This Bear Market Could Actually Drive More EV Sales

The lithium crash is underway

We recently wrote about ExxonMobil, the giant oil company, taking a step into lithium. They claim that direct lithium extraction (DLE) of oilfield brine is possible. And they put their money where their mouth was…they leased 120,000 acres of land. That’s 187.5 square miles, larger than 8 Manhattan Islands worth of land. They also created a whole new division, called Mobil Lithium.

They didn’t do this out of generosity of spirit. ExxonMobil thinks it can produce a lot of lithium. Their marketing claims that by 2030, they will produce enough lithium for over 1 million electric vehicles.

Here’s the thing, if ExxonMobil is doing it, you better believe that Shell, British Petroleum, and Chevron are right on their heels. That means we could see a glut of lithium hit the market. And that will be exactly what we need to spur adoption of electric vehicles.

Here’s what I mean.

According to a recent Goldman Sachs report on DLE, it can produce lithium faster, cheaper, and more efficiently than brine ponds or hard rock mining. It has a much smaller footprint and is far greener than the other techniques. The Goldman report compared the disruption coming to lithium to the impact fracking had on the oil industry.

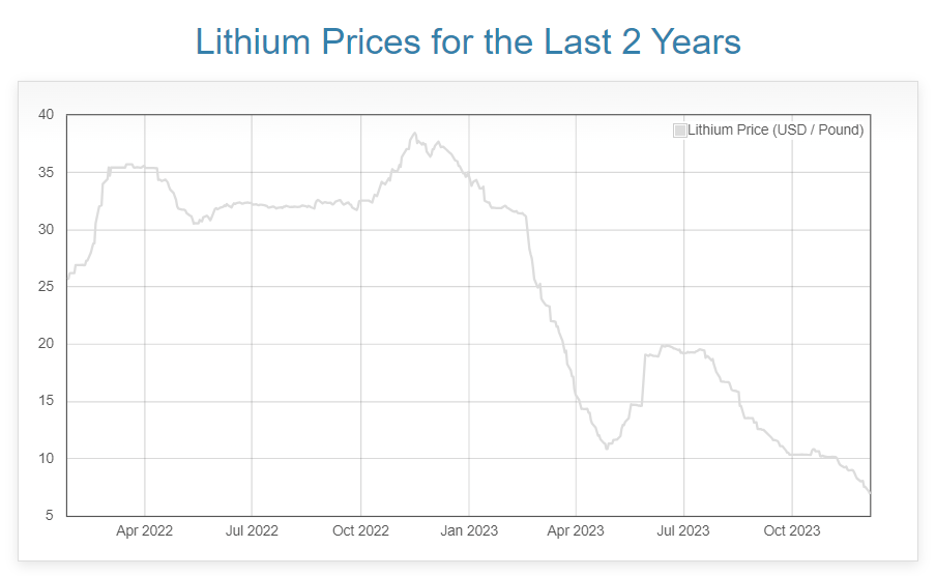

If you recall, the oil produced from shale crushed the oil price, as massive amounts of oil came to market. Interestingly, we are seeing similar price action from lithium already.

Here’s the chart:

My suspicion is that the price of lithium reflected the emergence of DLE and the participation of the major oil companies in the space. More lithium is coming. Apparently, a lot more.

The New York Times caught on to this trend back in March 2023. At that point, the metal price was down just 20%. Today it’s down 80% from its recent high price. The essay remarked that the drop in price defied analysis:

The sharp moves have confounded many analysts who predicted that prices would stay high, or even climb, slowing the transition to cleaner forms of transportation, an essential component of efforts to limit climate change.

Instead, the drop in commodity prices has made it easier for carmakers to cut prices for electric vehicles. This month, Tesla lowered the prices of its two most expensive cars, the Model S sedan, and Model X sport utility vehicle, by thousands of dollars.

The authors were early but correct about the price cuts. According to Money.com, a personal finance news site, the average electric car price is down 22% from last October. And much of that is on the lithium price decline.

A Tesla Model S battery holds around 138 pounds of lithium. In January 2023, the raw lithium metal in the battery cost about $2,195. Today, it costs about $1,035.

Cheaper cars will spur faster and broader adoption of electric vehicles. That will, in turn, require more battery metals. I suspect that we will see lithium prices settle significantly lower, despite that rise in demand.

Investors need to take this under advisement. It may be time to get out of lithium. The good news is you may be able to buy a cheap EV soon.

For the Good,

The Mangrove Investor Team

Numbers You Need to Know

88 Million Tonnes

According to the U.S. Geological Survey, Earth plays host to some 88 million tonnes of lithium. Of that number, only one-quarter is economically viable to mine (this is known as “reserves”). (Popular Mechanics)

17 Pounds

The battery cells in EVs contain roughly 17 pounds of lithium carbonate, 77 pounds of nickel, 44 pounds of manganese, and 30 pounds of cobalt. (Green Cars)

1,167,000

World output of Lithium Carbonate Equivalent (LCE) is expected to be 1,167,000 tonnes in 2024, according to the Resources and Energy Quarterly Report by the Australian Department of Industry, Science and Resources. (Reuters)

What’s New in Sustainable Investing

Sustainability is real and smart investors know it

The opportunity to increase revenue, reduce cost and avoid risk through managing for sustainability is real. The smart investors know that, and are acting on it (Financial Times)

China lithium price poised for further decline in 2024

Lithium carbonate prices in top consumer China could fall by more than 30% next year from the current level, analysts say, as growing supply from all major producers outpaces the rise in demand from battery user. (Reuters)

Video Of The Week

Since we are on the subject of Lithium..

How about a Music video by Evanescence performing Lithium.