The Best Mining Water Treatment

In 2015, I saw one of the worst mine spills of my lifetime.

The San Juan River, one of my favorite western rivers, turned orange from mine waste:

The tragic part is, this wasn’t from an active mine or even a recently closed one. This happened because the U.S. Environmental Protection Agency (EPA) tried to fix a modest leak from the historic Gold King Mine.

They plugged up a contaminated stream, which backed water up into the mine. When the mine eventually overflowed, it brought with it millions of gallons of contaminated water.

It was a disaster that cost the EPA (and taxpayers) millions of dollars. And it polluted one of the west’s world class rivers. In 1999, I camped on the banks of the San Juan for six weeks. It was our base for Florida Atlantic’s geology field camp, where I was the teaching assistant.

I spent a lot of time in and around that river. The water was clear and full of fish. This image above still turns my stomach, nearly a decade later.

Mining companies and mining communities pay a lot more attention to water. There were too many examples of mine waste contaminating drinking water, public waterways, lakes, and streams. The problem is that 90% of mining processes require water. And if you don’t have water, you don’t have a mine.

This is a massive problem for the mining industry. And we found a solution.

This month, we are going to become part owners in one of the best mining water treatment providers we’ve ever seen.

Turning Miners’ Wastewater into a Profitable Business

BQE Water Company (TSXV: BQE) is a C$40 million Canadian company that focuses on mine water from a mine’s development through retirement. The company specializes in treating water from mines and metallurgical processing around the world.

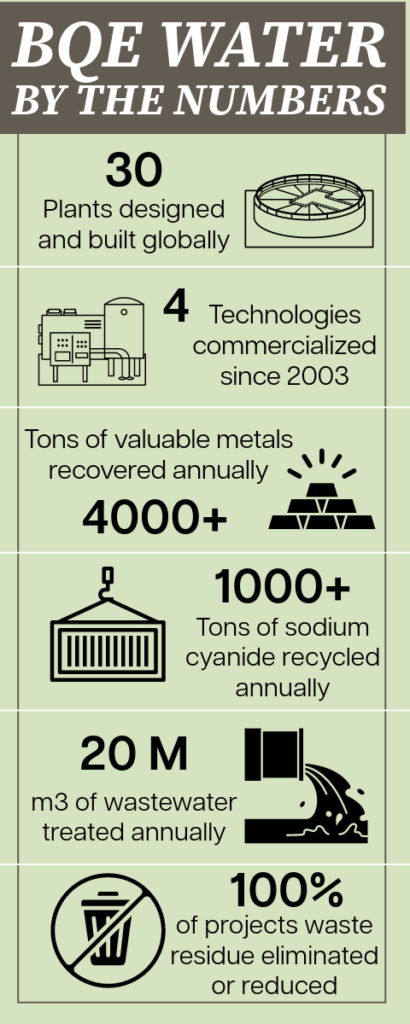

BQE Water designed and built thirty treatment plants around the world. They have four technologies commercialized since 2003. They recycle more than 1,000 tons of sodium cyanide every year. And they treat over twenty million cubic meters of wastewater every year.

The company’s business addresses several common problems in mine water:

- Selenium Contamination (27%)

- Metals Contamination (22%)

- SART Cyanide Recycling (15%)

- Detox Cyanide Destruction (15%)

- Sulphate (13%)

- Other (8%)

These are critical issues when companies mine or process metal ore. The company can provide turnkey solutions to these issues. And that can mean the difference between a company building a mine or not. Many of these processes are protected under intellectual property patents. That gives the company a significant edge in these treatments.

And these contaminants are a global problem. A quick internet search shows that selenium contamination in water is significant. Selenium is challenging because even a minute amount in wastewater can build up in fish.

In 2016, a research paper identified selenium compounds called “selenate” that weren’t being reported by commercial laboratories. It also showed that biological treatment systems were simply converting the measured selenium into this unmeasured form. In other words, while the measured amount of selenium went down, the actual amount didn’t.

