Sometimes the Share Price Performance IS the Message

Sometimes the Share Price Performance IS the Message

In 1963, at 30 years old, William O’Neil became the youngest person to buy a seat on the New York Stock Exchange.

He went to Harvard Business School and started his own stock brokerage in 1963. Later, he founded the Investor’s Business Daily in 1984. He authored several books on investing: How to Make Money in Stocks, 24 Essential Lessons for Investment Success, and The Successful Investor among them.

He developed a wildly successful trading system called the “CAN SLIM” strategy. From 1998 to 2009, it was the best performing investment strategy as reviewed by the American Association of Individual Investors.

Investing systems can improve our performance simply by introducing rules for buying and selling stocks. Many novice investors buy stocks at the absolute worst times, and then don’t know when to sell. They typically buy at the top of a stock’s popularity – because they saw it on TV or heard about a friend making a ton of money on it. Then, they ride the stock to the bottom, hoping it will turn around.

One of pillars of the CAN SLIM strategy was selling your losing positions. He was a strong proponent of selling losing positions because he understood the need to preserve capital.

And that’s a critical part of our philosophy at Mangrove Investor as well. No matter how much we like the company, its share price must perform.

This month, we’re taking a break from recommending new positions. Instead, we will trim some of our existing ones. It’s important to cut your losses, because sometimes things can get much, much worse.

Here’s an example from my own history:

We do our homework on companies prior to investing. Sometimes, in spite of our best efforts, things go wrong. Here’s an example. In the November 2007 issue, I recommended a little company called Superior Offshore for $11.73 per share.

Superior Offshore had 20 years of offshore oil service experience. It traded at just six times earnings and had a growing international presence. However, the company missed an earnings-filing date, and the stock price plummeted.

The share price hit our trailing stop of around $8 per share within a few weeks of the recommendation.

Thankfully, we hit watched the trailing stop and sold. By March 2008, a group of investors accused the company of fraud and became embroiled in a class-action lawsuit. It eventually delisted from the NASDAQ and now trades on the Pink Sheets at 44¢ per share.

That’s just one example of how trailing stops protect your capital. If we held onto the stock, hoping for a rebound, we’d be down 96%…and there’s no guarantee that Superior won’t sink to the bottom, taking all its investors with it.

That’s why we are going to trim some of our positions. It’s why we sell shares even when we love a company. Because we can’t know everything that’s going on. And sometimes the share price is telling us that something is wrong with a company.

Let’s jump right in.

Time to Sell

Adventus Mining (TSX V: ADZN)

Our copper mining company in Ecuador received some unwelcome news last month.

There is a new roadblock to development of its El Domo – Curipamba project. Here’s the comment from the August 1, 2023, Press Release:

On the afternoon of August 1, 2023, the Constitutional Court admitted for processing an unconstitutionality claim filed by the indigenous group CONAIE and other complainants against Presidential Decree 754 (the “Decree”), which was signed on May 31, 2023 that regulates environmental consultation for all public and private industries and sectors in Ecuador – not limited to the metals and mining sector. The Constitutional Court also ordered the provisional suspension of the Decree until the same Constitutional Court resolves, by sentence, the claim filed (the “Constitutional Court Proceeding”). The Government of Ecuador must now present argumentation within fifteen working days to evidence the constitutionality of the Decree for the consideration of the Constitutional Court.

The immediate effect of the provisional suspension of the Decree is that no medium or high impact projects, from any sector or industry in the country, including the El Domo – Curipamba project, shall be able to obtain an environmental license until the Constitutional Court resolves this issue. The Government of Ecuador has stated that it will employ all measures at its disposal to respond to the Constitutional Court.

The important part of this comment is that there are no new environmental licenses being issued right now. The big question is with the courts now. That means it could take months if not years for Adventus to get its license.

With shares down 44.5% from our purchase, it’s time to sell and move on.

Action to Take: Sell Adventus Mining Corporation (TSX V: ADZN) at the market price. We will record a 44.5% loss on our position.

Unfortunately, permitting is one of the biggest risks to exploration and development projects. We have no confidence that the problem in Ecuador can be resolved in a reasonable amount of time. While we like Adventus’ project and management, it’s far from a unique company.

There are many great and cheap copper projects today, so we need to move on from Adventus at this time.

