Copper Isn’t Just the New Oil

Dear Friend,

What a difference a week makes.

Checking in on the portfolio this Friday morning, we now only have two recommendations in the red. Last week, I showed you that most of our positions were rallying. This is good to see.

Our average gain on the whole recommended portfolio is over 5%. That’s a solid gain, considering we launched in June, just before the bear market kicked in.

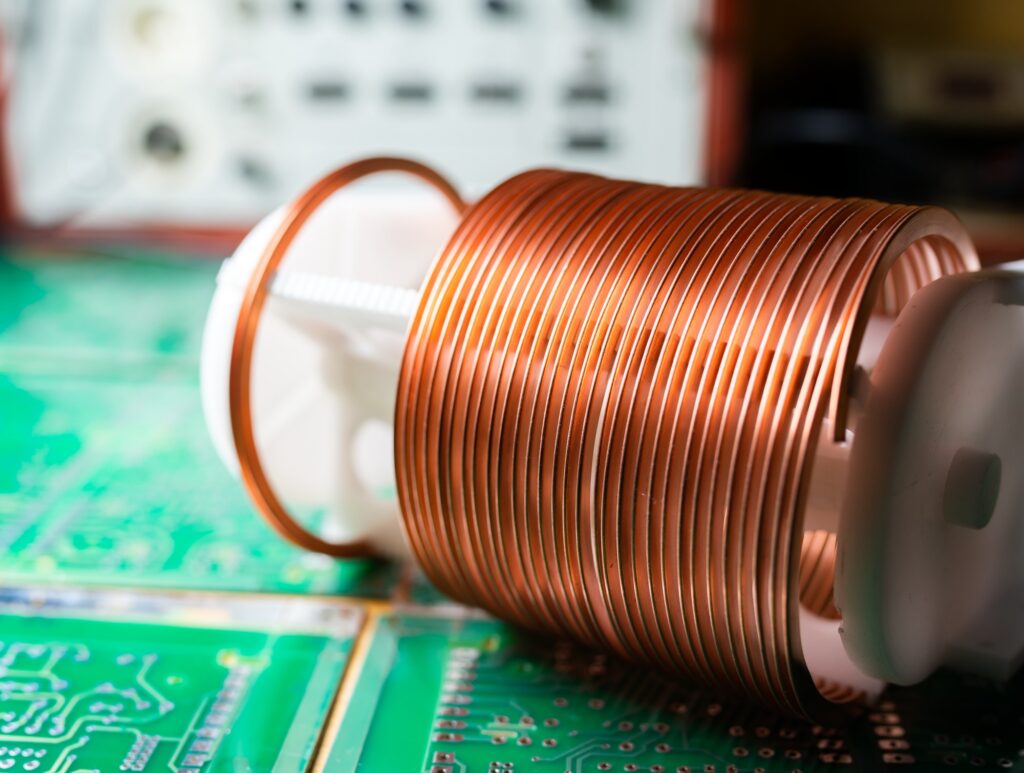

This copper chart captures the timing of the market’s bounce:

Copper will be the new oil in an electric world. It’s one of the main commodities we see benefitting from our “for the good” investing strategy. But the copper price fell 30% from April to mid-July. That was due to a resurgence of COVID-19 in China. It went back into lockdown and snarled up the supply chain again.

We see that as an opportunity to buy the future of energy at a discount today.

Even the most bearish energy predictions show an increase in copper demand. Energy forecaster Rystad Energy projects a 6-million-ton deficit by 2030. It sees copper demand rising 30% by 2030.

But unlike oil, it takes years to develop a new copper mine. Demand comes quickly, but mined supply comes slowly. That’s why the price will soar.

And there is a massive underinvestment in copper today. In May, the Bloomberg “Odd Lots” podcast hosts speculated that copper could be the story of the decade. They spoke with Goldman Sachs metals strategist Nick Snowdon. He did an outstanding job explaining the situation.

It’s an excellent listen and will go a long way to backing up what we have been saying in New Energy. In the podcast, Snowdon compares the future of copper to the behavior of oil during the decade after 2000. That’s the period that saw oil prices soar from $20 per barrel to $140 per barrel.

But I would also compare copper to palladium.

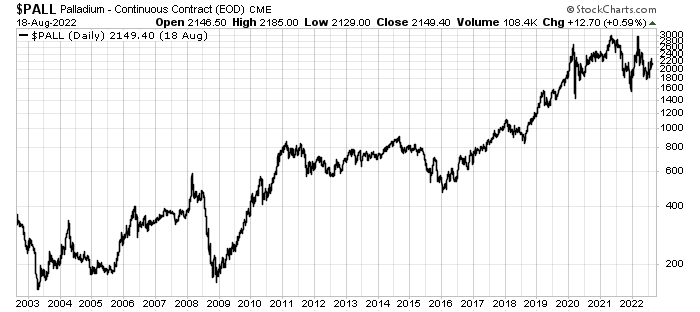

Palladium is a metal used in automobile exhaust systems. If we look at a 20-year chart, we see the metal had an outrageous run from under $90 per ounce to over $2,900 per ounce. That’s a ridiculous 3,100% gain.

Here’s the chart:

From 2002 to 2008, the price of palladium rose from $90 per ounce to $600 per ounce from bottom to top. That’s a 566% gain. But that was just the start. After retesting its lows in late 2008, the price ripped to over $800 per ounce in 2011. And it plateaued there for several years.

But from 2016 to 2022, the price had another massive move higher. From $600 per ounce to nearly $3,000 per ounce. That’s another 400% gain.

This is an excellent analogue for what we expect to see for copper. The soaring price of palladium didn’t stop us from buying cars. The overall price of a single car didn’t change much. But the industry had to invest massive amounts into the metal as more and more cars used better exhaust systems.

You see, European and American regulators increased the pressure on the auto industry during those years. A major part of how new cars cut their emissions was with new exhaust systems. Palladium played a key role in that.

Today, the public is moving toward electric cars. And we expect that electrification will follow a similar path in affecting the copper price.

In New Energy, we are building a portfolio that will benefit from this move in copper. But we are selecting companies that reduce their risks through community engagement and sustainable practices.

That may seem like an unnecessary step, but it is not. Here’s why it’s important…

Most of the world’s giant copper mines are old. The average age of the ten largest copper mines is 78 years:

- Escondida – established in 1990.

- Collahuasi – established in 1999.

- Buenavista Del Cobre – established in 1899.

- Morenci – established in 1872.

- Cerro Verde – established in 1976.

- Antamina – established in 2001.

- Las Bambas – established in 2016.

- Grasberg – established in 1990.

- El Teniente – established in 1819.

- Chuquicamata – established in 1879.

Old, legacy mining companies have huge environmental risks. These giant existing mines carry massive clean-up costs.

Additionally, these old miners under-invested in safety. That has resulted in huge losses of both capital and lives. A quick internet search turns up dozens of incidents in the last five years.

The most egregious example is mining giant Vale (NYSE: VALE). The company has had two deadly dam collapses since 2015. We wrote about one in our August issue of New Energy. It cost the company billions of dollars. And there is a third dam, at a retired mine, that could collapse at any time. That leaves the company at risk of yet more liability.

That’s just one reason we look for companies that embrace new mining practices. It lowers our risk, so we can benefit from this massive uptrend in full.

Have a great weekend!

Matt Badiali