthly updates. Remember, you are in charge of your personal positions. Our recommendations are just that. The actions we take in our model portfolio aren’t necessarily correct for your personal situation.

We are a small team, working hard to bring you the best ideas that we can find. The market doesn’t always agree with us. And we are limited by our monthly publication date. We don’t send out trade alerts because we do research only.

Please don’t wait for us to tell you what to do with any position. Remember, we never want to take a large loss. Ever. But that changes with each individual investor.

Please use our research as a tool for new ideas, but manage your positions to your own tolerances.

Have a Happy and Healthy Holiday Season

Thank you again for your subscription to Mangrove Investor’s New Energy publication. We are going to take some time with our families this month.

Normally, you would get your next issue on January 5th. We are going to push that back to Friday January 9th, to allow us to enjoy our holidays and get back to work the first full week of the month.

We will have a new idea for you then.

Sincerely,

Matt Badiali and the Mangrove Investor Team