Building a Sustainable Portfolio Without Getting Fooled

Caveat emptor, quia ignorare non debuit quod jus aliencum emit (let the buyer beware, for he ought not to be ignorant of the nature of the property which he is buying from another party).

That’s the long form of the phrase caveat emptor. And it’s something we don’t do enough, when it comes to investments. Too often, we don’t look past a name or a label, when we invest.

And that can lead to big trouble for conscientious investors.

There is a lot of misleading information. Particularly around investment products labeled “green” or “ESG” (environmental, social, and governance).

A recent Bloomberg article detailed how the U.S. Securities and Exchange Commission (SEC) and BaFin, Germany’s financial regulator began investigating Deutsche Bank. The allegation is that Deutsche Bank lured investors into ESG-related investment products by misrepresenting the credentials of the company. That sort of thing is rampant in the industry right now.

The SEC warned everyone, that if you made false claims about ESG, you could get in trouble. And through the first nine months of this year, some high-profile names got dragged through the mud for it.

For example, in May the SEC charged the Bank of New York (BNY) Mellon for claiming that certain mutual funds had gone through ESG quality reviews when they hadn’t. The SEC slapped them with a $1.5 million fine.

And it isn’t just BNY Mellon.

There are some shady exchange-traded funds (ETFs) out there that make big claims about sustainability. But fail to back them up upon a closer look.

An ETF is a basket of stocks built around a theme. You can create an ETF around anything, but most of them are created around an index. For example, let’s look at the Russell 2000 Index.

Created in 1984 by the Frank Russell Company, the Russell 2000 is a broad index of 2,000 small-cap companies. The “small-cap” designation means the median market value of these companies is about $922 million.

This is a huge index. It serves as a measuring stick for individual stocks, mutual funds, and ETF performance.

However, we can’t just invest in an index. So, investment banks create baskets of stocks (those ETFs) to recreate the index’s performance. For example, the iShares Russell 2000 ETF (NYSE: IWM) tracks the Russell 2000 Index.

Banks constantly create indices and funds to track different areas of the market.

But some funds aren’t based on indexes, they’re based on an idea or a trend. The Global X Millennial Consumer ETF (Nasdaq: MILN), which holds a basket of millennial-focused companies like Uber and Chipotle.

Anywhere that banks think people are interested in investing, they make a fund. And sustainability is a hot area right now. However, not all these indexes or funds do what they say they will.

Right now, there are hundreds of funds that relate to ESG issues. The chart below shows the breakdown of these ESG topics:

However, we don’t like the “ESG” designation. It’s vague. It’s politicized. It doesn’t really mean anything. And it doesn’t help us find great companies.

Few of the high-profile ESG funds focus on these ESG topics. The label also becomes a crutch that obscures the most important part of a company – whether it can succeed.

We saw this same kind of thing in the late 1990s, during the dot-com bubble. Back then, every manner of company tried to ride the tech wave. And many investors didn’t look too closely at what they bought.

The poster child for that bust was Pets.com. Here’s what CNN says about the company:

The company lost $147 million in the first nine months of 2000, and the company was unable to secure more cash from investors. When Pets.com went public in February 2000, its stock started at $11 a share and rose to a high of $14. But the rally was short-lived and Pets.com’s stock quickly fell below $1 and stayed there until its demise.

Pets.com spent millions of dollars on a Super Bowl ad at its peak. It didn’t help. And if you bought the initial public offering at $11 per share, you lost more than 90% of your investment.

That’s incredibly hard to recover.

We have a plan for that now (see the sidebar). But we also need to focus on the meat of the companies themselves. You can’t let an “ESG” label lead you to buy the green equivalent of Pets.com. That’s why we chuck that out and do our own research.

As you’ll see, this month’s company more than passes both the financial and the sustainability tests.

Cutting Our Losses

Pets.com is a fitting example of a stock that could wreck your portfolio. For example, if we bought Pets.com for $11 and sold it for $1, we lost $900 on that trade. That’s a 90% loss.

We have $100 left from that original $1,000. That means we need our next investment to go up 10 times to recover from that loss. And that will only get us back to zero, with no gain for the year. That’s why big losses can be devastating to a portfolio.

At Mangrove Investor, our philosophy is to minimize our losses by 25% to 30%.