BQE Water’s Selen-IX process is the only commercially available non-biological treatment system that can remove the “selenate” form of selenium. The Selen-IX plant for selenium removal won four different technological awards in 2020 and 2021.

The process isn’t selenium specific. Selen-IX can remove arsenic, antimony, bismuth, chromium, and molybdenum using the same process.

Thiocyanate is another emerging waste issue for gold miners. Cyanide (which is a compound formed by one carbon and one nitrogen atom) is a useful chemical for removing gold from ore. Thiocyanate forms when cyanide reacts with sulfur-containing minerals (a sulfur atom gloms onto the carbon and nitrogen).

Thiocyanate can harm people and aquatic life. And it doesn’t degrade through conventional cyanide destruction processes. That’s why cyanide recycling and destruction make up 30% of the company’s business. They can manage difficult mining-specific water issues.

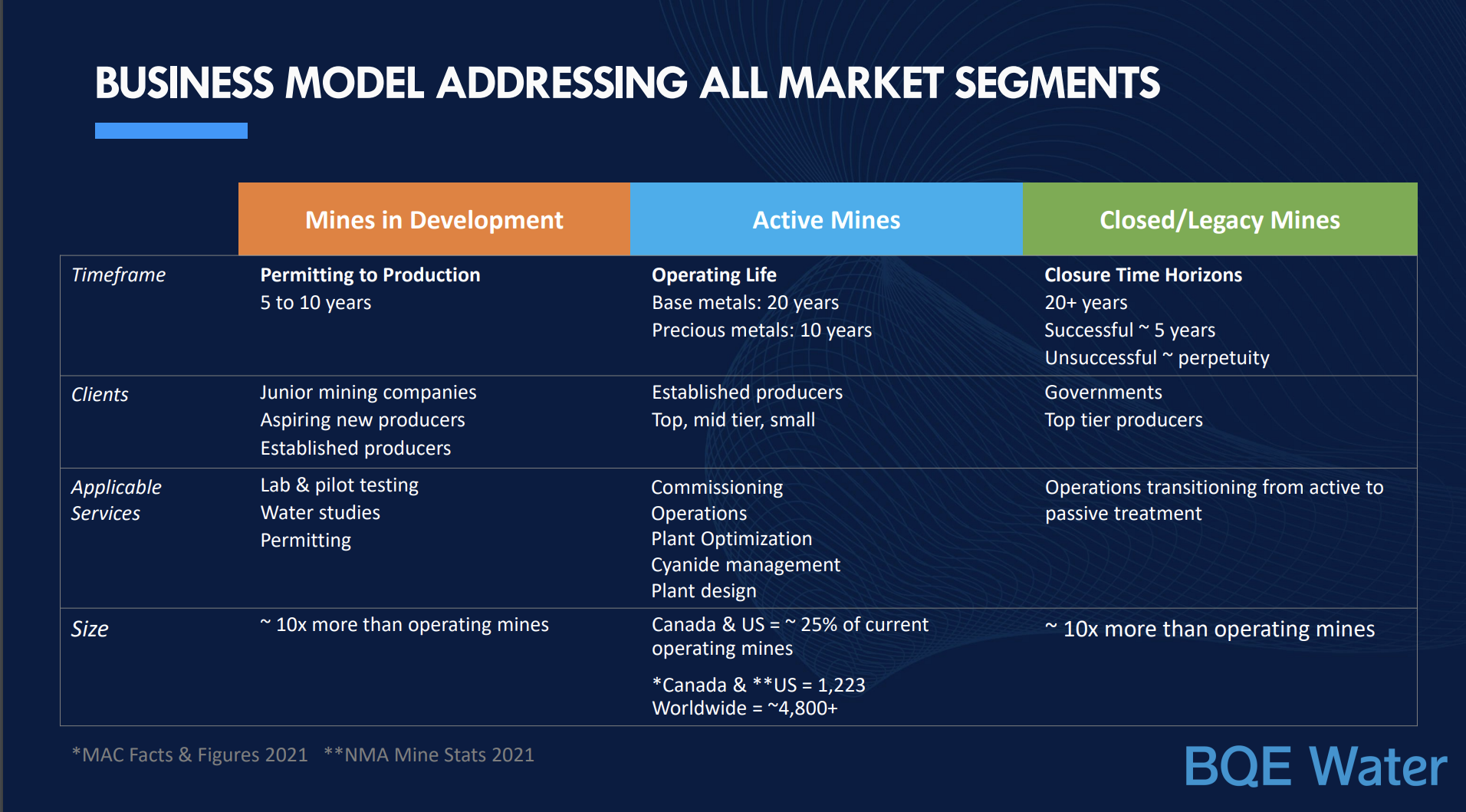

The graphic below shows BQE Water’s business model. The goal is to turn a one-off development project into recurring revenue streams.

The company’s business focus is on major mining companies. They currently work with the following:

Glencore, Codelco, Jiangxi Copper, Freeport-McMoRan, U.S. EPA, Kinross Gold, Centerra Gold, Torex Gold, South 32, Coeur, Anglo American, Agnico Eagle, U.S. Power Utility, Trafigura, Cameco, and Orano.

These companies are the elite of the world’s mining companies. It’s no wonder the company grew over the past five years.

Financials

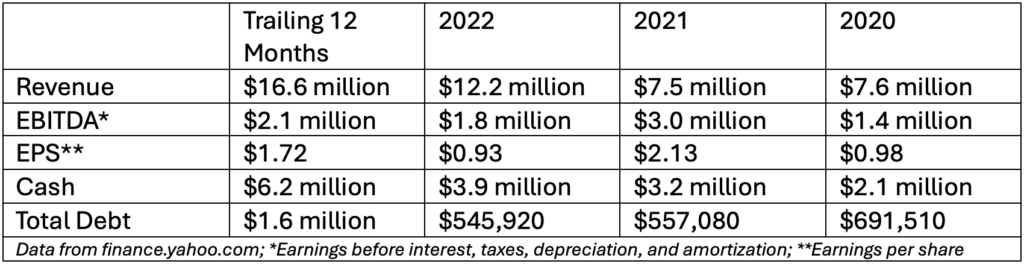

BQE Water has an excellent growth profile. As you can see in the table below, the company steadily grew revenue and earnings over the last few years.

