New Energy Weekly – If you own stocks exposed to housing

If you own stocks exposed to housing, it’s time to get out.

Some important economic data dropped this week. Most importantly, the Federal Reserve continued to hike interest rates to slow the economy. These rates directly affect short-term borrowers. However, they have rippled out into the rest of the economy.

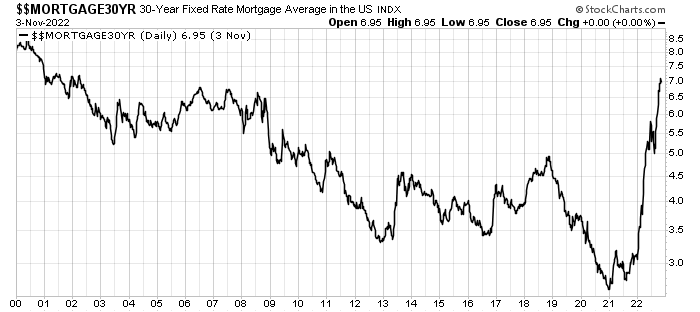

For example, a thirty-year fixed mortgage rate is now at its highest point since 2002:

We know that the economy isn’t the stock market… BUT.

This will have a massive impact on a broad swath of the stock market. I expect real estate and related industries to fall. Companies that depend on mortgages to drive demand will struggle. And many investors own these companies and funds.

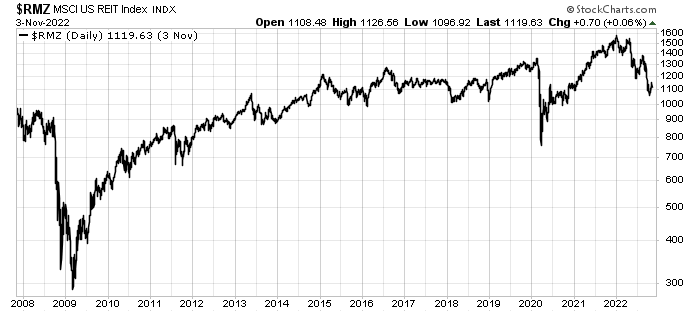

Real estate investment trusts (REITs) are popular investments. There are more than 130 REITs in the U.S. market. According to Nareit, a REIT industry research and marketing group:

An estimated 145 million Americans own REITs through their retirement savings and other investment funds.

That’s a lot of investors who could be a lot poorer in a year. The MSCI U.S. REIT Index tracks a basket of over 130 publicly traded REITs, and you can see it has fallen for much of 2022:

In the current economic situation, real estate could be in big trouble. All the signs are pointing that way. According to data from online real estate brokerage Redfin, 15.2% of home purchase agreements fell through in August. Normally, that rate is around 12%.

And deals in some formerly hot markets fell through at an even higher rate:

- Jacksonville, Florida: 26.1%

- Las Vegas: 23%

- Atlanta: 22.6%

- Orlando, Florida: 21.9%

- Fort Lauderdale, Florida: 21.7%

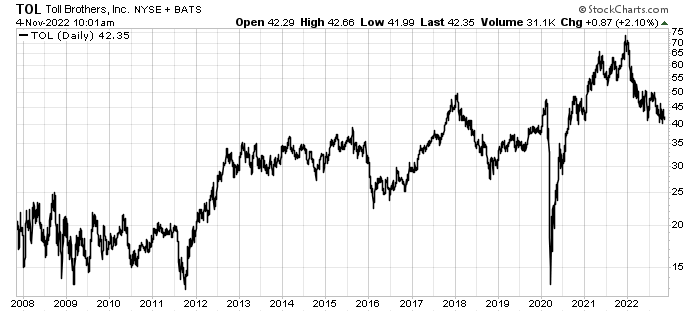

This is an early warning sign that housing is going into a bear market. That means giant engineering firms and home builders like Toll Brothers (TOL) have a lot of risk today:

And there will be a “trickle down” effect.

For example, I’d love to put a new roof on my house. And in the past, I could get a home equity line to finance that. However, home equity loan rates have soared as well.

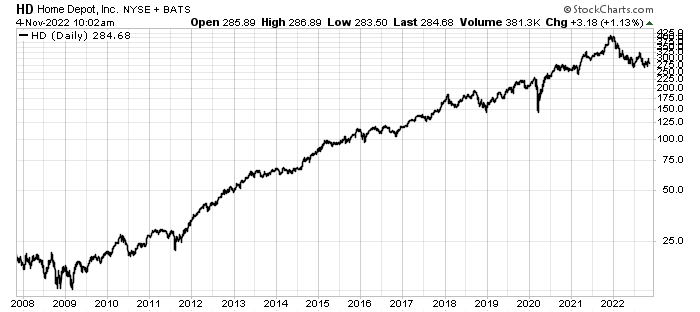

That will push back my project for at least a year. Not only will that impact my local roofers, but it will also impact the providers of all the material that would go into that job from companies like Lowes (LOW) and Home Depot (HD). These types of home goods stores have had a remarkable run since 2009, as you can see:

In the current economy, that’s a chart with an enormous amount of risk built in.

Our job in this kind of environment is to begin to move capital out of higher-risk segments of the market. And today, the housing and real estate sector has too much risk. It’s time to look at your portfolio and make sure you reduce (or eliminate) exposure soon.

Good Investing,

Matt Badiali