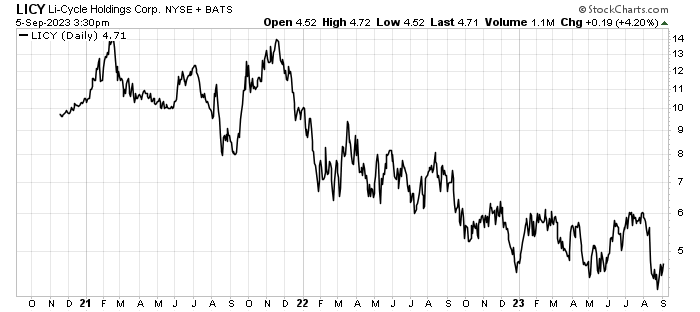

Li-Cycle Holdings Corp (NYSE: LICY)

Li-Cycle remains one of our favorite companies. The lithium battery recycler has enormous potential.

However, the market is not rewarding that right now. The company recently hit its lowest price since going public in 2020, as you can see below:

The stock performance belies the company’s performance. Li Cycle appears to be on the verge of a huge breakout. In its August 2023 Second Quarter results press release, the company laid out several important milestones, including:

- Expanded market-leading position and speed to market through growth of Spoke & Hub network in North America and Europe; on path to produce up to 25,000 tonnes of lithium carbonate per year.

- Advanced construction of the Rochester Hub, maintaining start of commissioning in late 2023; successfully received and installed the largest piece of progress equipment on site – video link here.

- Progressed development of European Hub (Portovesme Hub) with Glencore with Definitive Feasibility Study (DFS) expected to be completed by mid-2024.

- Commercialized first European Spoke in Germany, largest in Li-Cycle’s global Spoke network and one of the largest on the continent.

- Signed memorandum of understanding with EVE Energy to collaborate on global sustainable lithium-ion battery recycling solutions, exploring site selection for new Spoke in Hungary.

- Advanced documentation for $375 million Department of Energy (DOE) loan to final stages, with close anticipated in September 2023; and

- Ended June 30, 2023, with cash on hand of $288.8 million.

In isolation, these are solid achievements. However, in context with the share price, it tells us we’re missing part of the story.

That’s why we need to sell Li Cycle Holdings (NYSE: LICY) now.

Action to Take: Sell Li Cycle Holdings (NYSE: LICY) at the market price. We will record a 40.7% loss on our position.

We’ll watch the company’s price over the next six months.

There is a chance that it will recover, and we can get back in.

However, for now, our best plan is to take the loss and sit on the sidelines.

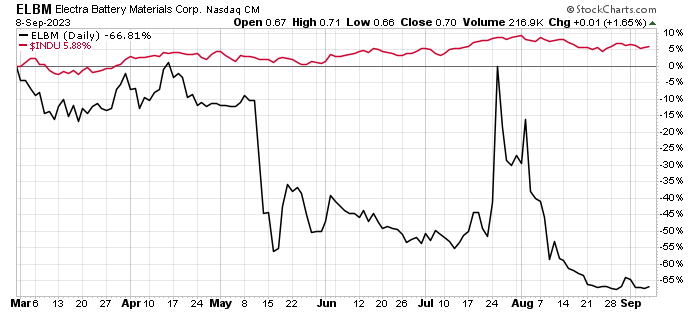

Electra Battery Metals (Nasdaq: ELBM)

We recommended Electra Battery Metals in April 2023.

The company owns the Iron Creek Cobalt project in Idaho and a fully permitted battery recycling refinery. However, the stock has fallen over 60% since we bought.

In the same period, the Nasdaq is up 5%:

This is an epic collapse in the stock price. Shares of Electra Battery Materials are down 64.3% in just over four months. This is in direct opposition to the results the company posted in its August 17th second quarter results press release. That included making its first shipment of nickel-cobalt from its recycling and refining complex near Toronto.

The stock price collapse is both surprising and disappointing.

Action to Take: Sell Electra Battery Materials (Nasdaq: ELBM) at the market price. We will record a 64.3% loss on our position.

As with Li Cycle, Electra Battery Materials is the kind of business that will prosper in the future. The company’s sale of the recycled nickel-cobalt and ongoing relationship with major battery maker LG spell good things for its future.

However, we simply can’t stomach the current loss.

We will continue to track the company’s progress in the future.

We need to cut those three companies from our portfolio.

While we hope that all three will recover, hope is not an investment strategy. We need to cut our losers and let our winners continue.

We will have a brand-new investment idea next month.

For the Good,

The Mangrove Investor Staff