Tweaking our Portfolio for 2024

Happy Holidays to you all!

This month, Spotlight will focus on several issues in our portfolio. We have a couple of sells and a new buy.

But first, we need to talk about the ultimate central bank Goldilocks moment.

Market Update – This is the Soft Landing

The Covid 19 Pandemic wrecked economies all over the world. Mandatory screenings slowed the supply chain to a crawl. Prices soared. People lost jobs.

Prices of all sorts of goods – cars, appliances, food, and sundries rose so rapidly that it forced the Federal Reserve Bank (Fed) to raise its benchmark interest rate. That rate affects consumer loans, credit cards, and mortgage rates. By making it higher, the Fed made all those things more expensive.

The goal was to slow spending. By cutting demand for “stuff” the Fed hoped to slow that price increases, also known as inflation.

That’s not an easy thing to do. By raising interest rates, the Fed deliberately hurt the economy. High interest rates are like chemotherapy – they hope to kill off inflation before sending the economy into a recession.

The goals were simple:

- Keep employers hiring.

- Reduce the rate of inflation to around 2%

- Keep corporations profitable.

- Avoid a stock market collapse.

In a recession, jobs disappear. Spending dries up because people have less money and corporations aren’t profitable for the same reason. The stock market typically falls sharply and then moves sideways for years.

Recessions are brutal and difficult to heal. The financial crisis of 2008 is a good example. Home prices fell as much as 20%. That recession lasted 3.5 years before recovery kicked in.

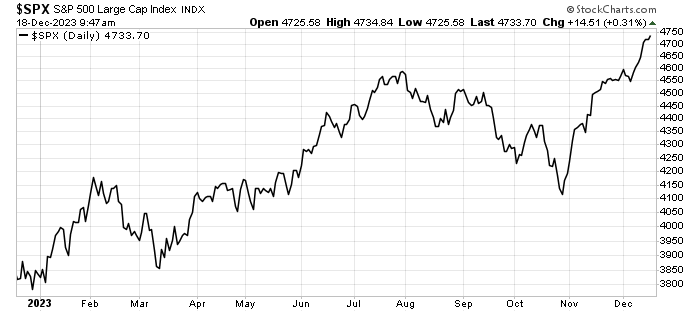

However, that fear never materialized. Inflation is close to the target range. There are plenty of jobs and wages are going up. Corporations are setting profit records as they hold prices high, even as their costs decline. And the stock market is near all-time highs:

This is the unicorn – a soft landing. And as long as this trend holds, we should do well with our investments. But first, we need to address some problems in our portfolio.

Lithium Disruption will Hurt Juniors Like Piedmont Lithium

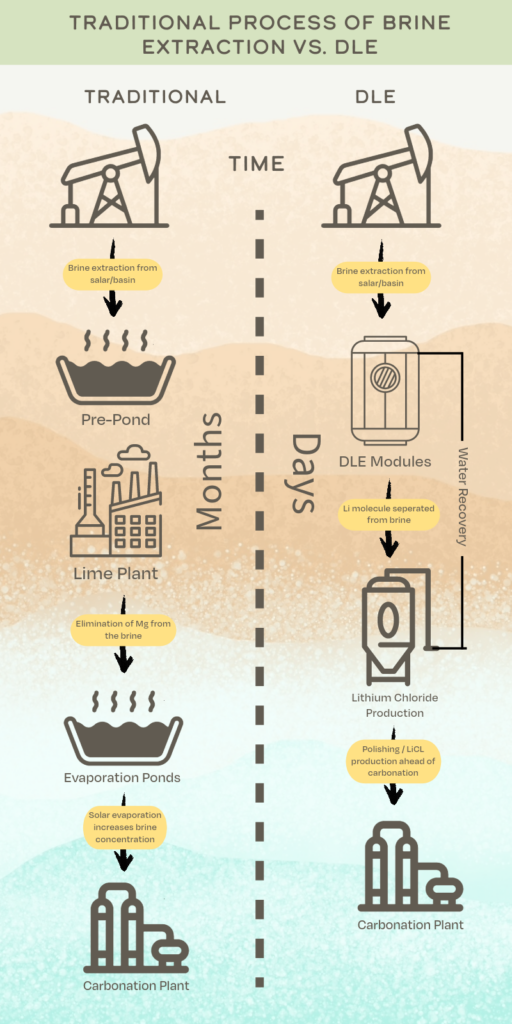

There is a major new player in the lithium market – ExxonMobil (NYSE: XOM). And it’s just the first of many oil companies getting into the act. Oil field brines are rich in lithium. Exxon believes it can use a new process, called direct lithium extraction (DLE).

