This Energy Company Was so Cheap, It Acquired Itself

By Matt Badiali

In 1841, the Akers Mekaniske Verksted, a small mechanical workshop, began life on the banks of the Aker River in Oslo, Norway.

The workshop eventually became a shipbuilding and engineering firm.

The company prospered throughout the Industrial Revolution. However, it really boomed in the 1960s during the oil discoveries in the North Sea.

Aker was one of the first marine engineering firms to adapt offshore rigs for the difficult conditions of the North Sea.

In 1971, Aker launched its iconic H-3 semi-submersible drilling platform. Designed to drill in water as deep as 1,000 feet, it was an engineering marvel.

This design transformed the offshore drilling industry. The company, now called Aker Solutions, is a world leader in offshore engineering.

By now, you’re probably wondering why we’re talking about an oil industry stalwart like Aker. The answer is simple: It’s out in front with offshore wind designs too.

Aker Offshore Wind is an Aker company dedicated to designing, building, and (eventually) operating offshore wind farms.

The company is a subsidiary of Aker Horizons (Oslo: AKH), which is listed on Norway’s stock exchange.

We initially featured Aker Offshore Wind in our first New Energy special report back when it was a separate company.

At the time, it had a huge suite of projects worth far more than its valuation. We saw it as a smart play on offshore wind power.

The company’s portfolio consists of a net capacity of 3.5 gigawatts diversified around the world. It owns shares of fields in the U.S., Japan, Sweden, South Korea, Norway, and Scotland.

The company is still in development mode. It generates almost no revenue… and its investments run into the tens of millions of dollars.

That added risk but also increased the potential reward for success. We also believed in the company because it had the support of the greater Aker family of businesses.

The Aker group has decades of experience in deep-water technology. That reduces costs and opens acreage for offshore wind farms that are too deep for single piling structures.

In addition, the Aker company has a large construction site in Verdal, Norway. That means it’s close to the North Sea, which reduces costs for projects in that region.

The company is a leader in floating wind platform technology. Its sweet spot is water deeper than 200 feet.

Eighty percent of offshore wind resources are in that territory. Bottom-fixed structures aren’t safe over a depth of 200 feet.

Why Offshore Wind?

The benefit of deep-water offshore wind is that it can employ the largest turbines, which dramatically increases energy production and efficiency.

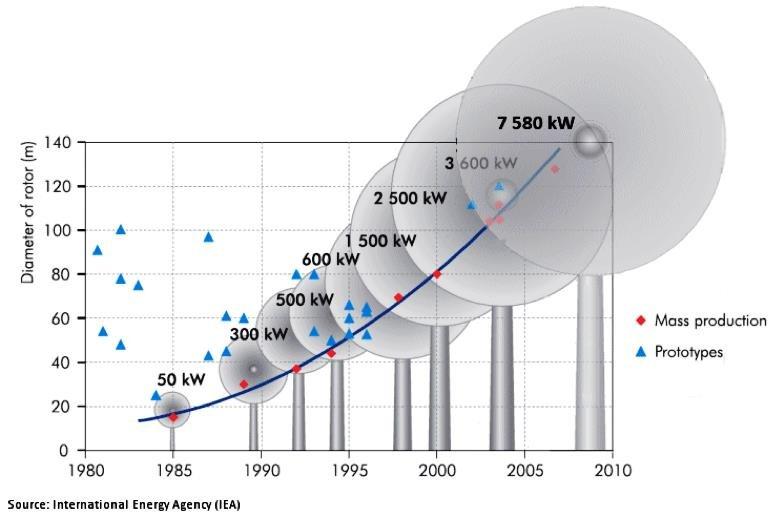

Offshore wind turbines can be nearly four times the size of an onshore wind turbine.

The chart below shows how wind turbines grew in size over several decades.

As wind turbines get larger, they create much more energy:

The large, offshore wind farms are more cost-effective per megawatt-hour than the smaller, land-based wind farms.

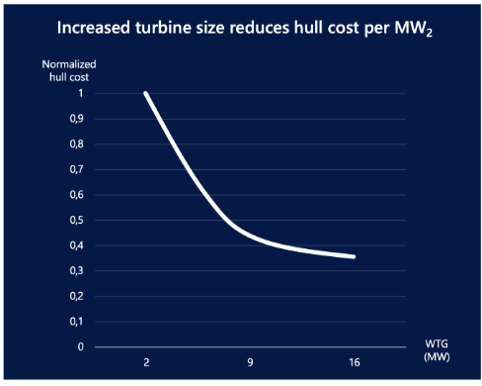

As you can see in the chart below, as the turbine size grows, the cost plummets:

(Source: Aker Offshore Wind.)

