Suddenly Looking Scarce

“The World’s Copper Supply is Suddenly Looking Scarce” blared the headline in Bloomberg this week

Several major events hit the copper market in recent weeks: The giant Cobre Panama mine closed, Peruvian unrest impacted mines there, and mining giant Anglo American (LSE: AAL) cutting copper output for 2024.

Analysts at Wood Mackenzie, a widely respected industry watchdog, said the risk to copper supply in South America are high. They built in a million metric ton disruption into their forecast. And they aren’t alone in worrying. Macquarie analyst Alice Fox told Reuters,

“Peru is obviously a concern but so far production disruptions have not been that significant. Logistics are impacting ability to transport supplies in and concentrates out, so the risks lie with the duration of the protests and road blockades, but we note the government is working to clear these.”

Peru supplies 10% of the world’s copper, roughly 2.2 million metric tons in 2022. Political unrest there impacted two major mines: Las Bambas and Antapaccay.

Analysts with Morgan Stanley, the giant investment bank, believe copper supply risks will be high in 2024. Their model assumes a 6.5% supply disruption next year, up from 5.5%. That basically means the price model builds in a loss of 1.4 million metric tons of copper.

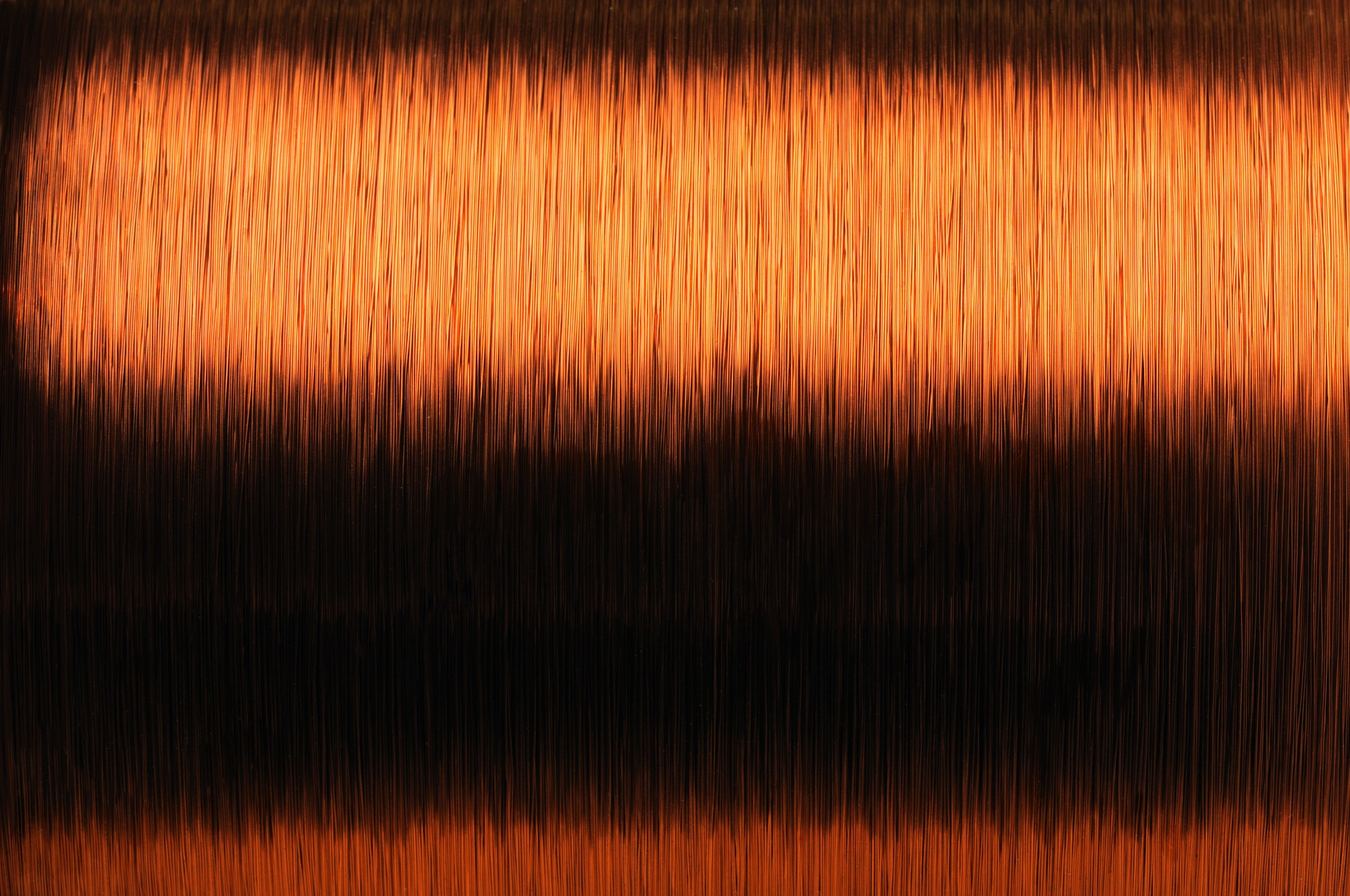

As you can see in the chart below, the price of copper jumped higher after the pandemic. It’s up around 35% from pre-Covid levels

According to a recent Goldman Sachs report on DLE, it can produce lithium faster, cheaper, and more efficiently than brine ponds or hard rock mining. It has a much smaller footprint and is far greener than the other techniques. The Goldman report compared the disruption coming to lithium to the impact fracking had on the oil industry.

If you recall, the oil produced from shale crushed the oil price, as massive amounts of oil came to market. Interestingly, we are seeing similar price action from lithium already.

And the price forecasts point to much higher copper prices coming. According to Dr. Kwasi Ampofo, Head of Metals and Mining, BloombergNEF we could see copper prices up 20% by 2027.

That expectation comes from a looming shortfall over the next three years. He points out that the deficit in 2024 will be less than the 10-year average. And the price will reflect economic sentiment rather than fundamentals. However, the article goes on to say that will change in 2025:

