Why the Price of Copper is About to Explode

Why the Price of Copper is About to Explode

Way back in August 2022, we published a Grove Essay titled: “This Metal’s 3,100% Rally Shows What’s Coming Next.” In that essay, we showed the palladium price run, due to demand from catalytic converters.

In the essay, we show a chart of palladium’s incredible 19 year, 3,100% bull market. And we predicted that copper would be the next metal to run. When we wrote the essay, the copper price was around $3.40 per pound. Today, as you can see in the chart below, it’s back up to $4.07 per pound:

According to a new Goldman Sachs commodities research report, “Copper’s time is now.” They use a long-winded and wonky argument about “resilient global growth” and “passive monetary easing.” But what really matters is two-fold: global manufacturing is picking up and we have a massive underinvestment in copper supply.

Let me explain.

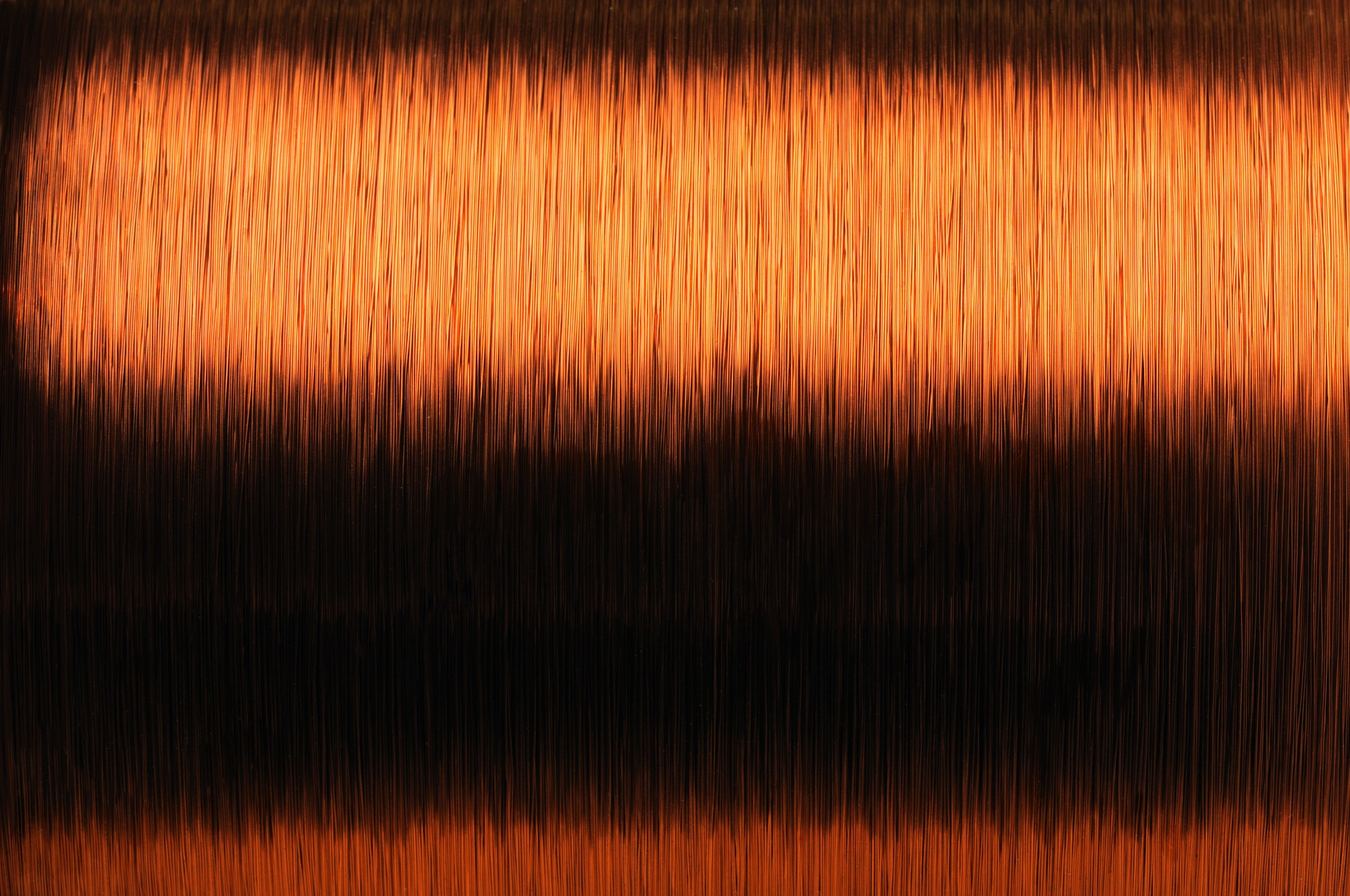

Copper is such an important metal that economists call it Dr. Copper – as in it has a Ph.D. in economics. That’s because it is in everything. According to The Copper Alliance, it takes one metric ton of copper to build forty cars or 100,000 cell phones or 400 computers or wire 30 homes. Anything that carries electricity, from toys to power stations, needs copper.

They often point to copper demand as a leading indicator for economic health. When copper demand is high, the world’s economy is healthy. The reciprocal is true too, when the world economy strengthens, copper demand rises.

And that’s where we are today.

According to Goldman Sachs’ research, low periods of global manufacturing kick off strong runs in copper. The average price climbs 25% over the next year. And today, we have a multi-year low in copper supplies.

And copper’s price has another tailwind – global consumption stimulus. Governments and major corporations around the world continue to push electrification. There are tax breaks and incentives driving the switch. It’s a plan we at Mangrove Investor support. But electrification needs significantly more copper than we did in the past.

That combination of increased demand and tight supply will create a price shock. Goldman’s outlook for copper is $10,000 per metric ton ($4.54 per pound) by the end of 2024 and a whopping $15,000 per metric ton ($6.81 per pound) by 2025.

For investors, it’s time to jump on this trend. If you wait, you could miss it.

For the Good,

The Mangrove Investor Team

Numbers You Need to Know

2.1 milligrams

Copper is essential to all living organisms as a trace dietary mineral. The adult human body contains between 1.4 and 2.1 milligrams of copper per kilogram of body weight. (Natural Resources Canada)

6.3 Billion Metric Tons

There is roughly 6.3 billion metric tons of copper on Earth. This would fit into a cube measuring about 890 meters on a side. (U.S. Geological Survey)

22 million metric tons

For investors interested in the red metal, it’s worth looking at copper production by country. According to the latest US Geological Survey data, global copper production reached 22 million metric tons (MT) in 2023. With Chili leading the way at 5 MT. (U.S. Geological Survey)

What’s New in Sustainable Investing

Why has ESG Become The Toxic Wordle In Asset Management?

In their recent article “It’s not just ‘woke.’ These are the most polarizing words in America,” the CEO of the Harris Poll and vice chair of Stagwell explain how certain words have become “like dog whistles” to hinder business. At the top of the list are “DEI” at 31 percent partisan split and “ESG” at 27 percent. They have even coined the new term “toxic wordle” to describe the most damaging current business words and phrases. (Forbes)

How AI can boost sustainable investing

With disclosure requirements emerging in nations ranging from India to China, the demand for tools that help firms track environmental, social, and governance factors are expected to rise. Many of those tools are going to lean on artificial intelligence to help multinational companies remain compliant—but also transform their businesses along the way. (Fortune)

Video Of The Week

Why Copper Is Now One of the World’s Most In-Demand Metals

Why copper is so important to the global economy – and how a massive shortage is threatening the green-tech transition.