Here’s How We Can Profit by Taking on Steel’s Ugly Carbon Footprint

Steel making has a huge problem

It accounts for about 8% of all global carbon dioxide emissions.

That’s one third of all the emissions from industrial energy use. It’s more than all the carbon dioxide produced by airlines and ships combined.

That’s because the process hasn’t changed much in more than a century. Iron ore becomes iron by heating it (usually with coal).

The process to turn iron into steel requires even more coal. The whole process is carbon intensive. This is a major problem because of the coal use.

The bulk of the carbon dioxide comes from burning fossil fuels for energy to make and shape the steel. In the U.S., industrial greenhouse gas emissions make up 30% of the total.

However, there are some alternatives.

About 100 million tons of steel production uses natural gas (a major improvement) instead of coal.

This month we will focus on a company doing something about that.

Founded in 1915 as American Iron & Metal, the company’s headquarters are in Irving Texas. It’s a global company that produces industrial steel products.

It’s one of just two primary suppliers of steel for reinforcing concrete. The company helps build highways, bridges, railways, and buildings all over the world.

And they are carbon neutral.

That’s a huge leap for a steelmaker. And the fact that this company can be both a major global supplier of structural steel and carbon neutral is fantastic. This is a company that we need to dig into.

Commercial Metals Corp. (NYSE: CMC) – Embracing Net Zero in Steel Making

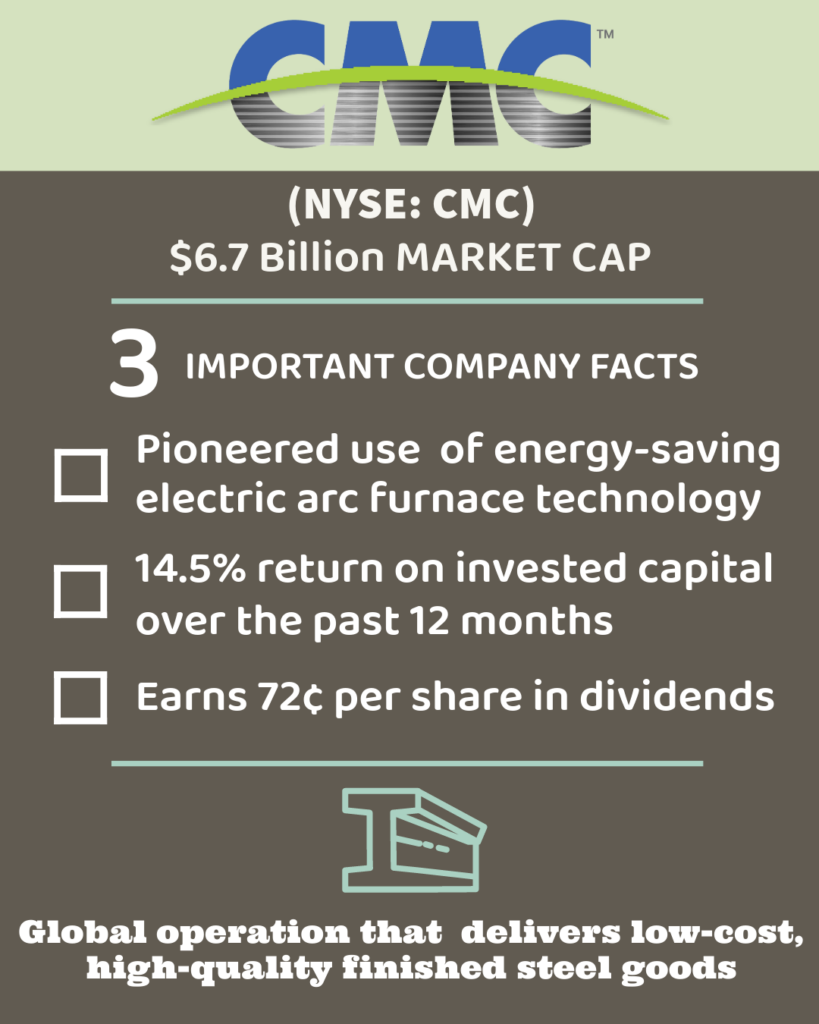

Commercial Metals Corp. (CMC) is a $6.7 billion steel and metal products manufacturer and recycler.

It’s known for its concrete-reinforcing rebar manufacturing. The show Repurposed, features CMC in its second season (you can watch it Here, we highly recommend it!)

The company uses the most modern technologies to recycle metal. Newsweek named them on of America’s Most Responsible Companies in 2023. CMC Poland received the Silver Laurel in QUALITY. In 2020, former CEO Barbara Smith receives the S&P Global Platts CEO of the Year Award.

The company has four main divisions: recycling, milling, fabrication, and construction services.

CMC has operations in Germany, Poland, the United Kingdom, China, India, Vietnam, and the United States. It was the first company to introduce vertical integration business model in the U.S. That means they start with waste and end with new material. They combine recycling, processing, and blending scrap metal into new steel. Then CMC produces finished steel products.