If we took a 30% loss on Pets.com, it would have been $300. Then we only need the remaining $700 (from our original $1,000 investment) to go up by 43% to recover the loss. A much easier goal than 1,000%.

That’s why we use trailing stops.

A trailing stop tells us exactly when to sell our position, based on math, rather than emotion. It limits the amount of capital we risk on any given position. We never, ever want to risk all our capital. Typically, we risk 25% to 30% on any given position. That’s $250 to $300 on a $1,000 investment.

The trailing stop tracks that value, based on the highest closing price of the stock. For example, let’s say we bought $1,000’s worth of a solar power company. We bought 10 shares at $100 each and used a 25% trailing stop.

Our trailing stop would start at 25% of $100. If the stock price closed below $75 per share, it would trigger our stop – telling us to sell our position

That can be hard to do because we don’t want to take the loss. That’s why we use math and not emotion to tell us when to sell.

Emotionally, we are never prepared to sell a stock at the right time. When they are going down, we hope that they will come back up. It’s human nature… and it will hurt your investments long-term.

Trailing stops are great for setting exit prices after big gains too. I personally know too many people that did everything right on a stock… except sell.

Take Teck Resources (NYSE: TECK) for example:

The stock ran from under $2.50 per share in March 2009 to over $55.00 per share by March 2011. In just two years, investors could have made 2,100%. That kind of gain turns every $1,000 into $21,000.

But then shares began to fall. By June 2012, they hit $25 per share. Now the gain is down to 900%. Still great but falling fast.

If you just bought and held that stock, you were back to zero by January 2016. All the gains evaporated.

A 25% trailing stop would have triggered a sell at $41.25 per share (based on the high price of $55 per share). That would lock in a 1,550% gain on the position.

That’s the important thing about trailing stops. They protect our capital on the downside and protect our gains on the upside.

Here at Mangrove Investor, we always focus on risk first. If we understand our risk, we know where to set our trailing stops.

That’s critical, no matter what kind of investing we do. However, there are risks in the sustainable investment world today.

According to industry website ETF.com, there are more than 50 ETFs that claim some ESG component to their holdings.

But there is A LOT of greenwashing going on, as well.

Take the iShares ESG Aware ETF (NYSE: ESGU), for example. As of August 2022, the fund holds 307 companies. And it touts a series of sustainability characteristic scores from index company MSCI. But it’s still a big fund that buys baskets of companies.

Here’s the breakdown of the fund. For every dollar invested into the fund (rounded to the whole cent):

- 29¢ goes into Information technology companies like Facebook and Apple.

- 14¢ goes into health care companies like Medtronic and Pfizer.

- 11¢ goes into consumer discretionary companies like Nike and Pepsi.

- 11¢ goes into financial companies like Chubb and Citigroup.

- 8¢ goes into industrials like Raytheon and Johnson Controls.

- 7¢ goes into communication companies like T-Mobile and Twitter.

- 5¢ goes into oil companies like ExxonMobil and Chevron

- Just 3¢ goes into utilities like Nextera and Entergy

- 3¢ goes into materials companies like Newmont and Mosaic

That looks more like a generic Nasdaq fund than what I want in a sustainable investing fund. And that sort of “lump it in a fund and call it green” is rampant in the industry.

That’s why Mangrove Investor exists today. We want to shine a spotlight (see what we did there?) on greenwashing AND on companies that are doing good.

That’s where our current recommendation comes in. It sits at No. 4 on the Investor’s Business Daily (IBD) Top 100 Best ESG Companies list. This is a proprietary ranking system, by a reputable company. We consider it a good place to start.

According to the IBD list, this company had a composite ESG score of 74.14. The highest, by Microsoft, was just 76.30. But that’s just a small part of the story.

We think this company has a bright future. And the post-pandemic shipping recovery will drive this company’s shares higher.

Why Should We Own J.B. Hunt Transport Services (Nasdaq: JBHT) Today?

Financials are important, they show us we can make money on this stock. But more than that, J.B. Hunt exemplifies what we want to support in a public company.

The company ranks fourth on the IBD 2021 Best ESG Companies. That’s a statistic I never expected from a trucking company. And yet, it does not appear among the 307 companies owned by the iShares ESG Aware ETF.

However, the company does appear in several other ESG funds. That’s because the company focuses on its people and its communities. And that’s important to us.

