The Fed Hikes Rates Again – and We’re Not Worried

The market has fallen over 20% since the start of 2022.

Investors seem to be reacting to the Federal Reserve’s moves to increase interest rates.

Here’s how Reuters summed it up last week:

U.S. stocks’ volatile run this year shows no signs of abating as stubbornly high inflation data makes it likely the Federal Reserve will continue to raise U.S. borrowing costs … boosting the chances that the U.S. economy will run into trouble.

Bank of America reports that it believes the worst is yet to come. And it’s cutting its losses.

Are we panicking too?

Of course not.

We’re long-term investors here at Mangrove. We believe that short-term moves are just that: short term.

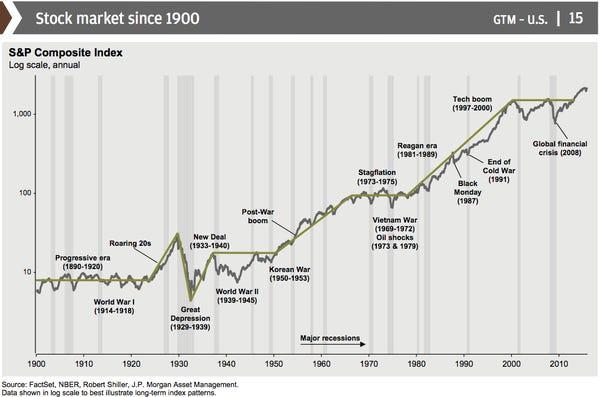

Case in point, check out this long-term chart of the S&P 500 Index, the proxy most pros use for the market.

You might have seen this chart before. It’s a famous one from JPMorgan:

This doesn’t cover the last few corrections in the market. But it illustrates our point.

Over the long term, the stock market tends to go up. That’s not hope – it’s history.

But we aren’t oblivious. We know that there are drawbacks to this chart.

For one thing, it’s only showing an index – the S&P 500. Gains in an index aren’t the same thing as gains in an individual company.

And more importantly, gains in an index don’t show when an individual company goes out of business.

It happens. And if you’re holding a company that has weak financials or operates in a quickly evolving industry, you can end up with a time bomb on your hands.

It can be nerve-wracking, even in boom times.

If you’re a long-term investor, you want to make sure you’re protecting your hard-earned money.

You want to take emotion out of the equation and have a plan in place to keep your portfolio safe.

So what do you do? Use trailing stops.

This genius little tool keeps you in the game when the market is in the green, and it keeps you safe when things start to fall.

You’ll be able to ride the highs and keep your emotions in check during the lows.

That way, when a stock falls, the rest of your portfolio doesn’t have to take a massive hit.

We wrote about trailing stops in our Grove U series. That’s where we put our investing education on MangroveInvestor.com.

You can check it out here. And to see the rest of our Grove U educational series, click here.

Don’t let a fall worry you. Have a plan.

Now, onto the news…

Numbers to Know

75

The number of basis points the Federal Reserve raised interest rates on Wednesday. It’s the third consecutive time the Fed has hiked rates by 75 basis points. The fed funds rate is now at its highest level since the global financial crisis in 2008. (CNN)

1.5 million

Square feet of office space in development in West Palm Beach, Fla. The city has earned the nickname “Wall Street South” because many New York firms are opening offices there. Those big companies include BlackRock and Goldman Sachs. (WPTV)

5 million

Metric tons of CO2 that will be removed from the atmosphere yearly by one facility in Wyoming. CarbonCapture plans to have the facility up and running by late 2023. The company will concentrate the captured carbon and store it underground. (Interesting Engineering)

What’s New in Sustainable Investing

Patagonia founder is giving away his billion-dollar company

Yvon Chouinard, founder of the outdoor apparel company, will ensure that the business’s profits go toward fighting climate change. “Instead of extracting value from nature and transforming it into wealth for investors, we’ll use the wealth Patagonia creates to protect the source of all wealth,” wrote the 83-year-old billionaire. (Business Insider)

Uber commits to an EV-only fleet by 2030

According to Uber CEO Dara Khosrowshahi, drivers who haven’t made the switch to an electric vehicle (EV) by 2030 won’t be allowed to drive for the company. Uber said it would commit $800 million in funding to help drivers make the transition to EVs. In addition, drivers who participate in Uber’s Comfort Electric service will earn an additional $1 per ride. (Car and Driver)

Links We Like

“More than 70 years after India declared the Asiatic cheetah domestically extinct, their African cousins have been introduced in an ambitious project to have the world’s fastest land animal roam again in India.” (Deutsche Welle)

“Personal carbon allowance programs have had limited success due to a lack of awareness and fair mechanism for tracking emissions. Yet there have been major developments in recent years that could help realize ‘My Carbon’ initiatives.” (World Economic Forum)

“Richard Branson’s newest travel brand establishes an alliance with three leading sustainable fuel providers, signaling an important step forward and a call-to-action for the cruise industry and policy makers alike.” (Virgin Voyages)