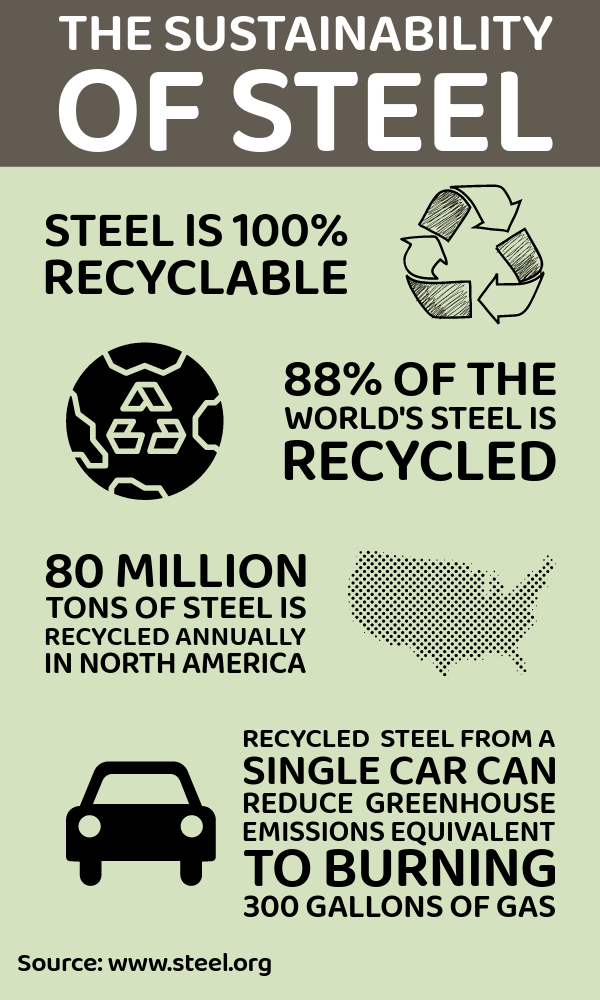

The process delivers low-cost, high-quality finished steel goods. The most important (to us) is that the company uses electric arc furnace technology in the process. These modern, innovative furnaces create 63% less greenhouse gas emissions than traditional steel making. However, in order to reach net zero, the company factors in renewable energy credits and carbon offsets.

The company makes a series of products that are net zero: rebar, structural steel, wire, and high-strength steel posts.

In the latest quarter, the company generated a whopping 14.5% return on invested capital over the past 12 months.

In other words, they money they put into the company over the past year has already generated double digit returns.

The company plans to create a unified platform for the sales group. This is a global company. The new platform will allow the entire sales group to share information and bundle customer solutions. It’s a way to use its current customer base to increase sales and margins.

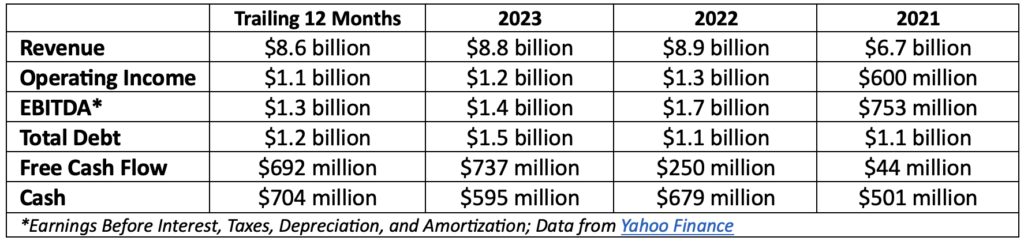

The company currently has a 13% operating margin, as you can see in the table below. That means it costs the company 87¢ to earn a dollar. It’s an area that the company can improve, and that’s what the unified sales platform will address.

Here are some of the company’s financials back to 2021:

As you can see, it’s healthy. We like to use free cash flow as a measure of financial success. That’s the cash generated after everything gets paid for the year. In this case, CMC banks about half its operating income as free cash flow. That’s great because it allows the company to pay its shareholders.

The company just announced a 13% increase in its quarterly dividend. They grew the dividend by 50% since the end of 2021. Today, we will earn 72¢ per share in dividends. That’s a 1.2% dividend yield as we write this.

As you can imagine, a high-profile, innovative company like CMC is popular with funds. Blackrock, the giant investment bank, owns 13.4% of the company. Vanguard Group, Dimensional Fund Advisors, and State Street Corporation (all fund managers) own 10.9%, 6.5%, and 5.0%, respectively. In all, institutions own 89% of CMC.

We see CMC as a beneficiary of two trends – the overall reduction of greenhouse gases and the rising demand for metal as electrification continues.

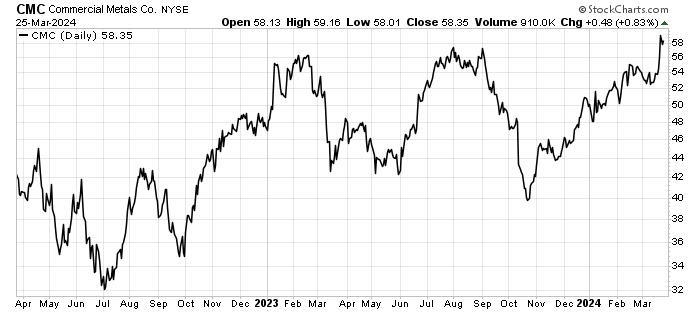

Action to Take: Buy Commercial Metals Corp. (NYSE: CMC) up to $60 per share. That will lock in a 1.2% yield. Use a 25% trailing stop on the position. That means, if we pay $60 per share, we will sell if the shares close below $45 per share.

When we use a trailing stop, we are committing to risking 25% of our initial capital. So, if we put $1,000 to work in the stock, we want to preserve $750. We never, ever, want to risk 100% of our position in a stock. We can recover a 25% loss. It’s much, much harder to recover a 100% loss.

We definitely want to pay close attention to our trailing stops over the next few weeks. The market has gone up so far, so fast that we need to be ready to sell if it turns downward. While we don’t expect it, you should be prepared. We should tighten up our stops to 20% across the board to protect our gains.

For the Good,

The Mangrove Investor Team