New Energy Weekly – Immaculate Disinflation

Immaculate Disinflation– Recession Risk is Fading Fast

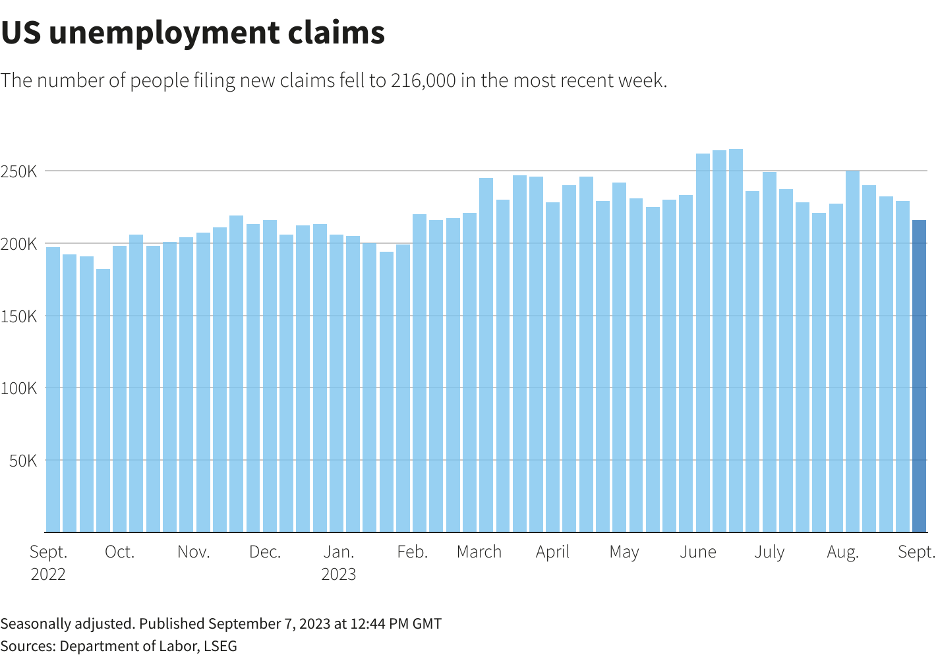

The latest job report shows that the unemployment rate fell to 216,000. That’s the lowest point since mid-February according to the U.S. Labor Department.

The jobless claims show that the U.S. job market looks solid and stable. This flies in the face of all the economic experts’ confidence that unemployment would spike before the economy rallied.

Now, the experts are crowing about “immaculate disinflation”. That’s the scenario we see playing out today – cooling inflation without mass unemployment. And it’s blowing up an economic sacred cow called “the sacrifice ratio”.

That’s a beloved theory that says every reduction in inflation MUST inflict pain on the economy. But what’s happened in the U.S. from June 2022 to today defies that theory.

Inflation fell from a peak of 9.1% in June 2022 to 3.2% in July 2023. That’s a huge decline that, according to the sacrifice ratio, should result in mass layoffs and economic weakness. But we don’t see it. And that split the market into two camps: the “doom & gloomers” and everyone else.

The doom & gloomers think a recession is inevitable. They call out every down day in the market as the start of a new bear market. Everyone else is out buying stock. That drove the bull market that we’ve seen over the past 11 months:

The question is, can this rally continue. My answer is that the trend is king. And right now, the trend is up.

While a recession isn’t out of the question, the data doesn’t support it. And anyone calling for a recession is simply picking sides. There isn’t any data supporting that position. It’s more about clinging to an economic doctrine. And we know that those don’t work every time.

That’s why we’re bullish, going into the fall of 2023.

Sincerely,

Matt Badiali