The process is cheaper, faster, and more efficient than either evaporation ponds or hard rock.

I wrote a Grove Essay about it.

DLE has the potential to significantly change the lithium market. And Exxon isn’t alone – Equinor, Occidental Petroleum, and Schlumberger are reportedly looking at options for lithium production.

Both Equinor and Occidental invested in lithium companies already. Equinor owns a stake of Lithium de France and Occidental is a co-owner of TerraLithium.

The subsidies laid out in the Inflation Reduction Act make these investments attractive to big oil.

These companies already know how to do all the critical work. They can drill wells and extract liquids. The hurdle remains the DLE technology.

All these new suppliers implies that the market will get a big glut of supply in the next couple of years. ExxonMobil says it will be in production by 2027. And it claims it will be able to supply enough lithium for over 1 million electric vehicles by 2030.

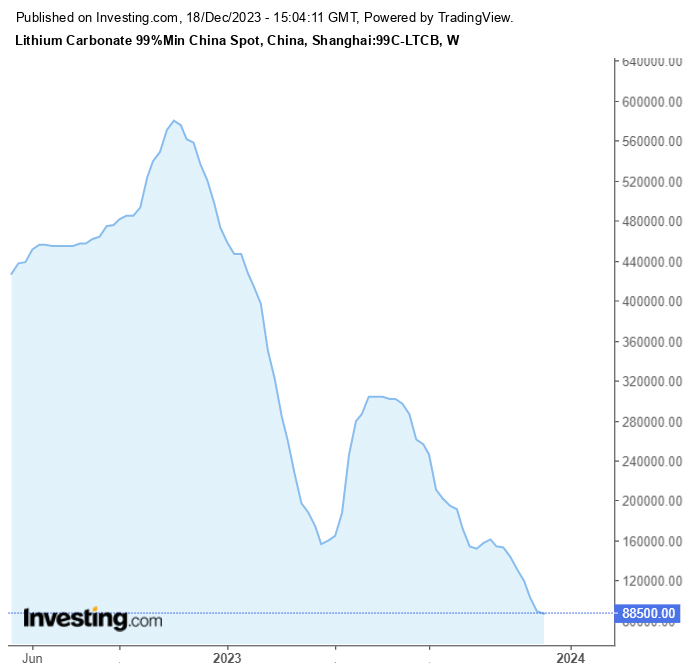

The lithium price responded already:

That fall impacted many junior lithium companies, including our portfolio company Piedmont Lithium (Nasdaq: PLL).

We bought the company back in August. At the time, the lithium price looked like it was recovering, and we hadn’t heard from the oil companies yet.

Now, lithium prices resumed their downward march. And we see an impending supply glut. It’s time to cut our losses.

Action to Take: Sell Piedmont Lithium (Nasdaq: PLL) and take a 32% loss on our position.

Government Theft of a Major Copper Mine Killed Our First Quantum Minerals Position

Our single greatest risk for First Quantum Minerals (TSX: FM) came true. Panama tossed out its agreement with the copper mining company and shut down its Cobre Panama mine.

This is a huge problem for mining companies. They investment hundreds of millions (if not billions) of dollars to find, develop and build mines. But they can’t be moved. And if a government changes its mind, they can do whatever they want.

As we said in our note on December 2022:

The government of Panama renewed its contract with First Quantum in 2017. Legally, that contract runs through 2037. However, the Panamanian Supreme Court ruled the law governing the current concession is unconstitutional.

Interestingly enough, that point didn’t come up in the six years prior to commercial production. During that time, First Quantum sunk over $10 billion into developing the mine. Now that it’s in production, the government can effectively hold the mine hostage.

At the time, analysts like those at Wolfe Research thought this was a negotiating tactic by the Panamanian government to get more taxes. A year later, we found out that it was outright theft.

Back in May 2023, we warned readers to put a stop on the position at $25.37 per share.