After 2025, the supply deficit is forecast to peak at 4.5 million tons, and pricing should then begin to reflect the tighter market compared with previous years. This will incentivize production from recycling sources to meet growing demand. In addition, the global economy will likely overcome recession concerns, which will lead to a stabilization of interest rates. The deficit level in 2025 will be similar to the 4.6 million tons seen in 2021, when the average copper price was $9,700 per ton.

The takeaway is that investors should position themselves for higher copper prices. And that will have an impact across the market. Home construction will cost more. So will refrigerators and air conditioners. As investors, we should use this projection to inform our decisions. The easy takeaway is to buy some major copper miners like Freeport McMoRan (NYSE: FMC), BHP Group (NYSE: BHP) or Glencore (LSE: GLEN).

For the Good,

The Mangrove Investor Team

Numbers You Need to Know

27%

Chile is the world leader in copper production with 28% of the global total of mined production. (Government of Canada)

100%

Copper is 100% recyclable and can be recycled repeatedly without any loss of performance. There is also no difference in the quality of recycled copper and mined copper, thus they can be used interchangeably. (Copper Alliance)

62,000

The Statue of Liberty was unveiled in 1886, it was a dull brown color. Comprised of more than 62,000 pounds of copper, the statue began to turn green due to the oxidation of its copper plating. (National Park Service)

What’s New in Sustainable Investing

COP28 and Sustainable Investing

Apollo Head of Sustainable Investing, Olivia Wassenaar, discusses sustainable investing in an interview with Tom Keene and Lisa Abramowicz from COP28.(Bloomberg)

The Kellogg-Morgan Stanley Sustainable Investing Challenge

Every year, the Kellogg-Morgan Stanley Sustainable Investing Challenge invites teams of graduate students from around the world to develop and pitch creative financial approaches to tackle pressing social and environmental challenges. Deadline for 2024 entries is fast approaching. (Morgan Stanley)

Video Of The Week

Final day at COP28: What you need to know

CNBC’s Diana Olick joins from Dubai to report on what’s happening on the final day of the UN climate summit.