New Energy Weekly Update – June 17, 2022

The markets this week were not great.

On Monday, stocks sold off during one of the worst trading days in history, according to our friend Jason Goepfert of market research company SentimenTrader. He said that the three trading days around that Monday were among the worst stretches ever.

That led me to take a look at the last bear market. And you have to go a loooong way back to find it.

We have to look all the way back to 2009 – 13 years ago – to find the last real (non-pandemic-induced) bear market. That means many current “investors” have never lost money like this in the stock market. And that, my friends, is what fuels market hysteria.

As you can see in the chart of the S&P 500 Large Cap Index, the last bear market lasted for about 18 months. And if the past is prologue, the worst is yet to come for those big caps. We’ll keep an eye on things, but it may be sensible to take a slow approach to new positions right now.

That said, I’m not worried about our New Energy recommendations. They aren’t going bankrupt and should recover quickly.

I am watching the commodity sectors closely right now because they will tell us a lot about the future.

To get a glimpse into what the smart money thinks, I look at hedges. A hedge is the amount of product that commodity producers (like coffee growers, oil companies, miners, etc.) agree to sell for a fixed price. That’s done in the form of futures contracts. And Jason Goepfert’s team at SentimenTrader tracks those contracts.

The commercial hedgers are considered the smart money in the sector, while the large and small speculators are the dumb money. And right now, the smart money is hedged across nearly all the commodities.

That means the smart money traders have locked in their prices. And that makes sense. Oil prices are cyclical (they go up AND down). And the sure-fire way to drop oil prices is to reduce demand through eyepoppingly high gas prices – when 60% of a barrel of oil goes into vehicle fuel, that matters to oil demand.

That’s going on right now – high fuel prices are destroying demand.

And one of the reasons fuel prices are so high isn’t supply, but transport. According to the Energy Information Administration (here), Colonial Pipeline reported that the demand volumes for gasoline and diesel fuel on the east coast outpaced pipeline capacity to move it there. Demand for both fuels is well above the previous five-year average.

The other side of the coin is supply. And no matter what you read in the news, supply is on its way up. Oil producers all around the world are drilling as fast as they can.

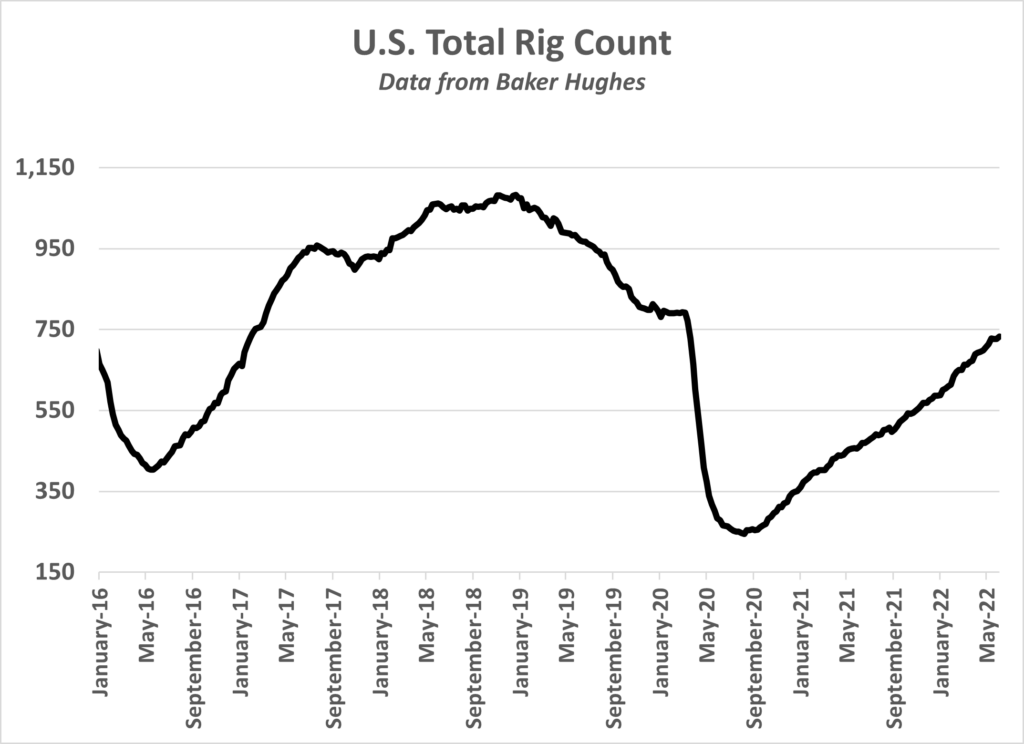

It’s certainly happening in the U.S. According to data from oil industry service company Baker Hughes, the U.S. oil drilling rig count is steadily climbing.

Rig count is nearly back to pre-COVID levels. This doesn’t convert directly to new supply – it usually takes 3 months-6 months to bring new production onstream. But the dramatic increase in the number of drill rigs working means oil production will recover quickly.

However, the damage is done. We saw the impact of high oil prices after 2008: There was a massive move to hybrid cars.

That flight from gas guzzlers is back, only now it’s into electric vehicles (EVs).

According to Car and Driver magazine, EV registrations are up 60% in the first quarter of 2022 (here). That confirms my expectation, and it’s borne out in the fact that Tesla just increased prices across all its models.

According to EV industry site Electrek, some Tesla models’ prices went up as much as $6,000 (here) per vehicle. That tells me Tesla’s sales are strong in the second quarter of 2022. In 2021, Tesla raised prices nearly every month. But in earlier in 2022, they had eased up.

The last material price increase in 2022 came in March. And if Tesla’s sales were low, it probably wouldn’t raise prices now. I take that data to mean sales for its cars are ripping right now. And I attribute that to the high oil prices.

So, my thoughts on the week are mixed. I think we are in for at least another 12 months of downward pressure on stocks. It’s not great, but it will lead us to the next bull market. And it gives us time to ease into stocks we like for low prices.

And the spike in oil prices is juicing the move to EVs. That’s an existing trend that will boom in the next couple of years, if history is any indicator.

While this isn’t fun now, we know it will end. And when it does, the people with the capital and confidence to buy low will make a lot of money on the other side. We just need to be patient and it will work out in our favor.

For the good,

Matt Badiali