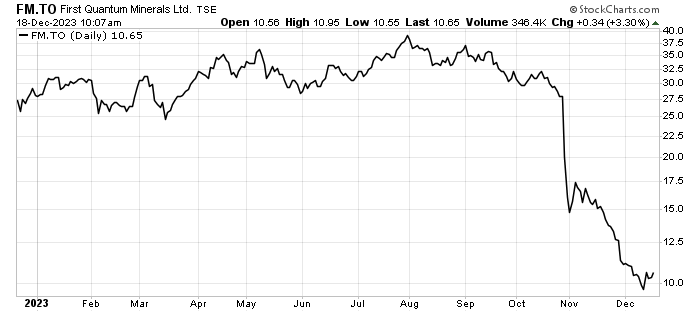

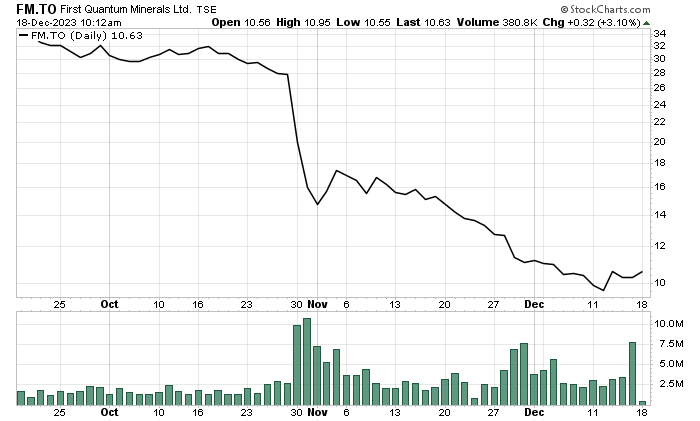

We didn’t get the chance to sell at our stop price. On October 30, the stock fell 28% from $27.96 to $20.00 in a single day. We should have closed our position the next day, but it continued to fall as you can see here:

The stock bottomed at $14.78 on November 1, before rebounding up to $17.46 per share the next week. We will use the $14.78 as our close since that was the bottom after we hit our stop. However, we hadn’t addressed this previously.

Action to Take: Record the Sale of First Quantum (TSX: FM). We will take a 50% loss on our position.

This move caught most of the market offsides. More than 30 million shares traded after the news came out:

Funds had massive exposure to First Quantum. They had to dump shares as fast as possible. For us, this was like being caught in an avalanche. It was a low probability event. That’s why the funds waited so late to sell.

However, this event created a ripple in the copper sector. Cobre Panama’s production supplied 1.5% of the world’s copper demand. The shut down, combined with political disruptions in Peru, pinched the world’s copper supplies.

As we recently wrote here, we suddenly have a razor thin copper supply/demand margin. And that could be severe by 2027. Dr. Kwasi Ampofo, Head of Metals and Mining, BloombergNEF believes copper prices could rise 20% by 2027. That’s based on supply/demand fundamentals.

That lines up with our investment thesis that led us to buy First Quantum initially.

As we said back in 2022: If you like sustainability, then you are a copper bull.

Copper is in everything electrical. You can’t make an electric motor without copper. It’s literally irreplaceable. And 8% of lithium-ion batteries are copper. And demand is soaring. Here’s what we wrote back then:

By 2027, copper demand from electric vehicles will go up by 1.7 million metric tons. As they roll out all these new vehicles, each one needs wiring. They need motors. They need batteries. All that adds up to 1.7 million metric tons. But that’s more copper than the world’s third largest copper producing country produced in 2019. China produced 1.6 million metric tons. So, by 2027, we need to add the equivalent of another China to copper production.

And as events like the theft of Cobre Panama occur, we are going the wrong direction with copper supply. We are subtracting production when we need to multiply it.

That points to higher copper prices in the future. And that’s why we need to find another good copper play.

This time, we will diversify our risks by owning a basket of copper stocks.

We do that through the Global X Copper Miners Exchange Traded Fund (NYSE: COPX).

Created in 2010, this fund holds about $1.5 billion in thirty-nine copper miners. It tracks the Solactive Global Copper Miners Total Return Index. Its largest holdings are:

- Zijin Mining (5.2%)

- Kghm Polska Miedz Sa (5.0%)

- Sumitomo Met Min (5.0%)

- BHP Group (4.9%)

- Antofogasta Plc (4.9%)

- Southern Copper Corp. (4.9%)

- Aurubis AG (4.9%)

- Glencore PLC (4.8%)

- Freeport McMoRan (4.7%)

- Boliden AB (4.7%)

This is an excellent way for us to get exposure to the copper market with the protection of diversification. We also earn a 2.6% yield from its dividends.

Action to Take: Buy Global X Copper Miners ETF (NYSE: COPX)

The Panamanian government’s theft of Cobre Panama from First Quantum Minerals was devastating for the company and its investors. I expect this to be litigated for years if not decades.

It will also put a huge chill on mining investment in risky countries. That’s a problem for the future copper supply. Miners must be careful where they explore because they can’t trust governments to honor their commitments. It’s a shocking lesson, but we see it every few years in places like Venezuela, Kyrgyzstan, Kazakhstan, Zimbabwe, etc.

We should watch the copper price over the next six months. These events should materialize in a gently rising copper price. And our new addition should benefit from that.

Have a happy holiday season. We will be back in 2024!

For the Good,

The Mangrove Investor Team