Buy when there is blood in the streets

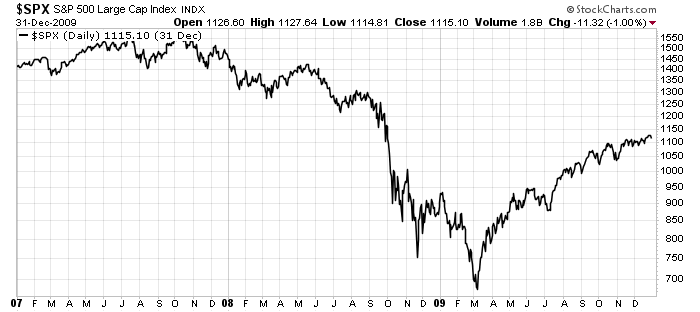

In late 2008, as the stock market cratered, I decided to test the “buy when there is blood in the streets” theory.

I told my wife about a small mining exploration company run by two guys – Rob and Tony.

They had around $2 million in the bank and were in no danger of going bankrupt. The company’s shares traded for just 6¢, a fraction of the price just six months prior.

This was a scary time for us. We had two toddlers. I was just three years into my new job. This was my first stock market crash, where I had real money at stake. And, according to the financial news, it was the end of the world.

It was a stressful time. It would have been easy to do nothing. To sit on our hands and take no chances.

But I felt like we had an opportunity to plant seeds in the stock market that would grow into real wealth. I told her that if we were patient, we could probably double our money on the stock. So, I scraped together some cash and invested in the company.

Two things happened.

First, the stock market recovered, as you can see in the chart. Second, Rob and Tony made a discovery – the 2.8-million-ounce Coffee gold deposit, in Yukon Territory. The stock took off like a rocket.

In just about two years, I sold our shares around $1.30 each and bought my wife a car.

That’s the kind of opportunity that comes from bear markets.

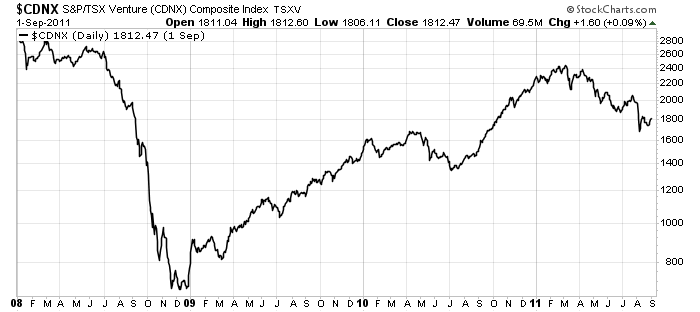

There was some luck involved. If they had not made the Coffee discovery, the stock wouldn’t have gone up quite that much. But the entire junior mining complex went up 300%, as you can see from this chart of the TSX Venture Index:

I focused on three things: great management, cash in the bank, and zero risk of bankruptcy.

I still focus on these qualities, with each company I recommend. And in a normal market, they do well. But these crashes happen and with them come opportunities to create wealth.

We just have to have the conviction to buy great companies, even when we are terrified.

Good Investing,

Matt Badiali

P.S.: If you have any questions or just want to say “Hi”, drop us a line at wecare@mangroveinvestor.com. I’ll respond to questions in next week’s update.