That means the largest offshore wind turbines cost roughly one-third of an onshore wind turbine on a per-megawatt basis.

That’s a huge incentive to build these projects. And governments around the world are embracing this technology.

However, offshore projects require more initial capital and engineering. That’s where Aker comes in. It can draw on more than a century of marine construction experience.

Here’s what we originally wrote in the New Energy special report:

We see its portfolio of future wind projects as an attractive asset play. The company will win some of these and lose others. However, Aker Offshore Wind is one of the premier engineering companies in deep-water wind development. It will build out a significant energy portfolio over the next few years.

We see its 20.4% ownership of Principle Power as even more attractive. This private company holds the record for the world’s first 8.4-megawatt floating turbine, installed offshore in Portugal.

It has installed more than 100 megawatts of wind turbines, and it has a strong brand in the floating wind industry. Plus, its field-proven designs make it easier to get projects financed.

Aker Offshore Wind leads a consortium looking into recycling windmill blades. Currently, the giant fiberglass blades get landfilled. Aker Offshore Wind and a team of Scottish scientists took on that problem.

As you can see, we believe Aker Offshore Wind offers an excellent slate of early-stage offshore wind assets. And as you’ll see, the market doesn’t assign much value to these assets today.

Too Cheap to Last

At the time we wrote about it, the market’s value of Aker Offshore Wind priced in a lot of risk.

The average value of Aker Offshore Wind’s peers worked out to $318,420 per megawatt of power. We could’ve bought the company for about $10,114 per megawatt.

Based on that valuation, Aker Offshore Wind’s stock would have to go up 3,048% just to get it to the average value of its peers.

Here’s what we said at the time:

We don’t see that outcome soon. But we believe that this stock could rally sharply as the company begins to get contracts.

That gives us a six-to-12-month runway. If the company executes, the stock should easily double from here. And a 1,000% gain is on the table as it builds out and turns on these offshore fields.

That said, a lot of things could happen before then… not the least of which would be a U.S. stock market listing.

Just as we prepared to launch New Energy, Aker Offshore Wind issued an announcement: It merged with its sister company, Aker Mainstream Renewables. Shareholders got stock in their parent company, Aker Horizons, at a 6.9% premium to the stock price.

We knew the price was too low, and so did the parent company. So it did the smart thing and bought it. And just like that, our fantastic wind company disappeared.

The point of this story is that there are tremendous opportunities to build wealth in alternative energy companies… as long as their parent companies don’t take them over first.

Good Investing,

Matt Badiali

Numbers to Know

83%

The population decline of Alaskan snow crabs since 2018 due to climate change. Alaskan officials decided to cancel snow crab season for the first time in history. “It’s going to be life-changing, if not career-ending, for people,” said one crab boat captain. (USA Today)

$199

The cost of over-the-counter (OTC) hearing aids at Walmart. New federal regulations allow the sale of OTC alternatives to prescription hearing aids, which typically sell for between $2,000 and $8,000. This change could mean huge savings for the 37 million Americans with hearing problems. (CBS News)

$1.2 billion

Amount that the Bill and Melinda Gates Foundation will donate to help eradicate polio. The virus was recently detected in New York City and London, leading officials to ramp up calls for vaccination. In a statement on Sunday, billionaire Bill Gates said polio “remains a threat.” (Forbes)

What’s New in Sustainable Investing

Clean energy has a tipping point, and 87 countries have reached it

The transition to clean energy is now approaching full speed, with 87 countries drawing at least 5% of their electricity from wind and solar. The U.S. surged past 20% renewable electricity last year. If the country follows the trend set by others at the leading edge, wind and solar will account for half of U.S. power-generating capacity just 10 years from now. (Bloomberg)

BYD flags huge quarterly profit jump as China sales surge past Tesla

BYD, China’s biggest electric car maker, said third-quarter profits more than quadrupled as it extends its sales lead over Tesla in the world’s largest auto market. Robust sales and a product range broader than other EV competitors have allowed the company, which is 19% owned by Warren Buffett’s Berkshire Hathaway, to significantly reduce costs per vehicle. (Yahoo Finance)

Links We Like

“The White House is coordinating a five-year research plan to study ways of modifying the amount of sunlight that reaches the earth to temper the effects of global warming, a process sometimes called solar geoengineering.” (CNBC)

“[YouTuber Warped Perception] must be credited for coming up with bizarre ways of torturing the Tesla battery. […] A small modification allowed his Tesla Model S to travel 1,600 miles without charging.” (Interesting Engineering)

“MacKenzie Scott, the billionaire philanthropist and former wife of Amazon founder Jeff Bezos, has donated $15 million to a social enterprise that helps provide glasses to farmers in developing countries.” (The Guardian)