From its 2021 Annual Report:

A strong company is one that is rich in diversity and champions inclusivity. We put great importance on creating a lasting culture of inclusion that rallies around and encourages its many forms. Our company culture, including our corporate giving practices, reflect the desire to support inclusive practices.

We formally launched our Inclusion Office in 2021, led by our first VP of Inclusion, Jermaine Oldham, a five-year employee and former United States Air Force service member. Mr. Oldham and his team are working to expand and lead our Enterprise Inclusion strategy and help foster a more inclusive culture at J.B. Hunt.

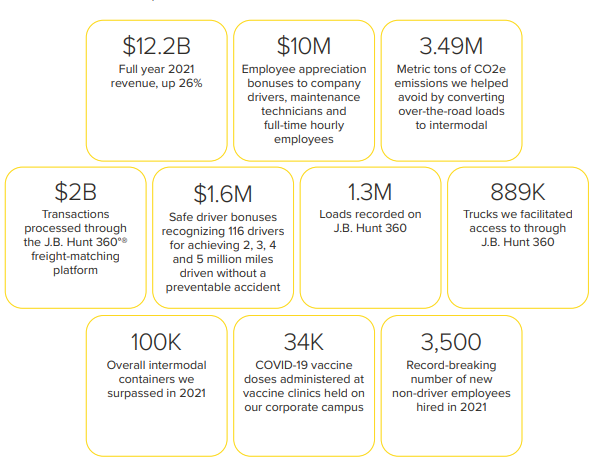

It’s refreshing to see a company as large as J.B. Hunt embrace that point of view. Here are some more highlights from the company’s 2021 Annual Report:

Aligning Transport Efficiency and Carbon Footprint Reduction

J.B. Hunt’s efforts to optimize supply chains also works toward reducing its carbon footprint. It published its first Sustainability Report in 2020.

The company embraces innovative technologies, from A.I. and machine learning to autonomous driving. It partnered with Waymo, the leading autonomous driving technology developer, to carry freight from Houston to Fort Worth in Texas.

The company’s success with Waymo Via and Waymo Driver kicked off a new relationship between J.B. Hunt and Waymo. The two companies have a strategic alliance to advance commercial autonomous driving technology in transportation and logistics. One goal is to have driverless transport approved in Texas in the next few years.

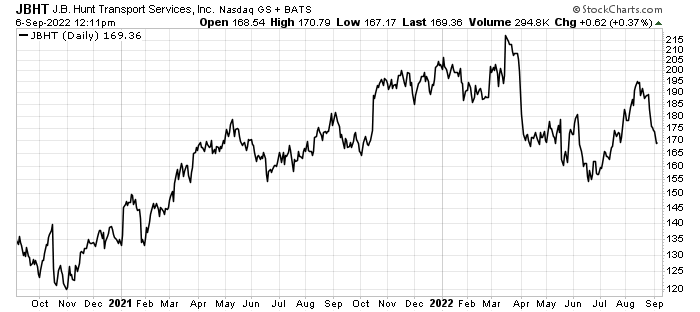

Action to Take: Buy J.B. Hunt Transport Services (Nasdaq: JBHT) and use a 25% trailing stop on the position. The company’s shares cost around $170 each, but that’s ok. A high share price doesn’t mean an expensive stock. It just means that J.B. Hunt has fewer shares outstanding.

Share Price vs. Market Cap

A company’s value is expressed in its market capitalization (market cap). And that value is determined by the share price multiplied by the number of shares outstanding.

For example, J.B. Hunt has a market cap of $17.7 billion and a share price of $170. We can use that information to figure out that the company has 104 million shares outstanding.

If the company wanted a lower share price, it could double its share count. If J.B. Hunt had 208 million shares outstanding, its share price would be $85… but its market cap would still be $17.7 billion.

None of that has any bearing on whether a company is “cheap” or “expensive.” That’s just the price.

We use price ratios like “price to sales,” “price to earnings,” or “price to book value” to evaluate whether a stock is cheap or expensive. Figuring out the price is just the first step in the process.

J.B. Hunt is an ideal company for the Spotlight portfolio. It has a strong financial position. It’s growing revenue, income, and dividends. And that growth doesn’t come at the expense of its workers, communities, or the environment. Plus, this is a good time to buy the stock. The price is down, but growth hasn’t slowed.

Good Investing,

Matt Badiali