The company grew its revenue by 13% per year over the past five years. However, its recurring revenue grew 33% per year over the same period. That’s important because recurring revenue doesn’t have to be replaced. It creates building blocks for growth.

Today, the company estimates that 67% of its revenue comes from technical services required before water treatment plant operations. This is non-recurring revenue (but could lead to recurring revenue). The remaining 33% is recurring revenue from cleaning water, tolling fees from long-term operation contracts, and the sale of metals recovered from wastewater.

BQE Water is exactly the kind of company we want to own in the New Energy Portfolio. It’s a profitable company doing good in the world. And it has a technological moat around large parts of its business. That intellectual property could be a lure for a takeover down the road.

Action to Take: Buy BQE Water (TSXV: BQE) up to C$30 per share. We can use a 30% trailing stop on this position. That means, at $30 per share, we would sell the stock if it closed below $21 per share.

BQE Water has significant upside potential.

We believe, as most readers know, that mining must go through a period of growth. The math for metal demand outstrips supply by a lot. That means we need many new mines. And all those mines will be built to new, higher environmental standards. That opens the door to faster growth for BQE Water.

And there’s another potential win for shareholders, that’s a takeover. BQE Water is a microcap at C$40 million. Most of the water treatment companies (like Xylem) are in the multi-billion-dollar market cap range. A company like that could easily buy BQE Water as a bolt-on division.

Both options have exciting potential for investors.

For the Good,

The Mangrove Investor Team