New Energy Weekly – It’s a Bull Market Again!

It’s a Bull Market Again!

On Wednesday December 13, the Federal Reserve Bank (the Fed), which controls the benchmark Federal Funds rate, suggested that it may begin cutting the rate next year. The officials voted unanimously to leave the target Federal Funds rate between 5.25% to 5.5%.

That’s the highest rate since 2001…but Wall Street loved it. The market exploded higher:

The giant S&P 500 index is once again near all time highs. It’s up 110% from its March 2020 low!

The bull market is in control again after bottoming in October 2022. And that’s due to the Fed’s decision this week.

The reason the Fed left the rate alone is because the inflation rate is settling down close to their goal of 2%. You should see a big boost in your retirement accounts.

That’s great for Wall Street, but it didn’t reach everyone.

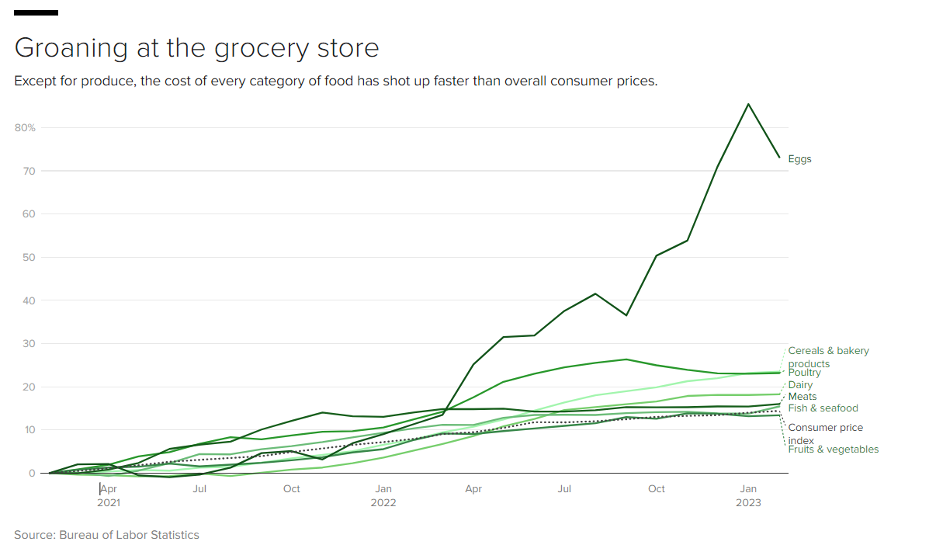

You see, any inflation means the price of stuff is going up. And the affect of the last couple years of soaring inflation is that prices are much higher today. Importantly, prices of food staples like butter, eggs, bread, etc.

That has an outsized impact on the budgets of the lowest earners, including elderly on fixed incomes. According to CBS News, the price of butter soared 31% and margarine jumped 44% from December 2021 to December 2022. And they have not gone back down.

I’m concerned that we are at a new price plateau. That prices will stabilize at these new highs, putting many folks in jeopardy of going hungry.

At Mangrove, we support our communities. This year, we’ll be contributing to our local food pantry. We hope that you’ll consider helping those folks in your communities hardest hit by the rising food prices.

Happy Holidays,

The Mangrove Investor Team

P.S. Looking to give this holiday season check out Feeding America because no one should go hungry.